Today's Top Supply Chain and Logistics News From WSJ

January 23 2018 - 6:36AM

Dow Jones News

By Brian Baskin

Sign up: With one click, get this newsletter delivered to your

inbox.

Luxury retailers are starting to embrace e-commerce - on their

terms. Compagnie Financière Richemont SA, owner of Cartier and

other brands, will pay up to $3.3 billion to buy the shares in

e-commerce firm Yoox Net-a-Porter it doesn't already own, the WSJ's

Matthew Dalton reports. Luxury brands have been slow to embrace

e-commerce, largely avoiding partnerships with Amazon.com Inc. and

other marketplaces due to concerns about counterfeiting and

pricing. But the industry faces the same problems as down-market

brick-and-mortar chains, including declining store traffic and

competition from online-only competitors. Richemont's decision

shows that neither side has all the answers - online marketplaces

need well-known brands for their financial firepower and large

customer bases, and the incumbents need help attracting younger,

web-savvy shoppers and tackling the complex logistics of e-commerce

distribution.

Retail's automated future is here - albeit later than expected.

Amazon.com Inc. opened to the public a cashierless store in the

base of its Seattle headquarters about a year later than originally

planned, the online retailer's latest foray into the physical

world, the WSJ's Laura Stevens writes. Shoppers are tracked

throughout the location and charged when they pick out an item,

eliminating the need for checkout counters. Amazon says it's

trained the system to recognize subtle differences in packaging and

shoppers' unpredictable movements.The technology has the potential

to accelerate a shift already underway in the retail world, where

brick-and-mortar chains are shifting employees and resources from

the storefront to warehouses. Still, former Amazon executives say

the Amazon Go store concept would be difficult to scale up to a

larger footprint.

Globalization's decades-long winning streak appears to be over.

Businesses cut back on overseas investments for a second

consecutive year in 2017, the WSJ's Paul Hannon writes. The United

Nations report showed foreign direct investment, covering

everything from new factories and international mergers, declined

by 16% last year to $1.52 trillion. The drop is surprising in that

it comes at a time when the world economy is growing, and may

indicate that a backlash to globalization is having some tangible

effects on where businesses choose to invest. Not all of the

decline can be attributed to protectionist rhetoric or President

Donald Trump's election. A temporary lull in mega-mergers and

uncertainty over U.S. tax policy and Brexit also kept some

businesses on the sidelines. The U.N. Conference on Trade and

Development anticipates a rebound this year, but says the era of

one-way globalization has come to an end.

ENERGY

The owner of a pair of Philadelphia refineries has found itself

cut out of the rapidly evolving global energy supply chain.

Philadelphia Energy Solutions LLC affiliates filed for bankruptcy

protection, blaming federal environmental regulations, the WSJ's

Peg Brickley and Christopher M. Matthews write. But the refineries'

problems run much deeper than the cost of complying with ethanol

blending rules. East Coast refineries, which mainly process oil

imported from Russia, Nigeria and other foreign sources, have been

undercut by competitors that have easy access to cheaper

domestically produced crude. The lifting of a ban on U.S. oil

exports further doomed the Philadelphia refineries, which found it

even more difficult to bring in oil from the Bakken basin in the

Northern U.S. after producers there gained access to the

international market. With the U.S. set to surpass Saudi Arabia as

the world's biggest oil producer, the two refineries are the

latest, but likely not the last, examples of businesses that have

struggled to keep up with the changing market.

QUOTABLE

IN OTHER NEWS

The Trump administration imposed tariffs on washing machines and

solar panels, its most aggressive steps yet to implement an

"America First" trade policy. (WSJ)

The International Monetary Fund predicts the world economy will

grow 3.9% in 2018 and 2019, the strongest pace since 2011.

(WSJ)

Canadian and Mexican trade officials are looking to salvage the

North American Free Trade Agreement in talks now underway in

Montreal. (WSJ)

Activist investor Daniel Loeb's Third Point LLC put fresh

pressure on Nestlé SA to sell stakes in non-core businesses.

(WSJ)

Billionaires Carl Icahn and Darwin Deason teamed up to urge a

sale of Xerox Corp. (WSJ)

Bacardi is acquiring the maker of Patrón tequila for $5.1

billion. (WSJ)

The Transportation Safety Administration ordered stricter

screening of cargo originating in the Middle East. (Air Cargo

World)

Cosmetics companies are taking a cue from fast-fashion retailers

and speeding up their supply chains. (Business of Fashion)

A union representing Bangladeshi textile workers reached a $2.3

million settlement with a multinational apparel brand over unsafe

working conditions. (The Guardian)

Companies that rent big rigs for under 30 days received a 90-day

exemption from the new rule requiring electronic logging devices.

(Transport Topics)

Freight forwarders are struggling to find enough capacity to

handle increased air freight demand. (Lloyd's Loading List)

Mid-Atlantic ports are seeing a revival in coal exports.

(Associated Press)

Port of Charleston officials are looking for more space as

container volumes surge. (The Post and Courier)

Alstom will test an automated freight train in the Netherlands.

(Reuters)

ABOUT US

Brian Baskin is editor of WSJ Logistics Report. Follow him at

@brianjbaskin , and follow the entire WSJ Logistics Report team:

@PaulPage, @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Brian Baskin at brian.baskin@wsj.com

(END) Dow Jones Newswires

January 23, 2018 07:21 ET (12:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

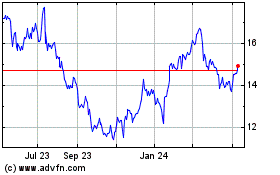

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

Historical Stock Chart

From Apr 2023 to Apr 2024