As Headwinds Ease, Mideast Airlines Go Shopping

November 15 2017 - 8:41AM

Dow Jones News

By Nicolas Parasie and Robert Wall

DUBAI--Middle East airlines are showing signs of emerging from a

period of heavy turbulence.

At the Dubai Airshow on Wednesday, budget airline Flydubai

committed to buy up to 225 more Boeing 737 Max single-aisle planes

valued at $27 billion.

Its sister carrier, Emirates Airline--the world's largest by

international traffic--on Sunday placed a 40-plane commitment with

Boeing for 787 Dreamliners valued at $15.1 billion at list price,

though buyers typically get discounts.

The deals reflect an upswing in sentiment among executives at

airlines in the Middle East whose earnings have been dented over

the past 18 months by low oil prices, which have hit business

travel.

Demand for U.S. flights this year has been hurt by efforts from

the Trump administration to restrict travel from some Middle East

countries, as well as a temporary ban on carrying laptops and

similar electronics in the cabin on some U.S.-bound flights, over

terrorism concerns. Airlines in the region deferred plane

deliveries to cope with slower growth.

Those headwinds marked a sharp turnaround in fortunes for

airlines that had been expanding heavily. Their growth drew ire

from some U.S. and European rivals, who argued that state subsidies

fuel their expansion--a charge the Persian Gulf carriers deny.

Some of those economic headwinds may be starting to ease. "We

have seen some strengthening in the region," Kevin McAllister,

president of Boeing Commercial Airplanes, said on the eve of the

Dubai Airshow, often a hotbed of plane deals.

Emirates Airline President Tim Clark said, "The whole market is

experiencing an uplift." A strong rebound in recent months in cargo

demand has been a boon to the airline, he said, adding that traffic

on European routes has grown strongly and U.S. demand is

rebounding.

Peter Baumgartner, who runs Etihad Airways in neighboring Abu

Dhabi, said, "The Middle East has been particularly

challenged."

The downturn has forced airlines to reconsider their strategies

and pursue more measured growth, he said. For Etihad, that has also

meant shedding some investments in foreign airlines that helped

deliver larger passenger numbers, but cost billions and were a drag

on earnings. Etihad this week remained on the sidelines of the

aircraft-buying activity.

Mr. Baumgartner said ticket prices were starting to improve on

the back of stronger regional economic growth. The rebound has been

steady, but measured.

"I see signs of progress but not the rebound as for example

after the global financial crisis," Mr. Baumgartner said in an

interview.

The upturn also is being felt at the lower end of the market.

Ghaith Al Ghaith, chief executive of Flydubai, said pricing "has

stabilized" after a period of sharp declines. "There is momentum

for growth in the region, " said the carrier, which this month

received its first Boeing 737 Max 8 single-aisle plane.

The recent upturn in oil prices also could help boost airfares,

he said.

Not everyone is enjoying an easy ride. The region's No. 2

carrier by passenger numbers, Qatar Airways, has been hit by a

protracted diplomatic dispute between Doha and its Arab neighbors.

It has been banned from flying to countries such as Saudi Arabia

and the United Arab Emirates, and has had to reroute some other

flights. Chief Executive Akbar Al Baker this month said the airline

would lose money this financial year.

Questions have also been raised about whether an anticorruption

drive in Saudi Arabia could affect economic activity, and in turn

hurt the region's airlines. Flydubai's Mr. Ghaith said bookings

from the kingdom so far hadn't been affected.

Even though their fortunes are showing signs of improvement,

Middle East airlines aren't abandoning some of their cost-cutting

steps. Emirates and Flydubai, both Dubai-government owned, will

press ahead with a drive to increase cooperation, the airlines'

bosses said, adding that the collaboration so far has been

beneficial.

Etihad is similarly focusing on more-profitable growth. The

airline has ceased flying some unprofitable routes, including to

the U.S., and is introducing charges for seat selection. "In a good

way [the downturn] forced everybody to do some reality checks in

terms of the growth momentum moving forward," Mr. Baumgartner

said.

Write to Nicolas Parasie at nicolas.parasie@wsj.com and Robert

Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

November 15, 2017 09:26 ET (14:26 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

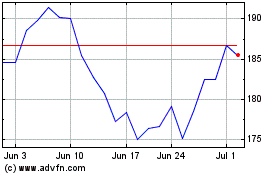

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024