Pound Extends Rise

July 15 2015 - 2:04AM

RTTF2

The British pound continued to be strong against the other major

currencies in the Asian session on Wednesday, as traders look ahead

to the release of U.K. employment report for June, due later in the

day.

The Office for National Statistics is set to publish U.K. jobs

data for June at 4:30 am ET. Economists expect the jobless claims

to decline to 9,000, down from 6,500 in May. The unemployment rate

is seen remaining unchanged at 5.5 percent in three months to May.

The average weekly earnings excluding bonus is expected to rise to

3.0 percent in three months to May, up from 2.7 percent.

Traders await the Federal Reserve Chair Janet Yellen's testimony

on the Semiannual Monetary Policy Report before the House Financial

Services Committee, in Washington DC, to get more cues about the

tightening of monetary policy.

Meanwhile, Asian stock markets were mostly higher, following the

overnight gains on Wall Street. Better-than-expected Chinese GDP

data also boosted investor sentiment.

The world's second-largest economy grew 7.0 percent on year in

the second quarter of 2015, China's National Bureau of Statistics

said on Wednesday. That beat forecasts for an increase of 6.8

percent and was unchanged from the three months prior. On an

annualized quarterly basis, China's GDP was up 1.7 percent, which

also beat forecasts for 1.6 percent following the 1.4 percent gain

in the first quarter.

Tuesday, the pound rebounded from its losses after the Bank of

England governor Mark Carney remarked that timing of the U.K. rate

hike is getting closer, given the performance of the economy. The

pound rose 0.30 percent against the U.S. dollar, 0.31 percent

against the yen, 0.14 percent against the Swiss franc and 0.87

percent against the euro.

Meanwhile, the BoE's Monetary Policy Committee member David

Miles said on Tuesday that the there should be a rate hike soon.

There is no need to wait for the U.S. Federal Reserve to move

first, he added. In the Asian trading today, the pound rose to more

than 2-week highs of 0.7025 against the euro and 193.22 against the

yen, from yesterday's closing quotes of 0.7037 and 192.87,

respectively. If the pound extends its uptrend, it is likely to

find resistance around 0.69 against the euro and 197.00 against the

yen.

Against the Swiss franc and the U.S. dollar, the pound advanced

to nearly a 2-week high of 1.4801 and a 2-week high of 1.5653 from

yesterday's closing quotes of 1.4769 and 1.5634, respectively. The

pound may test resistance around 1.49 against the franc and 1.59

against the greenback.

Looking ahead, U.K. unemployment data for May and Swiss ZEW

survey results for July are due to be released in the European

session.

In the New York session, Canada manufacturing sales for May,

U.S. PPI and industrial production for June are slated for

release.

The Bank of Canada's interest rate decision is due to be

released at 10:00 am ET. Economists expect the bank to retain

interest rates unchanged at 0.70 percent. Subsequently, Bank of

Canada Governor Stephen Poloz holds a news conference on the

monetary policy report at 11:15 am ET in Ottawa, Canada.

At 10:00 am ET, Yellen delivers semi-annual testimony on

monetary policy before the House Financial Services Committee in

Washington D.C.

At 12:25 pm ET, Federal Reserve Bank of Cleveland President

Loretta Mester will deliver a speech on the economic outlook and

participates in a live interview before the Columbus Metropolitan

Club Forum in Columbus U.S.

At 2:00 pm ET, Federal Reserve will release the Beige Book of

economic conditions.

After an hour, Federal Reserve Bank of San Francisco President

John Williams is expected to speak about the economic outlook at

the Mesa Chamber of Commerce in Phoenix, Arizona.

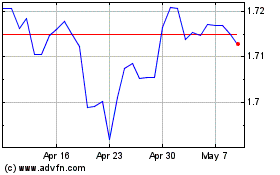

Sterling vs CAD (FX:GBPCAD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CAD (FX:GBPCAD)

Forex Chart

From Apr 2023 to Apr 2024