Highly Complementary to Thermo Fisher’s

Bioproduction Business and Strengthens Offering in the High Growth

Bioprocessing Market

Thermo Fisher Scientific Inc. (NYSE: TMO) (“Thermo Fisher”), the

world leader in serving science, today announced that the company

has entered into a definitive agreement with Solventum (NYSE: SOLV)

to acquire Solventum’s Purification & Filtration business for

approximately $4.1 billion in cash.

Solventum’s Purification & Filtration business is a leading

provider of purification and filtration technologies used in the

production of biologics as well as in medical technologies and

industrial applications. The Solventum business operates globally

with sites across the Americas, Europe, the Middle East, Africa,

and the Asia-Pacific region, and has approximately 2,500

colleagues. In 2024, Solventum’s Purification & Filtration

business generated approximately $1 billion of revenue.

Solventum’s Purification & Filtration business is highly

complementary to Thermo Fisher’s bioproduction business. Today,

Thermo Fisher has a leading portfolio of offerings in cell culture

media and single-use technologies. Solventum’s innovative

filtration portfolio broadens Thermo Fisher’s capabilities in the

development and manufacturing of biologics, spanning upstream and

downstream workflows.

“The addition of Solventum’s business is an outstanding

strategic fit with our company and will create significant value

for our customers and shareholders,” said Marc N. Casper, chairman,

president and chief executive officer of Thermo Fisher.

“Solventum’s portfolio of solutions will be valued by our

customers, and further demonstrate our disciplined capital

deployment strategy which has an excellent track record of creating

shareholder value.”

Casper continued, “As the trusted partner to our customers,

Solventum’s Purification & Filtration business will expand and

add differentiated capabilities to our bioprocessing portfolio to

better serve our customers in this rapidly growing market. We look

forward to welcoming our new colleagues to Thermo Fisher.”

The transaction is expected to be completed by the end of 2025

and is subject to customary closing conditions and regulatory

approvals. Once the transaction closes, Solventum’s Purification

& Filtration business will become part of Thermo Fisher's Life

Sciences Solutions segment.

Solventum’s Purification & Filtration, as part of Thermo

Fisher, is expected to generate mid- to high-single digit organic

growth and the application of the PPI Business System will enable

strong margin expansion and meaningful synergy realization. In the

first year of ownership, the transaction is expected to be dilutive

to adjusted EPS1 by $0.06. Excluding financing costs, the

transaction is expected to be accretive by $0.28 in that period.

This reflects the very strong day one cost synergies when

Solventum’s allocated segment costs are replaced by lower run rate

costs within Thermo Fisher, partially offset in year one by

one-time business stand up costs. Thermo Fisher expects to realize

approximately $125 million of adjusted operating income from

revenue and cost synergies by year five following the close. The

expected long-term business growth, margin expansion opportunity

and synergy realization make the financial returns on the

transaction very compelling with a double-digit internal rate of

return.

1Adjusted earnings per share and adjusted operating income are

non-GAAP measures that exclude certain items detailed later in this

press release under the heading "Use of Non-GAAP Financial

Measures."

Advisors

For Thermo Fisher, WilmerHale is serving as principal deal

counsel and Wells Fargo as exclusive financial advisor.

About Thermo Fisher Scientific

Thermo Fisher Scientific Inc. is the world leader in serving

science, with annual revenue over $40 billion. Our Mission is to

enable our customers to make the world healthier, cleaner and

safer. Whether our customers are accelerating life sciences

research, solving complex analytical challenges, increasing

productivity in their laboratories, improving patient health

through diagnostics or the development and manufacture of

life-changing therapies, we are here to support them. Our global

team delivers an unrivaled combination of innovative technologies,

purchasing convenience and pharmaceutical services through our

industry-leading brands, including Thermo Scientific, Applied

Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services,

Patheon and PPD. For more information, please visit

www.thermofisher.com.

Forward-Looking Statements

This communication contains forward-looking statements that

involve a number of risks and uncertainties. Words such as would,”

"believes," "anticipates," "plans," "expects," "seeks,"

"estimates," and similar expressions are intended to identify

forward-looking statements, but other statements that are not

historical facts may also be deemed to be forward-looking

statements. Important factors that could cause actual results to

differ materially from those indicated by forward-looking

statements include risks and uncertainties relating to: any natural

disaster, public health crisis or other catastrophic event; the

need to develop new products and adapt to significant technological

change; implementation of strategies for improving growth; general

economic conditions and related uncertainties; dependence on

customers' capital spending policies and government funding

policies; the effect of economic and political conditions and

exchange rate fluctuations on international operations; use and

protection of intellectual property; the effect of changes in

governmental regulations; and the effect of laws and regulations

governing government contracts, as well as the possibility that

expected benefits related to recent or pending acquisitions,

including the proposed acquisition of Solventum’s Purification

& Filtration business, may not materialize as expected; the

proposed acquisition of Solventum’s Purification & Filtration

business being timely completed, if completed at all; regulatory

approvals required for the transaction not being timely obtained,

if obtained at all, or being obtained subject to conditions;

Solventum’s Purification & Filtration business experiencing

disruptions as a result of the acquisition or due to

transaction-related uncertainty or other factors making it more

difficult to maintain relationships with employees, customers,

other business partners or governmental entities; difficulty

retaining key employees; the outcome of any legal proceedings

related to the proposed acquisition of Solventum’s Purification

& Filtration business; and the parties being unable to

successfully implement integration strategies or to achieve

expected synergies and operating efficiencies within the expected

time-frames or at all. Additional important factors that could

cause actual results to differ materially from those indicated by

such forward-looking statements are set forth in Thermo Fisher's

most recent annual report on Form 10-K, which is on file with the

U.S. Securities and Exchange Commission ("SEC") and available in

the "Investors" section of Thermo Fisher's website,

ir.thermofisher.com, under the heading "SEC Filings". While Thermo

Fisher may elect to update forward-looking statements at some point

in the future, Thermo Fisher specifically disclaims any obligation

to do so, even if estimates change and, therefore, you should not

rely on these forward-looking statements as representing Thermo

Fisher’s views as of any date subsequent to today.

Use of Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), Thermo Fisher

uses certain non-GAAP financial measures, including adjusted

earnings per share, and adjusted operating income, which excludes

certain acquisition-related costs, including charges for the sale

of inventories revalued at the date of acquisition and significant

transaction costs; restructuring and other costs/income;

amortization of acquisition-related intangible assets; certain

other gains and losses that are either isolated or cannot be

expected to occur again with any regularity or predictability, tax

provisions/benefits related to the previous items, benefits from

tax credit carryforwards, the impact of significant tax audits or

events, equity in earnings of unconsolidated entities and the

results of discontinued operations, as applicable. Thermo Fisher

excludes the above items because they are outside of the company's

normal operations and/or, in certain cases, are difficult to

forecast accurately for future periods. We use organic growth,

which is reported revenue growth, excluding the impacts of

acquisitions/divestitures and the effects of currency translation.

Thermo Fisher reports this measure because its management believes

that in order to understand the company’s short-term and long-term

financial trends, investors may wish to consider the impact of

acquisitions/divestitures and/or foreign currency translation on

revenues. Thermo Fisher management uses this measure to forecast

and evaluate the operational performance of the company as well as

to compare revenues of current periods to prior periods. Thermo

Fisher believes that the use of non-GAAP measures helps investors

to gain a better understanding of the company's core operating

results and future prospects, consistent with how management

measures and forecasts the company's performance, especially when

comparing such results to previous periods or forecasts. Thermo

Fisher does not provide GAAP financial measures on a

forward-looking basis because we are unable to predict with

reasonable certainty and without unreasonable effort items such as

the timing and amount of future restructuring actions and

acquisition-related charges as well as gains or losses from sales

of real estate and businesses, the early retirement of debt and the

outcome of legal proceedings. The timing and amount of these items

are uncertain and could be material to Thermo Fisher’s results

computed in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225251876/en/

Media: Sandy Pound Thermo Fisher Scientific Phone: 781-622-1223

E-mail: sandy.pound@thermofisher.com Investor: Rafael Tejada Thermo

Fisher Scientific Phone: 781-622-1356 E-mail:

rafael.tejada@thermofisher.com

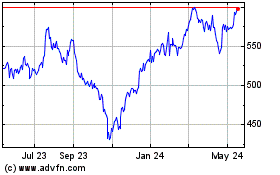

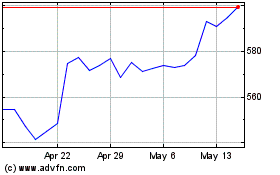

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Feb 2024 to Feb 2025