TSX VENTURE COMPANIES

ALANGE ENERGY CORP. ("ALE")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. has accepted for filing documentation in

connection with a Purchase and Sale Agreement (the "Agreement") between

Prospero Hydrocarbons Inc. ("Prospero"), a subsidiary of Alange Energy

Corp. ("Alange"), and Mecaya Colombia Partners LLC ("MCP") dated

September 15, 2008 (as amended by extension and amending agreements dated

October 15, 2008, November 14, 2008, December 15, 2008, January 15, 2009

and November 12, 2009). Under the Agreement, Prospero (now named "Alange

Alberta Corp.") will acquire a 50.9% share of MCP's 55% participating

interest in an area known as the Mecaya Block located in Colombia

(resulting in a 28% interest in the Mecaya Block). The Mecaya Block

consists of an area of approximately 30,000 hectares located in the

Putumayo Province of Southern Colombia. As consideration for the interest

in the Mecaya Block, Prospero must pay a purchase price of US$4,500,000

payable as to US$3,500,000 in cash (of which US$200,000 has been paid)

and the balance of US$1,000,000 in common shares of Alange being

1,967,593 common shares.

TSX-X

---------------------------------------------------------------------------

AMMONITE ENERGY LTD. ("AMO")

BULLETIN TYPE: Halt

BULLETIN DATE: December 11, 2009

TSX Venture Tier 1 Company

Effective at the opening, December 11, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

---------------------------------------------------------------------------

BLING CAPITAL CORP. ("BLI.P")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

Effective at the opening Monday, December 14, 2009, shares of the Company

will resume trading, an announcement having been made on November 12,

2009.

TSX-X

---------------------------------------------------------------------------

BRIDGEPORT VENTURES INC. ("BPV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 26, 2009:

Number of Shares: 12,590,000 shares

Purchase Price: $1.00 per share

Warrants: 12,590,000 share purchase warrants to purchase

12,590,000 shares

Warrant Exercise Price: $1.50 for a three year period

Number of Placees: 70 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Hugh Snyder Y 1,000,000

Andrew Wayne Beach P 250,000

Ryan Mathieson P 50,000

John McBride Y 150,000

Donato Sferra P 50,000

Jeff Kowal P 50,000

Don McFarlane P 175,000

Finder's Fee: an aggregate of $503,400, plus 521,200 broker

warrants (each exercisable into 1 common share

at a price of $1.00 for a period of 1 year)

payable to Andrew Beach, Toll Cross Securities

Inc., PowerOne Capital Markets Ltd., Canaccord

Capital Corp., Robert Chalmers, RPC Capital

Ltd., Arena Advisors Canada Inc., BMO Nesbitt

Burns, Foster & Associates, CIBC World

Markets, Haywood Securities Inc. and MGI

Securities

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). Note that in

certain circumstances the Exchange may later extend the expiry date of

the warrants, if they are less than the maximum permitted term.

TSX-X

---------------------------------------------------------------------------

BRIDGEPORT VENTURES INC. ("BPV")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation relating to a

purchase agreement (the "Agreement") dated November 10, 2009, between

Francisco Schubert Seiffert (the "Vendor"), Rio Condor Resources S.A.

("Rio Condor") and Bridgeport Ventures Inc. (the "Company"). Pursuant to

the Agreement, the Company shall acquire 100% of the issued and

outstanding shares of Rio Condor from the Vendor.

As consideration, the Company shall issue 1,200,000 common shares and pay

US$2,000 to the Vendor.

For more information, refer to the Company's news release dated November

11, 2009.

TSX-X

---------------------------------------------------------------------------

CASSIDY GOLD CORP. ("CDX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 16, 2009:

Number of Shares: 10,000,000 shares

Purchase Price: $0.20 per share

Warrants: 5,000,000 share purchase warrants to purchase

5,000,000 shares

Warrant Exercise Price: $0.30 for a two year period. The warrants are

subject to an accelerated exercise provision

in the event the Company shares are greater

than $0.60 on any 20 consecutive trading days.

Number of Placees: 23 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Osvaldo (Ozzie) Iadoraola Y 50,000

Phoenix Gold Fund Limited Y 3,500,000

Alvin F. Ritchie P 200,000

Cheryl Wheeler P 100,000

Randy Butchard P 200,000

Tumer Bahcheli P 220,000

Bob Verhelst P 25,000

Finders' Fees: Arena Advisors Canada Inc. - $50,000 and

250,000 Finder's Warrants that are exercisable

into common shares at $0.205 per share for a

two year period.

Haywood Securities Inc. - $8,000 and 40,000

Finder's Warrants that are exercisable into

common shares at $0.205 per share for a two

year period.

Leede Financial Markets Inc. - $8,000 and

40,000 Finder's Warrants that are exercisable

into common shares at $0.205 per share for a

two year period.

Jennings Capital Inc. - $3,920 and 19,600

Finder's Warrants that are exercisable into

common shares at $0.205 per share for a two

year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

CBM ASIA DEVELOPMENT CORP. ("TCF")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement, Correction

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

Further to the bulletin dated December 10, 2009, the bulletin should have

read as follows:

TSX Venture Exchange has conditionally accepted for filing an amendment

dated December 1, 2009 to the Letter of Intent dated October 16, 2009

between CBM Asia Development Corp. (the "Company") and Batavia Energy

Inc. ("Batavia"), a private Ontario company, and McLaren Resources Inc.

(collectively the "Vendors"), whereby the Company is to acquire,

indirectly through a holding company, 24% of South Sumatra Energy Inc.

("SSE") which, together with PT Medco CBM Sekayu, the operator, holds a

production sharing contract (the "Sekayu PSC") for coalbed methane on a

58,349 hectare block located in the South Sumatra Basin, Indonesia (the

"Property"). The 24% interest in SSE represents an estimated 12% working

interest in the Sekayu PSC. In consideration, the Company is required to

make a cash payment of US$730,000 to Batavia upon closing and US$350,000

on or before March 1, 2011 at the Company's discretion (if the Company

fails to make this payment by March 1, 2011, the Company's interest in

SSE will be reduced to a 22% interest representing an estimated 11%

working interest in the Sekayu PSC). The Company is to incur exploration

expenditures totaling US$3,243,500 under the Sekayu PSC on or before

December 31, 2012. The Company is required, under the Exchange

conditional acceptance, to submit a NI 51-101 compliant technical report

on the Property for disclosure purpose on or before March 10, 2010.

TSX-X

---------------------------------------------------------------------------

DEREK OIL & GAS CORPORATION ("DRK")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 5, 2009:

Number of Shares: 500,000 shares

Purchase Price: $0.10 per share

Warrants: 500,000 share purchase warrants to purchase

500,000 shares

Warrant Exercise Price: $0.12 for a five year period

Number of Placees: 3 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Greg Amor Y 190,000

Barry C.J. Ehrl Y 200,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

DRM VENTURES INC. ("DRM.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated October 15, 2009 has

been filed with and accepted by TSX Venture Exchange and the Ontario,

British Columbia, Alberta and Quebec Securities Commissions effective

October 19, 2009, pursuant to the provisions of the respective Securities

Acts. The Common Shares of the Company will be listed on TSX Venture

Exchange on the effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$1,000,000 (5,000,000 common shares at $0.20 per share).

Commence Date: At the opening Monday, December 14, 2009, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: Ontario

Capitalization: Unlimited common shares with no par value of

which 6,550,000 common shares are issued and

outstanding

Escrowed Shares: 1,550,000 common shares

Transfer Agent: Equity Transfer & Trust Company

Trading Symbol: DRM.P

CUSIP Number: 26210A 10 8

Agent: Haywood Securities Inc.

Agent's Options: 500,000 non-transferable stock options. One

option to purchase one share at $0.20 per

share for up to 24 months.

For further information, please refer to the Company's Prospectus dated

October 15, 2009.

Company Contact: Amin Khalifa

Company Address: c/o 365 Bay Street, Suite 800

Toronto, ON M5H 2V1

Company Phone Number: (949) 547-1368

Company Fax Number: (416) 361-1790

TSX-X

---------------------------------------------------------------------------

EAGLECREST EXPLORATIONS LTD. ("EEL")

BULLETIN TYPE: Consolidation

BULLETIN DATE: December 11, 2009

TSX Venture Tier 1 Company

Pursuant to a special resolution passed by shareholders on December 10,

2009, the Company has consolidated its capital on a 10 old for 1 new

basis; however, the name and the trading symbol of the Company have not

been changed.

Effective at the opening Monday, December 14, 2009, common shares of

Eaglecrest Explorations Ltd. will commence trading on TSX Venture

Exchange on a consolidated basis. The Company is classified as a 'Mining

Exploration/Development' company.

Post - Consolidation

Capitalization: Unlimited shares with no par value of which

43,381,203 shares are issued and outstanding

Escrow 18,750 shares are subject to escrow

Transfer Agent: Computershare Investor Services

Trading Symbol: EEL (unchanged)

CUSIP Number: 269903 30 8 (new)

TSX-X

---------------------------------------------------------------------------

ETNA RESOURCES INC. ("ETN")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 1, 2009:

Number of Shares: 9,848,801 shares

Purchase Price: $0.30 per share

Warrants: 4,924,400 share purchase warrants to purchase

4,924,400 shares

Warrant Exercise Price: $0.50 for an eighteen-month period

Number of Placees: 185 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Dallas Fahy P 40,000

William Vance P 200,000

David Lyall P 200,000

Finders' Fees: $37,416 cash and 124,720 warrants payable to

314 Finance Corp. (Tasso Baras)

$1,680 cash and 5,600 warrants payable to

Bolder Investment Partners, Ltd.

$840 cash and 2,800 warrants payable to

Northern Securities Inc.

$17,520 cash and 58,400 warrants payable to

Jordan Capital Markets Inc.

$72,715.22 cash and 242,384 warrants payable

to Canaccord Financial Ltd.

$40,000 cash and 133,333 warrants payable to

PowerOne Capital Markets Limited

$26,400 cash and 88,000 warrants payable to

Interglobal Trading, Inc. (Ian Heathcote)

$11,040 cash and 36,800 warrants payable to

Research Capital Corporation

$7,720 cash and 25,733 warrants payable to

Christopher Verrico

$7,999.99 cash and 26,666 warrants payable to

Frank Taggart

$1,440 cash and 4,800 warrants payable to Ian

Fuller

$2,400 cash and 8,000 warrants payable to Alex

Kuznecov

$7,680 cash and 25,600 warrants payable to

Ashley James

- Finder's fee warrants are exercisable at $0.50

per share for an eighteen-month period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

FOCUS VENTURES LTD. ("FCV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 5, 2009:

Number of Shares: 8,000,000 shares

Purchase Price: $0.75 per share

Warrants: 4,000,000 share purchase warrants to purchase

4,000,000 shares

Warrant Exercise Price: $1.00 for a two year period

Number of Placees: 102 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Catherine Seltzer P 65,000

Harry Pokrandt P 100,000

Finders' Fees: 351,435 units and 351,435 warrants payable to

Axemen Resource Capital Ltd.

140,023 warrants payable to Leede Financial

Markets Inc.

46,667 units and 46,667 warrants payable to

Global Resource Investments, Ltd.

11,375 units and 11,375 warrants payable to

PI Financial Corp.

- Finder's fee warrants are exercisable at $1.00

for two years.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

HTC PURENERGY INC. ("HTC")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 27, 2009:

Number of Shares: 40,000 shares

Purchase Price: $2.50 per share

Number of Placees: 2 placees

No Insider / Pro Group Participation

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

IMPAX ENERGY SERVICES INCOME TRUST ("MPX.UN")

BULLETIN TYPE: Halt

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

Effective at 7:37 a.m. PST, December 11, 2009, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

---------------------------------------------------------------------------

NANOTECH SCIENCES CORP ("NAN.P")

BULLETIN TYPE: Qualifying Transaction-Completed, Delist

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

Qualifying Transaction:

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Management Information Circular dated

November 2, 2009. The Qualifying Transaction involves the subscription by

the Company into a brokered private placement (the Courtland Private

Placement) being carried out by Courtland Capital Corporation

(Courtland), a capital pool company. The Company's subscription was for

2,176,875 units of Courtland (the Courtland Units) at a purchase price of

$0.10 per Courtand Unit. Each Courtland Unit consists of one common share

of Courtland (the Courtland Share) and three-quarters of one common share

purchase warrant of Courtland (the Courtland Warrant). Each whole

Courtland Warrant entitles the holder to acquire an additional Courtland

Share at an exercise price of $0.20 per share for a period of two years

after closing of the Courtland Private Placement.

The Courtland Private Placement was carried out in conjunction with, and

as a condition of, the completion of Courtland's Qualifying Transaction,

being its acquisition of ForceLogix Technologies Inc. (ForceLogix).

Pursuant to Courtland's Qualifying Transaction, Courtland securities,

including the Courtland Units, were automatically converted into

securities of ForceLogix.

The Exchange has been advised that the subscription by the Company into

the Courtland Private Placement, among other things, was approved by a

majority of the minority of the shareholders of the Company on November

26, 2009, and as a result, the Company completed its subscription into

the Courtland Private Placement.

As a result, the following insiders of the Company acquired the following

shares of ForceLogix, which are subject to a Tier 2 Value Escrow

Agreement, together with warrants of ForceLogix received by these

insiders, which are also subject to similar restrictions.

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P # of ForceLogix Shares

Jason Bullen Y 135,000

Scott Walters Y 270,000

Michael Mansfield Y 67,500

Linx Inc. (Bryce Bradley) Y 270,000

Delist:

Effective at the close of business on Friday, December 11, 2009 the

Company's shares will be delisted from TSX Venture Exchange at the

request of the Company, the Company having completed its Qualifying

Transaction through its subscription into the Courtland Private

Placement, which was carried out in conjunction with Courtland's

Qualifying Transaction.

Since the Company's shareholders also approved the voluntary dissolution

of the Company, following completion of the delisting of the Company

shares, the Company will be dissolved and all outstanding equity rights

of the Company will be cancelled.

For further information, please see the Company's Management Information

Circular dated November 2, 2009 and its news release dated May 11, 2009,

all as filed on SEDAR, as well as the Exchange Bulletin respecting

ForceLogix Technologies Inc. dated December 9, 2009.

TSX-X

---------------------------------------------------------------------------

NAVASOTA RESOURCES LTD. ("NAV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 9, 2009:

Number of Shares: 19,999,998 shares

Purchase Price: $0.15 per share

Number of Placees: 17 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P # of Shares

Jeffrey Mackie P 200,000

James F. Mackie P 733,300

Brenda Mackie P 666,700

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

OPEL INTERNATIONAL INC. ("OPL")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 7,500,000

Original Expiry Date of Warrants: December 13, 2009

New Expiry Date of Warrants: December 13, 2011

Exercise Price of Warrants: $1.90

These warrants were issued pursuant to a private placement of 15,000,000

shares with 7,500,000 share purchase warrants attached, which was

accepted for filing by the Exchange effective December 21, 2007.

TSX-X

---------------------------------------------------------------------------

ORGANIC RESOURCE MANAGEMENT INC. ("ORI")

BULLETIN TYPE: New Listing-Shares

BULLETIN DATE: December 11, 2009

TSX Venture Tier 1 Company

The Company is presently trading on the Toronto Stock Exchange and is

delisting at the close of market on December 11, 2009. Effective at the

opening Monday, December 14, 2009, the common shares of the Company will

commence trading on TSX Venture Exchange. The Company is classified as a

'Waste Management and Remedial Services' company.

Corporate Jurisdiction: Canada

Capitalization: Unlimited common shares with no par value of

which 4,404,935 common shares are issued and

outstanding

Escrowed Shares: 0 common shares

Transfer Agent: Equity Transfer & Trust Company

Trading Symbol: ORI

CUSIP Number: 68618L 10 4

For further information, please refer to the Company's public disclosure

documents available on www.sedar.com

Company Contact: Charles Buehler, Chairman and CEO

Company Address: 3700 Steeles Avenue West Suite 601,

Woodbridge, Ontario L4L 8K8

Company Phone Number: (905) 264-7700

Company Fax Number: (905) 264-7273

TSX-X

---------------------------------------------------------------------------

OUTLOOK RESOURCES INC. ("OLR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange (the "Exchange") has accepted for filing

documentation pertaining to a letter agreement (the "Agreement") dated

November 9, 2009, between Outlook Resources Inc. (the "Company"), ERTH

Solutions, Inc. ("ESI") and ERTH Technologies, LLC. Pursuant to the

Agreement, the Company shall acquire the remaining 93% of ESI. This

Agreement replaces and supersedes the original letter agreement (the

"Original Agreement") dated July 2, 2009, as described in the Exchange's

July 3, 2009 bulletin. Under the Original Agreement, the Company has

acquired an aggregate of 7% interest of ESI for US$150,000 and

CDN$25,000.

To acquire the remaining interest from ESI, the Company shall pay ESI

US$150,000 and issue an aggregate of 36,000,000 units to the shareholders

of ESI. Each unit will consist of a common share and one common share

purchase warrant. Each warrant is exercisable into one common share at a

price of $0.10 per share for a three year period.

For further information, please refer to the Company's press releases

dated September 22, 2009 and November 10, 2009.

TSX-X

---------------------------------------------------------------------------

PETRO UNO RESOURCES LTD. ("PUP")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced November 12, 2009:

Number of Shares: 4,000,000 flow-through shares

Purchase Price: $0.50 per share

Number of Placees: 53 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Jordan Kevol Y 70,000

Donald Boykiw Y 50,000

Neil Burrows Y 75,000

Agent's Fee: Blackmont Capital Inc. - $140,000 cash and

280,000 Agent's Options

Each Agent Option is exercisable at a price

of $0.50 per share for a one year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

Q-GOLD RESOURCES LTD. ("QGR")

(formerly Q-Gold Resources Ltd. ("QAU"))

BULLETIN TYPE: Consolidation, Symbol Change

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

Pursuant to a resolution passed by shareholders November 6, 2009, the

Company has consolidated its capital on a 15 old for 1 new basis. The

name of the Company has not been changed.

Effective at the opening Monday, December 14, 2009, the common shares of

Q-Gold Resources Ltd. will commence trading on TSX Venture Exchange on a

consolidated basis. The Company is classified as a 'Gold Mining' company.

Post - Consolidation

Capitalization: unlimited shares with no par value of which

7,730,943 shares are issued and outstanding

Escrow: Nil

Transfer Agent: Equity Transfer and Trust Company

Trading Symbol: QGR (new)

CUSIP Number: 747269 20 7 (new)

TSX-X

---------------------------------------------------------------------------

STELMINE CANADA LTD. ("STH")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of a

Purchase Agreement dated November 3, 2009 between the Company and 6845488

Canada Inc. (9112-3265 Quebec Inc. & Ricky Baril) and 9187-1400 Quebec

Inc. (R. Rousseau & F. Marcotte) (collectively, the "Optionors") whereby

the Company may acquire up to a 100% interest in thirty (30) mining

claims covering 950 hectares located in the Kipawa alkaline complex, 100

kilometers northeast of North Bay, Ontario.

The Company may acquire an initial 70% interest by paying $60,000,

issuing 350,000 shares of common shares and exploration expenditures

totaling $100,000 in 12 months. The Company could also acquire the

additional 30% interest by paying $50,000 and issuing 250,000 shares

within two years of the signing of the agreement.

For further information, please refer to the Company's news release dated

November 24, 2009.

TSX-X

---------------------------------------------------------------------------

STELMINE CANADA LTD. ("STH")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation of

an Agreement dated October 28, 2009 between the Company and Gemme

Manicouagan Inc. (the "Vendor". Insiders: Mario Bourque, Gilles Bourque

and Marcel Bourque) whereby the Company may acquire a 100% interest in

six (6) mining claims covering 360 hectares distributed into 3 blocs

located in the Wakefield alkaline complex north of Gatineau, Quebec.

The consideration payable to the Vendor is $25,000; the issuance of

300,000 common shares of the Company and exploration expenditures of

$100,000 on the property within 12 months following the completion of the

agreement.

For further information, please refer to the Company's news release dated

December 3, 2009.

TSX-X

---------------------------------------------------------------------------

STROUD RESOURCES LTD. ("SDR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 18, 2009:

Number of Shares: 6,000,000 shares

Purchase Price: $0.05 per share

Warrants: 6,000,000 share purchase warrants to purchase

6,000,000 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 10 placees

Finder's Fee: an aggregate of $5,250 payable to Wolverton

Securities Ltd. And Wellington West Capital

Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). Note that in

certain circumstances the Exchange may later extend the expiry date of

the warrants, if they are less than the maximum permitted term.

TSX-X

---------------------------------------------------------------------------

WCB CAPITAL LTD. ("WCB.P")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

Further to the Company's press release dated December 9, 2009, effective

at the opening Monday, December 14, the common shares of the Company will

resume trading, its proposed Qualifying Transaction having been

terminated.

TSX-X

---------------------------------------------------------------------------

XCEL CONSOLIDATED LTD. ("XCC")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement, Remain

Suspended

BULLETIN DATE: December 11, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to a

Share Purchase Agreement (the "Agreement") between Xpel Consolidated Ltd.

(the "Company") and an arm's length purchaser (the "Purchaser") dated

June 29, 2009 whereby the Company has agreed to sell 100% of the shares

of its subsidiary company, Diversified Properties Ltd. (the

"Subsidiary"). In consideration, the Purchaser will pay a total of

$120,000 over a period of 24 months with a 5% per annum interest.

This transaction was announced in the Company's press release dated July

3, 2009.

Further to the Exchange bulletin dated May 11, 2009 trading in the

Company's securities will remain suspended. Members are prohibited from

trading in the securities of the Company during the period of the

suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

NEX COMPANIES

NOVUS GOLD CORP. ("NOV")

(formerly Novus Gold Corp. ("NOV.H"))

BULLETIN TYPE: Change of Business, Private Placement-Brokered, Graduation

from NEX to TSX Venture, Symbol Change

BULLETIN DATE: December 11, 2009

NEX Company

TSX Venture Exchange Inc. (the "Exchange") has accepted for filing Novus

Gold Corp.'s (the "Company") Change of Business (the "COB") and related

transactions, all as principally described in its filing statement dated

as November 30, 2009 (the "Filing Statement"). The COB includes the

following matters, all of which have been accepted by the Exchange:

1. $2,650,000 Private Placement - Brokered:

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 24, 2009:

Number of Shares: 13,250,000 shares

Purchase Price: $0.20 per share

Number of Placees: 80 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Pat Robinson &

P. Leigh Sander P 300,000

Peter Brown P 400,000

Matthew H. Cicci P 65,000

Rick Langer P 80,000

Anthony Ostler P 50,000

Junya Huang P 50,000

Mark Hewett P 51,000

Erik Dekker P 51,000

Paul Dipasquale P 100,000

858795 BC Ltd. P 50,000

Robert Sali P 1,000,000

Richard Cohen P 125,000

Robert Klassen P 125,000

Kelly Klatik P 40,000

Steve Isenberg P 50,000

2. Graduation from NEX to TSX Venture, Symbol Change:

The Company has met the requirements to be listed as a TSX Venture Tier 2

Company. Therefore, effective at the opening Monday, December 14, 2009,

the Company's listing will transfer from NEX to TSX Venture, the

Company's Tier classification will change from NEX to Tier 2 and the

Filing and Service Office will change from NEX to Vancouver.

Effective at the opening Monday, December 14, 2009 the trading symbol for

the Company will change from NOV.H to NOV.

The Company is classified as a 'Mining' company.

Capitalization: Unlimited shares with no par value of which

33,585,000 shares are issued and outstanding

Escrowed: 1,288,000 common shares

TSX-X

---------------------------------------------------------------------------

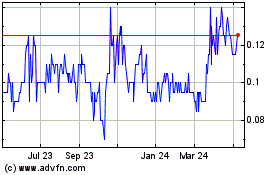

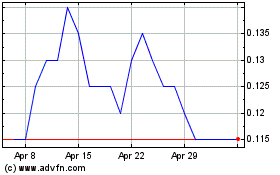

Cloud DX (TSXV:CDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cloud DX (TSXV:CDX)

Historical Stock Chart

From Apr 2023 to Apr 2024