Form 8-K - Current report

February 25 2025 - 3:17PM

Edgar (US Regulatory)

0000097745FALSE00000977452025-02-252025-02-250000097745us-gaap:CommonStockMember2025-02-252025-02-250000097745tmo:SeniorNotes0.125Due2025Member2025-02-252025-02-250000097745tmo:SeniorNotes200Due2025Member2025-02-252025-02-250000097745tmo:SeniorNotes3200Due2026Member2025-02-252025-02-250000097745tmo:SeniorNotes1.40Due2026Member2025-02-252025-02-250000097745tmo:A1.45SeniorNotesDue2027Member2025-02-252025-02-250000097745tmo:SeniorNotes175Due2027Member2025-02-252025-02-250000097745tmo:SeniorNotes0.500Due2028Member2025-02-252025-02-250000097745tmo:SeniorNotes1.375Due2028Member2025-02-252025-02-250000097745tmo:SeniorNotes1.95Due2029Member2025-02-252025-02-250000097745tmo:SeniorNotes0.875Due2031Member2025-02-252025-02-250000097745tmo:SeniorNotes2375Due2032Member2025-02-252025-02-250000097745tmo:SeniorNotes3650Due2034Member2025-02-252025-02-250000097745tmo:SeniorNotes2.875Due2037Member2025-02-252025-02-250000097745tmo:SeniorNotes1.500Due2039Member2025-02-252025-02-250000097745tmo:SeniorNotes1.875Due2049Member2025-02-252025-02-25

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2025

THERMO FISHER SCIENTIFIC INC.

(Exact name of Registrant as specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-8002 | | 04-2209186 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

168 Third Avenue

Waltham, Massachusetts 02451

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (781) 622-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $1.00 par value | | TMO | | New York Stock Exchange |

| 0.125% Notes due 2025 | | TMO 25B | | New York Stock Exchange |

| 2.000% Notes due 2025 | | TMO 25 | | New York Stock Exchange |

| 3.200% Notes due 2026 | | TMO 26B | | New York Stock Exchange |

| 1.400% Notes due 2026 | | TMO 26A | | New York Stock Exchange |

| 1.450% Notes due 2027 | | TMO 27 | | New York Stock Exchange |

| 1.750% Notes due 2027 | | TMO 27B | | New York Stock Exchange |

| 0.500% Notes due 2028 | | TMO 28A | | New York Stock Exchange |

| 1.375% Notes due 2028 | | TMO 28 | | New York Stock Exchange |

| 1.950% Notes due 2029 | | TMO 29 | | New York Stock Exchange |

| 0.875% Notes due 2031 | | TMO 31 | | New York Stock Exchange |

| 2.375% Notes due 2032 | | TMO 32 | | New York Stock Exchange |

| 3.650% Notes due 2034 | | TMO 34 | | New York Stock Exchange |

| 2.875% Notes due 2037 | | TMO 37 | | New York Stock Exchange |

| 1.500% Notes due 2039 | | TMO 39 | | New York Stock Exchange |

| 1.875% Notes due 2049 | | TMO 49 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On February 25, 2025, Thermo Fisher Scientific Inc. (“Thermo Fisher”) and Solventum Corporation (“Solventum”) entered into an agreement, pursuant to which, subject to the satisfaction or waiver of specified conditions, Thermo Fisher agreed to acquire Solventum’s purification and filtration business for approximately $4.1 billion in cash. The transaction is expected to be completed by the end of 2025 and is subject to customary closing conditions and regulatory approvals.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements that involve a number of risks and uncertainties. Words such as "believes," "anticipates," "plans," "expects," "seeks," "estimates," and similar expressions are intended to identify forward-looking statements, but other statements that are not historical facts may also be deemed to be forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by forward-looking statements include risks and uncertainties relating to: any natural disaster, public health crisis or other catastrophic event; the need to develop new products and adapt to significant technological change; implementation of strategies for improving growth; general economic conditions and related uncertainties; dependence on customers' capital spending policies and government funding policies; the effect of economic and political conditions and exchange rate fluctuations on international operations; use and protection of intellectual property; the effect of changes in governmental regulations; and the effect of laws and regulations governing government contracts, as well as the possibility that expected benefits related to recent or pending acquisitions, including the proposed acquisition of Solventum’s purification and filtration business, may not materialize as expected; the proposed acquisition of Solventum’s purification and filtration business being timely completed, if completed at all; regulatory approvals required for the transaction not being timely obtained, if obtained at all, or being obtained subject to conditions; Solventum’s purification and filtration business experiencing disruptions as a result of the acquisition or due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities; difficulty retaining key employees; the outcome of any legal proceedings related to the proposed acquisition of Solventum’s purification and filtration business; and the parties being unable to successfully implement integration strategies or to achieve expected synergies and operating efficiencies within the expected time-frames or at all. Additional important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in Thermo Fisher's most recent annual report on Form 10-K, which is on file with the U.S. Securities and Exchange Commission ("SEC") and available in the "Investors" section of Thermo Fisher's website, ir.thermofisher.com, under the heading "SEC Filings". While Thermo Fisher may elect to update forward-looking statements at some point in the future, Thermo Fisher specifically disclaims any obligation to do so, even if estimates change and, therefore, you should not rely on these forward-looking statements as representing Thermo Fisher’s views as of any date subsequent to today.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | THERMO FISHER SCIENTIFIC INC. |

| | | |

| | | |

| Date: | February 25, 2025 | By: | /s/ Michael A. Boxer |

| | | Michael A. Boxer |

| | | Senior Vice President and General Counsel |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.125Due2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes200Due2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes3200Due2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.40Due2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_A1.45SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes175Due2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.500Due2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.375Due2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.95Due2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.875Due2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes2375Due2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes3650Due2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes2.875Due2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.500Due2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.875Due2049Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

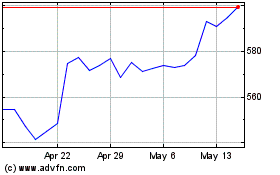

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Jan 2025 to Feb 2025

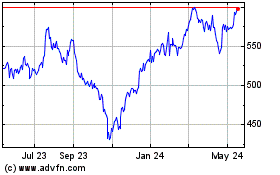

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Feb 2024 to Feb 2025