Eurogas Corporation Announces Financial Results for the Year Ended December 31, 2010

February 17 2011 - 3:19PM

Marketwired Canada

Eurogas Corporation ("Eurogas" or the "Corporation") (TSX:EUG) today announced

its financial results for the year ended December 31, 2010.

During 2010, the Corporation incurred a net loss of $3.8 million, or

approximately $0.02 per share. This compares with a net loss of $3.2 million in

2009. In June 2010, the Corporation successfully completed the acquisition of

oil and natural gas properties in and around Lake Erie, Ontario (the

"Acquisition"). Following the Acquisition, the Corporation began generating

revenues from, and incurring expenses related to the assets acquired. As such,

the nature of the Corporation's operations have changed significantly, impacting

the various components of net earnings when compared with those of the prior

year, where the Corporation's activities were limited to exploration and

development activities.

LAKE ERIE ASSETS

Revenues from Oil and Gas Sales

Since the Acquisition, Eurogas has earned gross revenues of $19.5 million

from the sale of oil and natural gas.

FROM JUNE 29, 2010 TO DECEMBER

FOURTH QUARTER 31, 2010

--------- -------------------------------- -------------------------------

($000's) ($000's)

Oil Average Realized Oil Average Realized

and Production Prices and Production Prices

Gas Sales Volumes per Unit Gas Sales Volumes per Unit

--------- -------------------------------- -------------------------------

Natural

gas $ 4,309 10,417 $ 4.50 $ 9,190 10,435 $ 4.79

(Mcf/d) (Mcf/d)

Oil 5,342 669 $ 86.82 10,141 669 $ 82.38

(bbls/d) (bbls/d)

Liquids 117 22 $ 58.18 189 19 $ 55.11

(bbls/d) (bbls/d)

--------- -------------------------------- -------------------------------

Total

Revenue $ 9,768 $ 19,520

--------- -------------------------------- -------------------------------

Revenues from natural gas sales were adversely affected by North American

natural gas prices which, as a result of excess supply, have continued to

decline throughout the second half of 2010. Global natural gas working

inventories at the end of 2010 remain near the record highs set in December

2009. The Corporation realized an average price of $4.79/Mcf, representing a

positive basis differential from the Nymex price of US$4.30/Mcf due to the

Corporation's proximity to the Dawn hub, which is located in southwestern

Ontario. The Dawn hub is a leading provider of natural gas supply to the greater

Toronto market area.

During the six months since the Acquisition, the Corporation realized an average

price of $82.38/bbl on sales of oil. While world oil consumption grew in 2010,

significant uncertainties in world markets continue to cause substantial

volatility in the price of oil.

Since the Acquisition, field level cash flows generated from the Lake Erie

Assets were $10.8 million.

(in thousands

except per unit FROM JUNE 29, 2010 TO

amount) FOURTH QUARTER DECEMBER 31, 2010

------------------ --------------------------- ---------------------------

Field Field

Level ($/bbl) ($/Mcf) Level ($/bbl) ($/Mcf)

Cash Oil and Natural Cash Oil and Natural

Flows Liquids Gas Flows Liquids Gas

------------------ --------------------------- ---------------------------

Total sales $ 9,768 $ 85.91 $ 4.50 $ 19,520 $ 81.64 $ 4.79

Royalty expense (1,467) (12.64) (0.69) (3,040) (12.73) (0.74)

Cost of sales and

transportation

costs (2,926) (23.29) (1.51) (5,719) (20.42) (1.63)

------------------ --------------------------- ---------------------------

Field Netbacks $ 5,375 $ 49.98 $ 2.30 $ 10,761 $ 48.49 $ 2.42

------------------ --------------------------- ---------------------------

Capital Expenditures

Since the Acquisition, the Corporation invested $3.8 million in the Lake Erie

Assets, including a new compressor at one of its gas plants, as well as pipeline

replacements and upgrades throughout the field. Planned capital expenditures in

2011 are estimated at $8.9 million on a net basis and include approximately $5.1

million for onshore projects and a further $3.8 million for offshore projects.

Capital expenditures in 2011 include the drilling of four infill wells onshore

and three wells offshore, at a cost of approximately $2.6 million and $1.5

million on a net basis, respectively.

Price Risk Management

The Corporation has entered into fixed price derivative contracts for the

purpose of protecting its oil and natural gas revenue from the volatility of oil

and natural gas prices and the volatility in Canadian to US foreign exchange

rates. The Corporation's price risk management strategies assist the Corporation

in securing a more stable amount of cash flows to protect a desired level of

capital spending and for debt management. At February 17, 2011, the Corporation

had locked in pricing for 350 bbl/d of oil production at a weighted average rate

of Cdn$90.40/bbl through to December 2011. It also entered into a commodity swap

on 6.5 million btu/day of natural gas from June 1, 2011 to February 28, 2012 at

a fixed price of Cdn$4.66/MMbtu. With these risk management contracts, the

Corporation has hedged approximately 50% of its oil production and 60% of its

natural gas production during the periods covered by the hedges.

CASTOR UNDERGROUND GAS STORAGE PROJECT

Project financing for the Castor Project was completed in July 2010, providing

the project with a 10-year, EUR1.3 billion project financing through a syndicate

of 19 banks. To provide security for the financing, the Corporation's

subsidiary, Castor UGS Limited Partnership ("CLP") pledged its 33.33% interest

in Escal UGS S.L., the owner of the Castor Project, to the banking syndicate.

Other than the pledging of its shares, CLP will not be required to provide any

equity or debt funds or provide any warranties required by the project finance

lenders as this obligation was assumed by ACS Servicios Communicacions y Energia

S.L. ("ACS"), CLP's partner in this transaction and a 66.67% owner of Escal.

Notwithstanding any form by which ACS may fund Escal during the construction

phase, CLP's interest in Escal will at all times remain at 33.33%, and CLP will

retain the right to 33.33% of all distributable cash flows.

During 2010, project construction and development, including the 12 well

drilling program, continued to advance. The routing of the subsea pipeline from

the shore to the site of the onshore facilities of the Castor Project was

established and the necessary rights of way were granted as part of the

Administrative Authorization Permit received in June 2010.

PREFERRED SHARE INTEREST IN EUROGAS INTERNATIONAL INC.

On January 18, 2011, Eurogas International announced that, together with its

joint venture partner, it has declared a condition of a Force Majeure with

respect to the Sfax Permit and Ras-El-Besh concession. Eurogas International and

its joint venture partner believe that the current political uncertainty and

civil unrest in Tunisia, which have resulted in the collapse of the government,

a declaration of a state of emergency and serious civil disturbance, adversely

affects their ability to continue their exploration and evaluation activities.

Eurogas International believes that the declaration of a Force Majeure will

temporarily suspend activities while the conditions resulting in the Force

Majeure continue.

During 2010, an aggregate of $3.4 million was capitalized by Eurogas

International to deferred exploration costs. In addition, Eurogas International

settled previously announced arbitration proceedings with Seawolf Oilfield

(Cyprus) Limited and Seawolf Oilfield Services Limited for US$12 million, to be

received over an 18 month period. Eurogas International's share of the

settlement proceeds were US$3.6 million and were primarily applied to reduce the

carrying amount of deferred exploration costs.

As a condition of the Sfax Permit, Eurogas International is committed to

drilling one new exploration well. Eurogas International has also committed to

complete the abandonment and reclamation of the REB-3 well, which was drilled in

2008. The estimated budget for the Sfax Permit and the associated Ras-El-Besh

concession during 2011, including these two commitments, is approximately US$25

million, of which Eurogas International is responsible for its net share of

approximately US$8.1 million. In the event that Eurogas International does not

complete its work commitments as outlined in the terms of the extension, a

compensatory payment of up to US$12 million (net US$5.4 million to Eurogas

International) will be payable to the Tunisian regulatory bodies, less any

amounts incurred by the joint venture in respect of the completion of its

obligations. Additional information regarding Eurogas International may be

accessed at www.eurogasinternational.com.

ABOUT THE CORPORATION

Eurogas has filed its consolidated financial statements and related management's

discussion and analysis for the year ended December 31, 2010 with the Canadian

securities regulatory authorities on the System for Electronic Document Analysis

and Retrieval ("SEDAR"). All documentation may be viewed under the Corporation's

profile on SEDAR (www.sedar.com), the Corporation's website www.eurogascorp.com

or by contacting Eurogas. Eurogas Corporation is listed on the Toronto Stock

Exchange under the symbol "EUG" and is engaged in oil and natural gas operations

in Ontario and indirectly in the development of a major underground storage

facility off the east coast of Spain. For more information on Eurogas, visit the

website www.eurogascorp.com.

FOOTNOTES

-- "Field Level Cash Flows" is calculated as revenues from oil and gas

sales, less royalties, cost of sales and transportation costs.

-- "Field Netbacks" refers to field level cash flows expressed on a barrel

of oil equivalent basis.

"Field Level Cash Flows" and "Field Netbacks" are common benchmarks in the oil

and natural gas industry. However, these measures are not defined by generally

accepted accounting principles, do not have standard meanings and as such, may

not be comparable to similar measures used by other companies.

FORWARD-LOOKING STATEMENTS

Certain information set forth in these documents, including management's

assessment of each of the Corporation's future plans and operations, contains

forward-looking statements. Forward-looking statements are statements that are

predictive in nature, depend upon or refer to future events or conditions or

include words such as "expects", "anticipates", "intends", "plans", "believes",

"estimates" or similar expressions. By their nature, forward-looking statements

are subject to numerous risks and uncertainties, some of which are beyond the

Corporation's control, including: exploration, development and production risks;

uncertainty of reserve estimates; reliance on operators, management and key

personnel; cyclical nature of the business; economic dependence on a small

number of customers; additional funding that may be required to execute on

exploration and development work; the ability to obtain, sustain or renew

licenses and permits; risks inherent to operating and investing in foreign

countries; availability of drilling equipment and access; industry competition;

environmental concerns; climate change regulations; volatility of commodity

prices; hedging activities; no history of earnings; potential defects in title

to properties; potential conflicts of interest; changes in taxation legislation;

insurance, health, safety and litigation risk; labour costs and labour

relations; geo-political risks; risks relating to management of growth;

aboriginal claims; volatility of the Corporation's share price; royalty rates

and incentives; regulatory risks relating to oil and natural gas exploration;

marketability and price of oil and natural gas; failure to realize anticipated

benefits of acquisitions and dispositions; information system risk; and other

risk factors discussed or referred to in the section entitled "Business Risks"

in the Corporation's Management's Discussion and Analysis as at and for the year

ended December 31, 2010. Readers are cautioned that the assumptions used in the

preparation of such information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance should not

be placed on forward-looking statements. The Corporation's actual results,

performance or achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking statements

will transpire or occur, or if any of them do so, what benefits the Corporation

will derive from them. The Corporation disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by law.

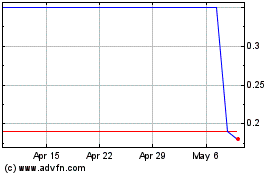

Archon Minerals (TSXV:ACS)

Historical Stock Chart

From Mar 2024 to Apr 2024

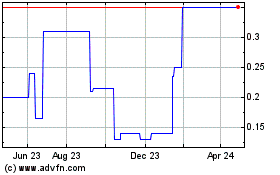

Archon Minerals (TSXV:ACS)

Historical Stock Chart

From Apr 2023 to Apr 2024