Mkango Resources Closes First Tranche of Private Placement

March 01 2013 - 12:22PM

Marketwired Canada

THIS NEWS RELEASE IS NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR

DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES

Mkango Resources Ltd. (TSX VENTURE:MKA) (the "Corporation" or "Mkango") is

pleased to announce that it has closed the first tranche of its non-brokered

private placement of units (the "Units") announced in its press release of

February 25, 2013.

4,285,715 Units were issued to Leo Mining and Exploration Limited ("Leominex")

at a price of C$0.175 per Unit for gross cash proceeds of C$750,000.

Each Unit consists of one common share ("Common Share") and one-half of a Common

Share purchase warrant ("Warrant") of Mkango. Each whole Warrant entitles the

holder to acquire one Common Share for C$0.35 for a period of 12 months

following the closing date of the financing. Where the closing price of the

common shares on the TSX Venture Exchange equals or exceeds C$0.40 for 20

consecutive trading days following the date that is four months and one day

after the date of issuance of the Warrants, the Corporation shall have the right

to require conversion of the Warrants at the exercise price upon 30 days'

notice.

The securities issued to Leominex have a hold period of four months and one day

from the closing date. No fees were payable in connection with this portion of

the Private Placement.

As previously announced, the Corporation also plans to offer up to 7,144,285

Units to certain existing shareholders and other potential investors who are

eligible to purchase the Units on a private placement basis. The Corporation

will ensure that any participating shareholder wishing to maintain its position

in Mkango has the opportunity to do so. The Units will be offered at the same

price as was paid by Leominex. This portion of the Private Placement may be

completed in a number of tranches however the last closing date of the Private

Placement will be no later than permitted by the TSX Venture Exchange. The

securities issued under the remaining tranches of the Private Placement will

have a hold period of four months and one day from the applicable closing date.

Fees may be payable by Mkango on this portion of the Private Placement.

The use of proceeds from the Private Placement comprise further metallurgical

test work, mine planning, environmental studies and other aspects required to

move the project through the pre-feasibility stage, in addition to regional

exploration and general corporate purposes.

As Leominex is an insider of the Corporation, the first tranche of the Private

Placement was a "related party transaction" as defined under Multilateral

Instrument 61-101 ("MI 61-101"). The transaction, however, was exempt from the

formal valuation and minority shareholder approval requirements of MI 61-101 as

neither the fair market value of any securities issued to or the consideration

paid by Leominex will exceed 25% of the Corporation's market capitalization.

Leominex now beneficially owns or controls 24,138,614 common shares of the

Corporation, representing approximately 58% of the issued and outstanding common

shares of the Corporation. Assuming the remaining portion of the Private

Placement is fully subscribed, Leominex will upon closing of the remaining

portion of the private placement beneficially own or control 24,138,614 common

shares of the Corporation, representing approximately 49% of the issued and

outstanding common shares of the Corporation. The Private Placement was

unanimously approved by the directors of the Corporation. The material change

report in respect of the Private Placement will be filed less than 21 days

before the expected date of the closing which the Corporation considers

reasonable and necessary in the present circumstances to continue to move the

Songwe project towards the pre-feasibility stage.

The Private Placement remains subject to final acceptance of the TSX Venture

Exchange.

The Songwe Hill Rare Earth Project

The Songwe Hill rare earth project is located within the 100% owned Exclusive

Exploration Licence 0284/10R in southeast Malawi. The Songwe project is

accessible by road from Zomba, the former capital, and Blantyre, the principal

commercial town of Malawi. Total travel time from Zomba is approximately 2

hours, which will reduce as infrastructure continues to be upgraded in the area.

On 22 November 2012, Mkango filed a Technical Report (the "Report") for its

maiden NI 43-101 mineral resource estimate entitled NI 43-101 Technical Report

and Mineral Resource Estimate for the Songwe Hill Rare Earth Element (REE)

Project, Phalombe District, Republic of Malawi authored by Scott Swinden, Ph.D,

P.Geo. and Michael Hall, Pr.Sci.Nat., MAusIMM. The Report's mineral resource

estimates, as previously announced, are summarized below.

----------------------------------------------------------------------------

In-situ Indicated Mineral In-situ Inferred Mineral

Cut-off grade Resource estimate Resource estimate

----------------------------------------------------------------------------

1.0% TREO 13.2 mt grading 1.62% TREO 18.6 mt grading 1.38% TREO

1.5% TREO 6.2 mt grading 2.05% TREO 5.1 mt grading 1.83% TREO

----------------------------------------------------------------------------

TREO - total rare earth oxides including yttrium. In-situ - no geological

losses applied. mt - million tonnes

For further details of mineral resource estimates including breakdowns thereof,

please refer to the Report which is available at www.sedar.com.

Mkango Resources Ltd.

Mkango's primary business is the exploration for rare earth elements and

associated minerals in the Republic of Malawi. It holds, through its wholly

owned subsidiary Lancaster Exploration Limited, a 100% interest in two exclusive

prospecting licenses covering a combined area of 1,751 km2 in southern Malawi.

The main exploration target is the Songwe Hill rare earth deposit, which

features carbonatite hosted rare earth mineralisation and was subject to

previous exploration in the late 1980s.

The Corporation's corporate strategy is to further develop the Songwe Hill rare

earth deposit and secure additional rare earth element and other mineral

opportunities in Malawi and elsewhere in Africa.

On behalf of the Board of Mkango Resources Ltd.,

William Dawes, Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements relating to the

Corporation. Readers are cautioned not to place undue reliance on

forward-looking statements, as there can be no assurance that the plans,

intentions or expectations upon which they are based will occur. By their

nature, forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that contribute to

the possibility that the predictions, forecasts, projections and other

forward-looking statements will not occur, which may cause actual performance

and results in future periods to differ materially from any estimates or

projections of future performance or results expressed or implied by such

forward-looking statements. Such factors and risks include, among others, the

interpretation and actual results of current exploration activities; uncertainty

of estimates of mineral resources, changes in project parameters as plans

continue to be refined; future commodity prices; possible variations in grade or

recovery rates; failure of equipment or processes to operate as anticipated;

labour disputes and other risks of the mining industry; delays in obtaining

governmental approvals or financing or in the completion of exploration.

The forward-looking statements contained in this press release are made as of

the date of this press release. Except as required by law, the Corporation

disclaims any intention and assume no obligation to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by applicable securities law.

Additionally, the Corporation undertakes no obligation to comment on the

expectations of, or statements made, by third parties in respect of the matters

discussed above.

The TSX Venture Exchange has neither approved nor disapproved the contents of

this press release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mkango Resources Ltd.

Ashlee Utterback

Corporate Communications Manager

+1 (403) 444 - 5979

ashlee@mkango.ca

Mkango Resources Ltd.

William Dawes

Chief Executive Officer

+1 (403) 444 - 5979

will@mkango.ca

Mkango Resources Ltd.

Alexander Lemon

President

+1 (403) 444 - 5979

alex@mkango.ca

www.mkango.ca

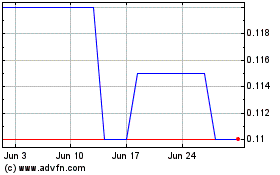

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Apr 2023 to Apr 2024