By Peter Grant

Co-working is coming of age.

Some of the world's largest landlords, facing weak growth in

traditional office rents and occupancies, are investing heavily in

what until recently was viewed as a niche office business that

catered primarily to technology startups and millennials.

A venture of Brookfield Asset Management and Onex Corp. is

negotiating to buy IWG PLC, which has a market capitalization of

GBP2.48 billion ($3.46 billion) and operates co-working facilities

as well as more traditional offices for small and midsize

businesses. On Saturday, the U.K.'s Takeover Panel extended the

deadline for the venture to make an offer until Feb. 2. Brookfield

declined to comment on the negotiations.

Meanwhile, Blackstone Group LP last year purchased the Office

Group in a deal that valued the U.K.-based co-working provider at

GBP500 million. Blackstone, Brookfield and Houston-based Hines also

are exploring a wide range of deals with new shared-space firms

like WeWork Cos., IWG, Industrious and Convene.

The new workplace trend "is certainly something we're spending a

lot of time focusing on in our office space business," said Rob

Harper, head of U.S. asset management at Blackstone's real estate

group.

Co-working at its core is a new name for a business that has

been around for decades. Firms simply lease big blocks of space

from landlords and subdivide it for smaller tenants and provide a

range of office services.

But as the economy began to recover after the 2008 recession, a

new set of co-working companies led by WeWork found surging demand

among young workers for densely packed spaces with hip designs and

buzzy vibe.

The changes are permeating most dimensions of the traditional

office space business, including lease terms and structure,

building financing and even valuations.

Traditional office building investors are watching closely. So

is the tech world, given WeWork's stratospheric $20 billion

valuation.

The interest among major landlords is being fueled by the

recognition that the co-working business has been one of the few

bright spots in the office market during the economic recovery.

Overall, growth in the U.S. market has been much slower than in

previous upcycles. Current occupancy in the top 50 markets is

roughly 85%, according to research firm Green Street Advisors. It

was close to 92% in 2000 and greater than 87% in 2007, Green Street

said.

Co-working firms are one of the few sources of growing demand, a

point stressed at an October investor presentation by Boston

Properties Inc., one of the country's largest office real-estate

investment trusts. The firms accounted for 30 million square feet

of absorption during the current cycle, or 9.1% of the total, said

Owen Thomas, Boston Properties' chief executive.

The firm has cut numerous leasing deals with WeWork. In one

high-profile project, Boston Properties, WeWork and Rudin

Development, currently are developing a 14-story building in the

Brooklyn Navy Yard that will include a food hall, health center,

open lawn conference center and access to a new ferry terminal.

"It's clearly an important trend in our business," said Mr.

Thomas.

But it also poses headaches for building owners. Up until

recently, firms like WeWork have attracted thousands of

entrepreneurs and small firms to spaces in major office buildings

that in the past didn't serve such tenants.

The co-working approach to office space, especially its focus on

flexible and short-term commitments, is beginning to spill over

into the more traditional office space businesses, however. Big

companies are pressing landlords for space with a hipper vibe, more

amenities and that can be expanded and contracted easily.

This will likely increase landlord costs for building out

spaces. "If you want to attract and retain tenants, you've got to

be a little bit more bling," said Jed Reagan, a Green Street

analyst.

Also, because co-working generally uses less space per worker,

occupancy likely will decline as big tenants begin to transition to

more flexible spaces. If big tenants succeed in reducing lease

lengths from the standard 10 or 15 year contracts to a few years,

building owners are going to have a tougher time obtaining

financing.

"If you're a landlord you have to feel somewhat threatened,"

said Matt Kopsky, a REIT analyst at financial-services firm Edward

Jones.

Landlords are responding with a variety of strategies. Some of

the biggest players are buying co-working and flexible-space

businesses, like Blackstone did with the Office Group and

Brookfield might do with IWG.

Owners also are exploring a wide range of business deals with

firms like WeWork and Industrious. In some cases, landlords will

simply lease space to co-working businesses. In other cases,

landlords are cutting management agreements with co-working

companies similar to the kind of deals that hotel owners may cut

with hotel brands like Hilton or Marriott.

Brookfield Property Partners, a listed company controlled by

Brookfield Asset Management, also has acquired a roughly 18% stake

in Convene, which offers co-working spaces as well as on-demand

meetings and conferences.

"We're keeping our options alive and open at this point and

we've got many," said Ric Clark, chairman of Brookfield Property

Partners.

--Eliot Brown contributed to the article.

Write to Peter Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

January 23, 2018 08:14 ET (13:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

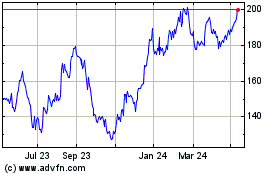

Iwg (LSE:IWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

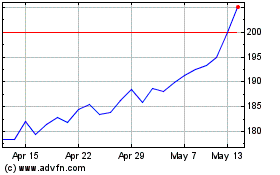

Iwg (LSE:IWG)

Historical Stock Chart

From Apr 2023 to Apr 2024