Citing data from Glassnode, famous Chinese crypto analyst Colin Wu illustrated the recent behavior of Bitcoin holders and their attitude towards the benchmark cryptocurrency. The analyst detailed that the percentage of long-term holders that have not moved their coins in over ten years stands at 12.3%. These tokens are deemed dormant for this reason.

The analyst further noted that the percentage of long-term holders that have not transferred their coins between two to three years and three to five years stands at 10% and 12.26%, respectively.

Finally, the highest percentage of long-term holders were those who have refused to move their coins between the last six months to twelve months, standing at 19.5%. That said, 85.14% of BTCs have not exchanged hands for at least three months, a new record high.

In July, Bitcoin struggled to keep its head above the $30,000 mark. Today, it has almost doubled this number, but investors remain steadfast in holding their coins.

Key Bitcoin Levels to Watch — October 14

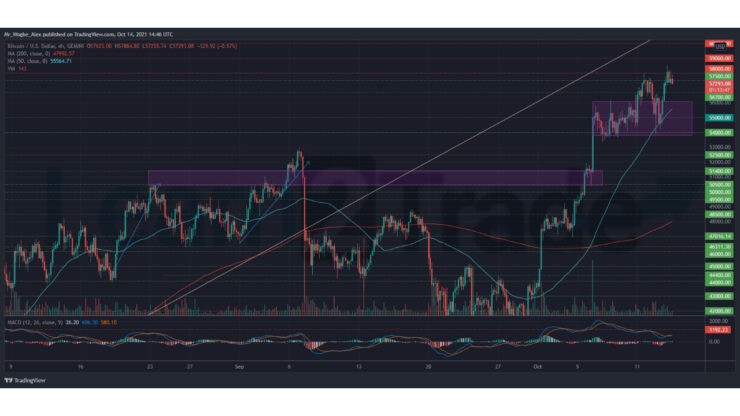

As predicted in our previous analysis, BTC witnessed a sharp correction to the $55,000 – $54,000 pivot axis from the $57,500 level over the last 48 hours. This correction found immediate support from the $54,000 level, which triggered a rebound to a new five-month high at $58,500 earlier today.

While the price currently rests around $57,500, we expect a bull run to the $59,000 resistance over the coming hours and days.

Meanwhile, our resistance levels are at $58,000, $59,000, and $60,000, and our key support levels are at $56,700, $56,000, and $55,000.

Total Market Capitalization: $2.40 trillion

Bitcoin Market Capitalization: $1.07 trillion

Bitcoin Dominance: 44.9%

Market Rank: #1

Source: https://learn2.trade

Hot Features

Hot Features