Cassidy Gold to Conduct IP Survey at Kouroussa Gold Project, Guinea

September 24 2009 - 11:13AM

Marketwired

Cassidy Gold Corp. ("Cassidy") (TSX VENTURE: CDX) is pleased to

announce plans for exploration work on the Kouroussa Gold Project,

located in Guinea, West Africa. Cassidy holds a 100% interest in

the project. The program will consist of a gradient Induced

Polarization (IP) survey of the Koekoe Prospect area extending over

to Sodyanfe and northeast to Kinkine. This grid, totalling 145

line-kilometres, will cover the entire project resource area and

the most prospective targets of the Kouroussa Project. Based on

results of the survey, targets will be prioritized ahead of a

planned drill program. IP surveys have been used to successfully

identify priority targets at Crew Gold's Lefa Gold Mine and

Semafo's Kiniero Mine, 120 kilometres north and 35 kilometres south

of Kouroussa, respectively.

The IP survey will extend across the length and width of the

Koekoe gabbro into the surrounding Birimian sedimentary strata.

Most mineralization associated with the Sanu Filanan, Sanu Filanan

North, Sanu Folo, JJ Vein, and KD-1 prospects is hosted in the

gabbro. However, significant intersections are also found off-board

of the Sanu Filanan trend and at the apparent southern limits of

both JJ and KD-1. These areas have seen limited drilling and remain

poorly understood. The survey will also cover adjoining resource

areas at Sodyanfe and Kinkine, following the Junction and Kinkine

faults, respectively. Both faults are believed to be controlling

structures to mineralization. A map highlighting the planned IP

program will be posted at www.cassidygold.com shortly.

Further exploration is designed to direct future drill programs

in identifying and expanding the resource picture at Kouroussa. A

Scoping Study completed by Coffey Mining earlier this year

recommended further work focused on the discovery of additional

"new" resources. Scoping work was based on an Indicated Resource of

680,000 ounces contained in 11,380,000 tonnes grading 1.9 g/t Au

and an Inferred Resource of 363,000 ounces contained in 6,466,000

tonnes grading 1.7 g/t Au (Table 1). Coffey Mining completed the

resource estimate in October 2008 in accordance with Canadian

National Instrument 43-101, Standards of Disclosure for Mineral

Projects and the classifications adopted by CIM Council in December

2005.

Table 1 Total Indicated and Inferred Resources, Kouroussa Project

(0.7 g/t Au cut-off)

--------------------------------------------------------------------------

Indicated Resource Inferred Resource

--------------------------------------------------------

Resource Area Tonnage Au g/t Au oz Tonnage Au g/t Au oz

--------------------------------------------------------------------------

Koekoe Trend 5,586,000 2.3 420,000 4,963,000 1.8 293,000

--------------------------------------------------------------------------

Kinkine Trend 2,353,000 1.8 136,000 843,000 1.4 39,000

--------------------------------------------------------------------------

Sodyanfe Trend 3,441,000 1.1 125,000 660,000 1.5 31,000

--------------------------------------------------------------------------

--------------------------------------------------------------------------

TOTALS 11,380,000 1.9 680,000 6,466,000 1.7 363,000

--------------------------------------------------------------------------

Based on these estimated resources, the Scoping Study concluded

that Kouroussa could produce an average of 79,000 ounces of gold

annually at a cash operating cost of US$484 per ounce over a 6-year

mine life. The Study proposed open pit mining of a series of pits

utilizing contract miners. Ore would be processed through a

conventional gravity-CIP (carbon-in-pulp) plant with a design

capacity of 1.0 million tonnes per annum (Mtpa). The average gold

recovery is 94.5% and the strip ratio is 6.7:1. Initial capital

costs for the Kouroussa Project are estimated to be $97 million,

with a further $11 million estimated for sustaining capital.

Table 1 shows the Net Present Value (NPV) at a discount rate of

10% and the Internal Rate of Return (IRR) for the Project for a

range of gold prices at a milling throughput of 1.0 Mtpa employing

a gravity-CIP process configuration and assuming 100% equity

financing. Project economics are favourable at a gold price of

greater than US$900. Cassidy believes that more work is warranted

including trying to reduce capital and operating cost and

investigating alternative mining configurations.

Table 1 NPV10% and IRR Sensitivity to Gold Price

-------------------------------------------------

Au Price (USD/oz) NPV10% (US$ million) IRR (%)

-------------------------------------------------

$ 750 -$23.6 1

-------------------------------------------------

$ 838 $0.0 10

-------------------------------------------------

$ 900 $16.8 16

-------------------------------------------------

$ 950 $30.3 21

-------------------------------------------------

$1000 $43.7 25

-------------------------------------------------

Mineral resources that are not mineral reserves do not have

demonstrated economic viability. The preliminary assessment

includes inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves, and there is no certainty that the preliminary assessment

will be realized.

Christopher J. Wild, P.Eng, V.P. Exploration, is Cassidy's

Qualified Person for this release. Harry Warries, MAusIMM,

Principal Consultant is the Qualified Person overseeing the

Kouroussa Scoping Study on behalf of Coffey Mining. For more

information, please visit the Company's website at

www.cassidygold.com.

On behalf of the Board of Directors

Cassidy Gold Corp.

James T. Gillis, President & CEO

This press release may be accessed at Cassidy Gold Corp.'s

website: www.cassidygold.com and at www.sedar.com.

If you wish to be placed on Cassidy Gold Corp.'s e-mail press

release list, please contact us at cassidygold@telus.net.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

Contacts: Cassidy Gold Corp. Jim Gillis President 250-372-8222

250-828-2269 (FAX) info@cassidygold.com www.cassidygold.com

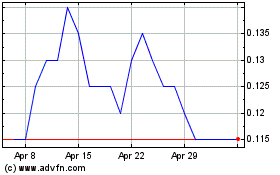

Cloud DX (TSXV:CDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

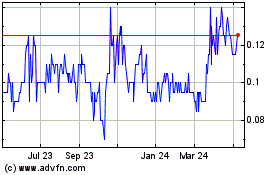

Cloud DX (TSXV:CDX)

Historical Stock Chart

From Apr 2023 to Apr 2024