Bitcoin mining has evolved from a small-scale technical experiment into a global industry worth billions. With a more crypto-friendly environment anticipated under the incoming Trump administration in the U.S., Bitcoin mining activity is expected to accelerate. To navigate this rapidly expanding sector, it’s crucial to grasp the metrics that define mining performance—one of the most important being hash rate.

This guide explains what hash rate means, why it matters, and how it influences the profitability and stability of cryptocurrency mining operations.

Defining Hash Rate

The hash rate—also called hash power—measures the total computational strength used to mine and validate transactions on a Proof-of-Work (PoW) blockchain, such as Bitcoin. In simple terms, it indicates how many calculations (or “hashes”) the network can perform per second.

Bitcoin’s global mining network consists of millions of specialized machines (miners) racing to solve complex cryptographic puzzles. Each solution, or “hash,” represents a guess at unlocking the next block in the chain. The faster a miner can perform these calculations, the greater their odds of successfully mining a block and earning the associated block reward.

Thus, a higher hash rate not only reflects stronger mining power but also enhances a miner’s competitiveness and potential revenue.

How Hash Rate Works

Hash rate represents the combined computing power of all miners operating on a blockchain network. For Bitcoin, miners continuously perform trillions of cryptographic calculations each second in pursuit of valid block solutions.

To maintain a consistent pace of approximately one new block every ten minutes, Bitcoin’s network automatically adjusts its mining difficulty. When total hash rate rises—meaning more miners or more powerful hardware join the network—the protocol increases the difficulty of mining. Conversely, if hash rate drops, difficulty decreases to keep block production stable.

This self-balancing mechanism ensures Bitcoin’s block time remains predictable, regardless of how much computing power floods or leaves the network. In essence, the hash rate is both a barometer of network security and a key determinant of mining profitability.

How Hash Power Is Generated

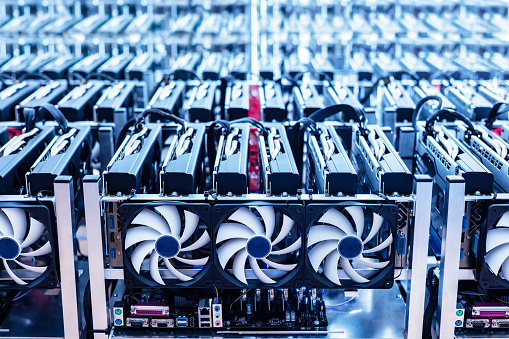

In Bitcoin mining, hash power is produced by specialized machines known as ASICs (Application-Specific Integrated Circuits). These devices are engineered solely for one purpose—performing hash computations at incredible speeds with high energy efficiency. Each ASIC miner runs billions or even trillions of calculations per second, competing to discover the correct hash that validates a block and earns the associated Bitcoin reward. The more powerful and efficient the hardware, the higher its hash rate output.

How Hash Rate Is Measured

Hash rate is quantified in hashes per second (H/s)—the number of cryptographic calculations performed each second. Because of the immense scale of Bitcoin’s mining operations, measurements are expressed using larger units:

Kilohashes (kH/s) – thousands of hashes per second

Megahashes (MH/s) – millions of hashes per second

Gigahashes (GH/s) – billions of hashes per second

Terahashes (TH/s) – trillions of hashes per second

Petahashes (PH/s) – quadrillions of hashes per second

Exahashes (EH/s) – quintillions of hashes per second

Bitcoin’s global network hash rate is currently measured in exahashes, reflecting the immense computational scale of its ecosystem. As of late 2024, the Bitcoin network recorded around 911 EH/s, an all-time high. For miners and mining pools, their individual contribution to this global hash rate directly affects their probability of winning block rewards.

Why Hash Rate Matters for Miners

For Bitcoin miners, hash rate is more than a technical figure—it’s a key determinant of profitability, efficiency, and competitiveness. Every mining operation, from large-scale farms to individual setups, relies on its hash power to generate returns. Here’s how hash rate influences mining outcomes:

1. Reward Probability

A miner’s hash rate directly affects their chances of earning Bitcoin rewards. The greater the computational power, the higher the likelihood of successfully solving a block and receiving its reward. To improve their odds, many miners join mining pools, where participants combine their hash power and share rewards proportionally. This approach provides a steadier income stream and reduces the unpredictability of solo mining.

2. Operational Costs

Hash rate is tightly linked to energy consumption. High-performance mining hardware—such as top-tier ASICs—offers superior hash rates but also draws significant amounts of electricity. For miners, profitability depends on striking a balance between computational output and energy expenses. In regions without access to inexpensive or renewable power, even efficient miners can struggle to stay profitable as operational costs climb.

3. Competitive Landscape

In the mining ecosystem, hash rate functions as a performance benchmark. As Bitcoin’s mining difficulty adjusts upward to match global computational growth, miners using outdated or less efficient rigs face diminishing returns. Continuous hardware upgrades are essential to maintain competitiveness and profitability, especially in an environment where margins tighten with each difficulty adjustment.

Closing Thoughts

Hash rate serves as a vital indicator not only for miners but also for investors and analysts tracking the health of blockchain networks. It represents the strength and security of a Proof-of-Work ecosystem, while also revealing broader market dynamics. Ultimately, understanding hash rate provides valuable insight into how technological capability, energy economics, and market sentiment intertwine to shape the future of cryptocurrency mining.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features