Barclays Champions Vodafone in Telecommunications -- Market Talk

December 08 2017 - 5:08AM

Dow Jones News

Barclays rebuffs market skepticism aimed at Vodafone, naming the

company its top pick in telecommunications, replacing Telenor.

Barclays says that questions about Vodafone's ability to grow, its

performance in monetizing data, and the regulatory headwinds it

faces--among others--focus too much on issues past. Barclays

estimates that Vodafone is on track for Ebitda compound annual

growth rate of 4%-5% in the next three years, saying that the above

arguments are increasingly irrelevant. Barclays raises its target

price to 280 pence per share and upgrades the rating to overweight.

Shares at 1036 GMT are up 0.6%, or 1.45 pence, at 229.30 pence.

(oliver.griffin@dowjones.com; @OliGGriffin)

(END) Dow Jones Newswires

December 08, 2017 05:53 ET (10:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

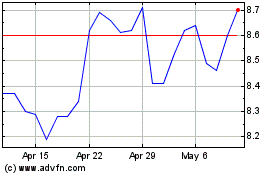

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

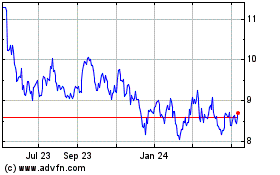

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024