Imperial Metals Announces Closing of Previously Announced Financings

March 12 2014 - 6:31PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Imperial Metals Corporation (the "Company") (TSX:III) announces it has closed

its previously announced offering of US$325 million 7% Senior Notes (the

"Notes"). The Notes are unsecured and will mature on March 15, 2019. Interest on

the Notes will accrue and be payable semi-annually on each March 15 and

September 15, commencing September 15, 2014.

References to dollar amounts in this press release are to Canadian dollars

unless otherwise indicated.

Concurrently with the closing of the Notes offering, the Company entered into a

five year senior secured credit facility (the "Senior Credit Facility") with a

syndicate of lenders providing for a $200 million revolving credit facility

consisting of two tranches: a $50 million revolving working capital tranche for

general corporate purposes and a $150 million revolving construction tranche to

fund Red Chris project costs.

The Company has used a portion of the net proceeds of the Notes offering and

borrowings under the Senior Credit Facility to repay the outstanding amounts

under its $250 million unsecured line of credit with Edco Capital Corporation

("Edco") and its revolving demand loan agreement with a commercial lender. The

Company intends to use the balance of such proceeds and borrowings to fund

capital expenditures related to the Red Chris project and for general corporate

purposes.

In addition, the Company entered into a five year $75 million junior unsecured

loan facility with Edco (the "Subordinated Credit Facility"). Edco is owned by

Mr. N. Murray Edwards, a significant shareholder of the Company. Interest is

payable at 10% per annum on amounts borrowed under the facility. The

Subordinated Credit Facility is available to fund project cost overruns

associated with the Red Chris project, backstop the payment of certain third

party reimbursement obligations relating to an extension of the Northwest

Transmission Line, and for general corporate purposes. In connection with this

facility, Edco will receive a $750,000 commitment fee and warrants to acquire

750,000 of the Company's shares at $20 per share. The Subordinated Credit

Facility advances, the fees thereunder and the warrants granted in connection

therewith constitute a related party transaction within the meaning of

Multilateral Instrument 61-101. Management considers the Subordinated Credit

Facility to be advantageous as it provides additional timing and flexibility for

financing the completion of the Red Chris project. Management also considers the

terms and conditions of the Subordinated Credit Facility and related warrants to

be reasonable, in the context of the market. These arrangements were reviewed

and approved by the independent members of the Company's Board of Directors. The

material change report in relation to this transaction will be filed less than

21 days before closing as the Company completed this transaction on March 12,

2014 as all necessary approvals had been received and the Company wished to

complete the transaction as soon as commercially feasible after such approvals

were obtained.

Edco purchased US$50 million principal amount of Notes and directors and

officers of the Company purchased an additional US$3.35 million principal amount

of Notes. These purchases were made on the same terms and conditions as

purchases of Notes by other investors. These transactions also constitute

related party transactions within the meaning of Multilateral Instrument 61-101.

The Subordinated Credit Facility transaction with Edco and the purchases of

Notes referred to above are exempt from the formal valuation and minority

approval requirements of Multilateral Instrument 61-101 as they represent less

than 25% of the Company's market capitalization.

The offer and sale of the Notes will not be registered under the United States

Securities Act of 1933, as amended (the "Securities Act") or the securities laws

of any state or the securities laws of any other jurisdiction. The Notes may not

be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act and

applicable state securities laws. Accordingly, the Notes will be offered and

sold in the United States only to "qualified institutional buyers" in accordance

with Rule 144A under the Securities Act, and outside the United States in

reliance on Regulation S under the Securities Act. In addition, in all cases,

the Notes may only be offered and sold on a private placement basis pursuant to

an exemption from the prospectus requirements of the Securities Act (British

Columbia) and, if applicable, securities laws in other provinces and territories

in Canada. Further, the Notes may only be offered and sold outside the United

States and Canada on a private placement basis pursuant to certain exemptions

from applicable securities laws.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy the Notes, nor shall there be any offer or sale of the Notes in

any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Imperial

Imperial is an exploration, mine development and operating company based in

Vancouver, British Columbia. The Company operates the Mount Polley copper/gold

mine in British Columbia and the Sterling gold mine in Nevada. Imperial has 50%

interest in the Huckleberry copper/molybdenum mine and has 50% interest in the

Ruddock Creek lead/zinc property, both in British Columbia. The Company is in

development of its wholly owned Red Chris copper/gold property in British

Columbia.

Cautionary Note Regarding "Forward-Looking Information"

This press release contains "forward-looking information" or "forward-looking

statements" within the meaning of Canadian and United States securities laws,

which we will refer to as "forward-looking information". Except for statements

of historical fact relating to the Company, certain information contained herein

constitutes forward-looking information. When we discuss mine plans; costs and

timing of current and proposed exploration or development; development;

production and marketing; capital expenditures; construction of transmission

lines; cash flow; working capital requirements and the requirement for

additional capital; operations; revenue; margins and earnings; future prices of

copper and gold; future foreign currency exchange rates; future accounting

changes; future prices for marketable securities; future resolution of

contingent liabilities; receipt of permits; or other matters that have not yet

occurred, we are making statements considered to be forward-looking information

or forward-looking statements under Canadian and United States securities laws.

We refer to them in this press release as forward-looking information. The

forward-looking information in this press release may include words and phrases

about the future, such as: plan, expect, forecast, intend, anticipate, estimate,

budget, scheduled, targeted, believe, may, could, would, might or will.

Forward-looking information includes disclosure relating to project development

plans, costs and timing. We can give no assurance the forward-looking

information will prove to be accurate.

It is based on a number of assumptions management believes to be reasonable,

including but not limited to: the continued operation of the Company's mining

operations, no material adverse change in the market price of commodities or

exchange rates, that the mining operations will operate and the mining projects

will be completed in accordance with their estimates and achieve stated

production outcomes and such other assumptions and factors as set out herein. It

is also subject to risks associated with our business, including but not limited

to: the risk that further advances may not be available under credit facilities;

risks inherent in the mining and metals business; commodity price fluctuations

and hedging; competition for mining properties; sale of products and future

market access; mineral reserves and recovery estimates; currency fluctuations;

interest rate risks; financing risks; regulatory and permitting risks;

environmental risks; joint venture risks; foreign activity risks; legal

proceedings; and other risks that are set out in the Company's Management's

Discussion & Analysis in its 2012 Annual Report. If our assumptions prove to be

incorrect or risks materialize, our actual results and events may vary

materially from what we currently expect as provided in this press release. We

recommend you review the Company's most recent Annual Information Form and

Management's Discussion & Analysis in its 2012 Annual Report, which includes

discussion of material risks that could cause actual results to differ

materially from our current expectations. Forward-looking information is

designed to help you understand management's current views of our near and

longer term prospects, and it may not be appropriate for other purposes. We will

not necessarily update this information unless we are required to by securities

laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Imperial Metals Corporation

Brian Kynoch

President

604.669.8959

Imperial Metals Corporation

Andre Deepwell

Chief Financial Officer

604.488.2666

Imperial Metals Corporation

Gordon Keevil

Vice President Corporate Development

604.488.2677

Imperial Metals Corporation

Sabine Goetz

Shareholder Communications

604.488.2657

investor@imperialmetals.com

www.imperialmetals.com

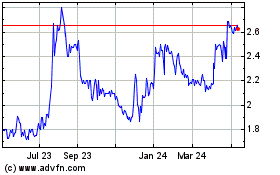

Imperial Metals (TSX:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

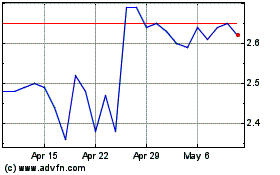

Imperial Metals (TSX:III)

Historical Stock Chart

From Apr 2023 to Apr 2024