Current Report Filing (8-k)

October 07 2016 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

September 20, 2016

Defense Technologies International Corp.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-54851

|

Not Applicable

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

4730 South Fort Apache Road, Suite 300, Las Vegas, Nevada 89147

(Address of principal executive offices)

Registrant's telephone number, including area code:

(800) 520-9485

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

FORM 8-K

When used in this Current Report on Form 8-K, the terms "company", "DTII," "we," "us," "our" and similar terminology are in reference to

Defense Technologies International Corp

.

Item 1.01 Entry into a Material Definitive Agreement.

On September 20, 2016, Defense Technologies International Corp., formerly known as Canyon Gold Corp., entered into an arrangement with Blackbridge Capital, with offices in New York City, New York, whereby Blackbridge agrees to provide certain funding to DTII. Initially, Blackbridge Growth Fund LLC will commit to purchase up to $35,000 worth of Convertible Promissory Notes from DTII. The term of the Notes will be for nine months and will bear interest at the rate of 9% per annum. The Notes are convertible into common shares of DTII at a price equal to 72.5% of the lowest trading price of DTII common stock during the 15 days prior to the conversion of the Notes.

In addition to the Notes, Blackbridge Capita Growth Fund will commit to purchase up to $2,500,000 of DTII common stock per an equity purchase facility, whereby DTII may draw against the facility periodically and at the company's discretion. The maximum draw will be equal to the lesser amount of $104,000, or 200% of the average daily trading volume of DTII common stock for the ten trading days immediately prior to the date notice of the draw is given. The company is permitted to make a notice of draw at least one day after the end of the purchase period (ten trading days) from a preceding draw down. Shares to be issued pursuant to the equity purchase facility will be registered pursuant to a registration statement to be prepared and filed by DTII. The purchase price per share of the common stock purchased under the equity purchase facility will equal 87.5% of the lowest trading price of DTII shares during the ten trading day period prior to the date notice of the draw is given. The facility will have a term os 24 months. The company has the obligation to file with the SEC a registration statement to register all shares issuable pursuant to the equity purchase facility. The company has also agreed to pay Blackbridge a commitment fee of 110,000 shares of DTII common stock

As of the date hereof, no Notes have been purchased or initial funding received by the company. DTII

has not filed the registration statement for the shares to be issued under the equity purchase facility and must do so prior to making any draw under the facility. The company intends to use its best efforts to complete and file the registration statement with the SEC.

Cautionary Note About Forward-looking Statements

Statements contained in this current report which are not historical facts, may be considered "forward-looking statements," which term is defined by the Private Securities Litigation Reform Act of 1995. Any "safe harbor under this Act does not apply to a "penny stock" issuer, which definition would include the Company. Forward-looking statements are based on current expectations and the current economic environment. We caution readers that such forward-looking statements are not guarantees of future performance. Unknown risks and uncertainties as well as other uncontrollable or unknown factors could cause actual results to materially differ from the results, performance or expectations expressed or implied by such forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Defense Technologies International Corp.

|

|

|

|

|

Date: October 7, 2016

|

By:

S/

Merrill W. Moses

|

|

|

Merrill W. Moses

|

|

|

President

|

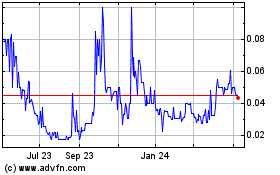

Defense Technologies (PK) (USOTC:DTII)

Historical Stock Chart

From Mar 2024 to Apr 2024

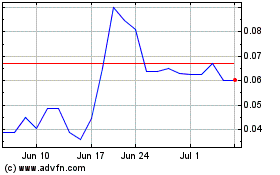

Defense Technologies (PK) (USOTC:DTII)

Historical Stock Chart

From Apr 2023 to Apr 2024