As filed with the Securities and Exchange

Commission on August 30, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LIMBACH

HOLDINGS, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

46-5399422

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

31 – 35th Street, Pittsburgh, Pennsylvania

15201

(412) 359-2100

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Charles A. Bacon III

Chief Executive Officer

Limbach Holdings, Inc.

31 – 35th Street

Pittsburgh, Pennsylvania 15201

Tel: (412) 359-2100

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Joel L. Rubinstein

Elliott M. Smith

Winston & Strawn LLP

200 Park Avenue

New York, New York 10166-4193

Tel: (212) 294-6700

Fax: (212) 294-4700

Approximate date of commencement of

proposed sale to the public:

From time to time after this Registration Statement becomes effective.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

|

¨

|

|

Accelerated filer

|

|

¨

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

x

|

|

|

|

|

|

Emerging growth company

|

|

x

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price per

Security(2)

|

|

|

Proposed Maximum

Aggregate Offering

Price(2)

|

|

|

Amount of

Registration Fee

|

|

|

Common stock, par value $0.0001 per share

|

|

4,971,748 shares

|

|

$

|

13.52

|

|

|

$

|

67,218,032.96

|

|

|

$

|

7,790.57

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”),

this Registration Statement shall also cover any additional shares of the Registrant's securities that become issuable by reason

of any stock split, stock dividends, recapitalization or other similar transaction.

|

|

|

(2)

|

The price is computed based upon the average of the high and low sale prices of the Registrant’s

common stock on August 29, 2017, as reported on The NASDAQ Capital Market.

|

The Registrant hereby

amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on

such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not

complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED AUGUST 30, 2017

PROSPECTUS

Limbach Holdings, Inc.

4,971,748 Shares of Common Stock

The selling stockholders

named in this prospectus may offer and sell from time to time up to 4,971,748 shares of our common stock, of which 560,000 shares

are issuable upon conversion of shares of our Class A Preferred Stock (“Preferred Stock”) and 2,087,471 shares are

issuable upon the exercise of certain warrants to purchase shares of our common stock. The selling stockholders will receive all

of the proceeds from any sales of their shares. We will not receive any of the proceeds, but we will incur expenses in connection

with the offering.

Our registration of

the shares of common stock covered by this prospectus does not mean that the selling stockholders will offer or sell any of the

shares. The selling stockholders may sell the shares of common stock covered by this prospectus in a number of different ways

and at varying prices. We provide more information about how the selling stockholders may sell the shares in the section entitled

“Plan of Distribution” beginning on page 6.

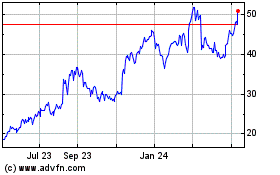

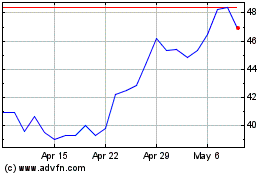

Our common stock is

listed on The Nasdaq Capital Market under the symbol “LMB”. On August 29, 2017, the last reported sale price of our

common stock and warrants on The Nasdaq Capital Market was $13.53 per share.

We are an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act, and, as such, are allowed to provide more limited

disclosures than an issuer that would not so qualify.

Investing in the

common stock involves risks. See “Risk Factors” on page 4 of this prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2017.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is

part of a registration statement on Form S-3 that we filed with the United States Securities and Exchange Commission (the “SEC”)

using a “shelf” registration process. The selling stockholders may use the shelf registration statement to sell up

to an aggregate of 4,971,748 shares of our common stock from time to time through any means described in the section entitled “Plan

of Distribution.” We will not receive any proceeds from the sale of common stock by the selling stockholders. If necessary,

the specific manner in which these securities may be offered and sold will be described in one or more supplements to this prospectus.

Any prospectus supplement may add, update or change information contained in this prospectus. You should carefully read this prospectus,

and any applicable prospectus supplement, as well as the documents incorporated by reference herein or therein before you invest

in any of our securities.

You should rely

only on the information contained in or incorporated by reference into this prospectus and any applicable prospectus supplements.

Neither we, the selling stockholders nor any underwriter has authorized anyone to provide information different from that contained

in this prospectus and the documents incorporated by reference herein. This prospectus is not an offer to sell or a solicitation

of an offer to buy these shares of common stock in any circumstances under which or jurisdiction in which the offer or solicitation

is unlawful.

The information contained

in this prospectus, in any prospectus supplement or in any document incorporated by reference is accurate only as of its date,

regardless of the time of delivery of this prospectus or any sale of common stock.

Unless the context

indicates otherwise, the terms “Limbach,” “Company,” “we,” “us,” and “our”

refer to Limbach Holdings, Inc., a Delaware corporation, and its consolidated subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, including

all documents incorporated by reference, contains forward-looking statements regarding the Company and represents our expectations

and beliefs concerning future events. These forward-looking statements are intended to be covered by the safe harbor for forward-looking

statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown

risks and uncertainties. The forward-looking statements included herein or incorporated herein by reference include or may include,

but are not limited to, (and you should read carefully) statements that are predictive in nature, depend upon or refer to future

events or conditions, or use or contain words, terms, phrases, or expressions such as “achieve,” “forecast,”

“plan,” “propose,” “strategy,” “envision,” “hope,” “will,”

“continue,” “potential,” “expect,” “believe,” “anticipate,” “project,”

“estimate,” “predict,” “intend,” “should,” “could,” “may,”

“might,” or similar words, terms, phrases, or expressions or the negative of any of these terms. Any statements in

this prospectus that are not based upon historical fact are forward-looking statements and represent our best judgment as to what

may occur in the future.

In addition to the

material risks listed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (our “Annual Report”),

which is incorporated by reference herein, that may cause business conditions or our actual results, performance or achievements

to be materially different from those expressed or implied by any forward-looking statements, the following are some, but not all,

of the factors that might cause business conditions or our actual results, performance or achievements to be materially different

from those expressed or implied by any forward-looking statements, or contribute to such differences: our ability to realize cost

savings from our expected performance of contracts, whether as a result of improper estimates, performance, or otherwise; uncertain

timing and funding of new contract awards, as well as project cancellations; cost overruns on fixed-price or similar contracts

or failure to receive timely or proper payments on cost-reimbursable contracts, whether as a result of improper estimates, performance,

disputes, or otherwise; risks associated with labor productivity; risks associated with percentage of completion accounting; our

ability to settle or negotiate unapproved change orders and claims; changes in the costs or availability of, or delivery schedule

for, equipment, components, materials, labor or subcontractors; adverse impacts from weather affecting our performance and timeliness

of completion, which could lead to increased costs and affect the quality, costs or availability of, or delivery schedule for,

equipment, components, materials, labor or subcontractors; operating risks, which could lead to increased costs and affect the

quality, costs or availability of, or delivery schedule for, equipment, components, materials, labor or subcontractors; increased

competition; fluctuating revenue resulting from a number of factors, including changes in energy prices and the cyclical nature

of the individual markets in which our customers operate; lower than expected growth in our primary end markets, risks inherent

in acquisitions and our ability to complete or obtain financing for acquisitions; our ability to integrate and successfully operate

and manage acquired businesses and the risks associated with those businesses; the non-competitiveness or unavailability of, or

lack of demand or loss of legal protection for, our intellectual property assets or rights; failure to keep pace with technological

changes or innovation; failure to remain competitive, current, in demand and profitable; adverse outcomes of pending claims or

litigation or the possibility of new claims or litigation, and the potential effect of such claims or litigation on our business,

financial position, results of operations and cash flow; lack of necessary liquidity to provide bid, performance, advance payment

and retention bonds, guarantees, or letters of credit securing our obligations under our bids and contracts or to finance expenditures

prior to the receipt of payment for the performance of contracts; proposed and actual revisions to U.S. tax laws, which would seek

to increase income taxes payable or a downturn, disruption, or stagnation in the economy in general.

Although we believe

the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee future performance or results.

You should not unduly rely on any forward-looking statements. Each forward-looking statement is made and applies only as of the

date of the particular statement, and we are not obligated to update, withdraw, or revise any forward-looking statements, whether

as a result of new information, future events or otherwise. You should consider these risks when reading any forward-looking statements.

All forward-looking statements attributed or attributable to us or to persons acting on our behalf are expressly qualified in their

entirety by this section entitled “Cautionary Note Regarding Forward-Looking Statements.”

THE COMPANY

The Company, formerly

known as 1347 Capital Corp., is a Delaware corporation headquartered in Pittsburgh, Pennsylvania. The Company was originally incorporated

as a special purpose acquisition company on April 15, 2014, formed for the purpose of effecting a business combination with one

or more businesses. On July 20, 2016, the Company consummated a business combination (the “Business Combination”) with

Limbach Holdings LLC and changed its name from 1347 Capital Corp. to Limbach Holdings, Inc.

The Company is a commercial

specialty contractor in the areas of heating, ventilation, air-conditioning (“HVAC”), plumbing, electrical and building

controls for the design and construction of new and renovated buildings, maintenance services, energy retrofits and equipment upgrades.

Across the United States, we provide comprehensive facility services consisting of mechanical construction, full HVAC service and

maintenance, energy audits and retrofits, engineering and design build services, constructability evaluation, equipment and materials

selection, offsite/prefab construction, and the complete range of sustainable building solutions and practices. Our primary customers

include: (i) general contractors and construction managers who serve as the prime contractors in designing and constructing commercial

buildings for public, institutional (not-for-profit) and private owners; and (ii) building owners themselves, for “owner-direct”

work in which we contract directly with the owners.

The Company operates

its business in two segments, (i) Construction, in which we generally manage large construction or renovation projects that involve

primarily HVAC, plumbing, sheet metal fabrication and installation, specialty piping and electrical services, and (ii) Service,

in which we provide facility maintenance or smaller general construction services primarily related to HVAC, plumbing or electrical

services.

Our core market sectors

for new construction, renovations, energy retrofits and maintenance services consist of the following:

|

|

•

|

Education

including schools and universities;

|

|

|

•

|

Sports & Amusement

including sports arenas and related facilities;

|

|

|

•

|

Transportation

including passenger terminals and maintenance facilities for rail and airports;

|

|

|

•

|

Government facilities

including federal, state and local agencies;

|

|

|

•

|

Hospitality

including hotels and resorts;

|

|

|

•

|

Corporate and commercial office buildings

;

|

|

|

•

|

Residential multifamily apartment buildings

(excluding condominiums); and

|

|

|

•

|

Industrial manufacturing

.

|

These sectors are projected

by FMI (a leading third-party consultant to the engineering and construction industry) to experience strong growth through 2021,

as noted in their 2017 Construction Outlook, First Quarter report. We are particularly focused on expanding our top four sectors

noted above (Healthcare, Education, Sports & Amusement, and Transportation), leveraging our core areas of expertise and targeting

projects with optimal risk/reward characteristics.

Our subsidiaries include

Limbach Company LLC, which operates in regions that utilize organized union labor in New England, Eastern Pennsylvania, Western

Pennsylvania, New Jersey, Ohio, Michigan and the Mid-Atlantic region; Limbach Company LP, operating in Southern California as a

union operation; and Harper Limbach, our non-union, “open shop” division, which operates in Florida. Each of our operations

(branches) provides design, construction and maintenance services in some or all of the HVAC, plumbing and electrical fields.

Among our core growth

strategies is to offer design, construction and maintenance services of the full complement of HVAC, plumbing and electrical in

all of our branch operations. We currently offer certain of these services in each of our branches, with electrical design, installation

and maintenance services being offered primarily in our Mid-Atlantic branch. Over the coming years, we plan to further equip each

of our branches to provide this combined offering. The approach of combined HVAC, plumbing and electrical is appealing to building

owners who own and operate facilities with complex building systems. Through this core growth strategy, we envision further expansion

of the electrical business across the rest of our company, following what we believe was a successful expansion of these services

in the Mid-Atlantic region.

Complex systems lend

themselves to delivery methodologies that fit our integrated business model, including design/assist, design/build and integrated

project delivery. We believe that few specialty contractors in the United States offer fully-integrated HVAC, plumbing and electrical

services. We believe our integrated approach provides a significant competitive advantage, especially when combined with our proprietary

design and production software systems. Our integrated approach allows for increased prefabrication of HVAC components, improves

cycle times for project delivery and reduces risks associated with onsite construction.

In 2016 and 2015, we

were ranked the 12th largest mechanical contractor by Engineering News Record.

RISK FACTORS

The risks associated with our business are

described in our Annual Report, which description is incorporated by reference herein.

USE OF PROCEEDS

All of the shares of

common stock offered by the selling stockholders pursuant to this prospectus will be sold by the selling stockholders for their

respective accounts. We will not receive any of the proceeds from these sales, but we are required to pay certain offering fees

and expenses in connection with the registration of the selling stockholders’ shares of common stock and to indemnify the

selling stockholders against certain liabilities.

SELLING STOCKHOLDERS

The following table

sets forth, as of the date of this prospectus, the names of the selling stockholders for whom we are registering the resale of

shares of our common stock from time to time and the number of shares that the selling stockholders may offer pursuant to this

prospectus. The shares offered by the selling stockholders were issued pursuant to an exemption from the registration requirements

of the Securities Act of 1933, as amended (the “Securities Act”) provided in Section 4(a)(2) of the Securities

Act and/or Regulation D promulgated thereunder. We have filed with the SEC under the Securities Act the registration statement

of which this prospectus forms a part pursuant to the Registration Rights Agreement (as defined below under the section titled

“Description of Securities—Registration Rights”).

The table below sets

forth certain information known to us, based on written representations from the selling stockholders, with respect to the beneficial

ownership of our shares of common stock held by the selling stockholders as of August 29, 2017, except as described in the notes

to such table. Because the selling stockholders may sell, transfer or otherwise dispose of all, some or none of the shares of our

common stock covered by this prospectus, we cannot determine the number of such shares that will be sold, transferred or otherwise

disposed of by the selling stockholders, or the amount or percentage of shares of our common stock that will be held by the selling

stockholders upon termination of any particular offering. See “Plan of Distribution.” For purposes of the table below,

we assume that the selling stockholders will sell all their shares of common stock covered by this prospectus.

The percentages of

shares owned set forth below are based on 7,454,602 shares of our common stock issued and outstanding as of August 29, 2017. Unless

otherwise described below, to our knowledge, none of the selling stockholders has held any position or office or had any other

material relationship with us or our affiliates during the three years prior to the date of this prospectus.

|

|

|

Shares Beneficially

Owned Prior to

the Offering

|

|

|

Maximum

Number

of Shares That

May be Sold in

|

|

|

Shares

Beneficially

Owned Following

the Offering

(2)

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

%

|

|

|

the Offering

(1)

|

|

|

Number

|

|

|

%

|

|

|

1347 Investors LLC

(3)

|

|

|

4,077,098

|

(4)

|

|

|

47.3

|

|

|

|

1,895,800

|

|

|

|

2,181,298

|

|

|

|

29.0

|

|

|

Larry G. Swets, Jr.

|

|

|

4,087,098

|

(4)

|

|

|

47.4

|

|

|

|

1,895,800

|

|

|

|

2,191,298

|

|

|

|

29.1

|

|

|

F

d

G Capital Partners LLC

(5)

|

|

|

2,669,659

|

(6)

|

|

|

32.1

|

|

|

|

2,669,659

|

|

|

|

-

|

|

|

|

|

|

|

David S. Gellman

|

|

|

2,669,659

|

(6)

|

|

|

32.1

|

|

|

|

2,669,659

|

|

|

|

-

|

|

|

|

|

|

|

Charles A. Bacon, III

(7)

|

|

|

383,322

|

|

|

|

5.0

|

|

|

|

383,322

|

|

|

|

-

|

|

|

|

|

|

|

Norbert W. Young

(8)

|

|

|

19,171

|

|

|

|

*

|

|

|

|

19,171

|

|

|

|

-

|

|

|

|

|

|

|

Kristopher Thorne

(9)

|

|

|

3,696

|

|

|

|

*

|

|

|

|

3,696

|

|

|

|

-

|

|

|

|

|

|

|

John T. Jordan, Jr.

|

|

|

100

|

|

|

|

*

|

|

|

|

100

|

|

|

|

-

|

|

|

|

|

|

|

|

(1)

|

Represents the number of shares being registered on behalf of the selling stockholder pursuant

to this registration statement, which may be less than the total number of shares beneficially owned by such selling stockholder.

|

|

|

(2)

|

Assumes that the selling stockholders dispose of all of the shares of common stock covered by this

prospectus and do not acquire beneficial ownership of any additional shares. The registration of these shares does not necessarily

mean that the selling stockholders will sell all or any portion of the shares covered by this prospectus.

|

|

|

(3)

|

Represents one hundred percent of the securities held by 1347 Investors LLC (“1347 Investors”).

The managers of 1347 Investors are Larry G. Swets, Jr. and D. Kyle Cerminara, and acting by unanimous consent, they exercise voting

and dispositive control over the securities held by 1347 Investors. Accordingly, they may be deemed to share beneficial ownership

of such securities. The securities held by 1347 Investors are pledged pursuant to loan agreements between 1347 Investors and certain

lenders party thereto.

|

|

|

(4)

|

Represents (i) 2,843,515 shares of common stock, (ii) 560,000 shares of common stock

issuable upon conversion of Preferred Stock, (iii) shares of

common stock underlying 149,167 Public Warrants (as defined below), each

exercisable to purchase one-half of one share of common stock at $11.50 per whole share, (iv) shares of common stock

underlying 500,000 $15 Exercise Price Warrants (as defined below), each exercisable to purchase one share of common stock at

an exercise price of $15.00 per share and (v) shares of common stock underlying 198,000 Sponsor Warrants (as defined below),

each exercisable to purchase one-half of one share of common stock at an exercise price of $11.50 per whole share, which are

beneficially owned by 1347 Investors. Mr. Swets also induvidually owns 10,000 shares of common stock.

Mr. Swets has served as a director of the Company since July

2014. He was also the chairman of the Company’s

board of directors from 2014 until the closing of the Business Combination in July 2016.

|

|

|

(5)

|

Represents one hundred percent of the securities held by F

d

G Capital Partners LLC (“F

d

G

Capital”). David S. Gellman is the sole member of the investment committee of the managing member of F

d

G Capital,

and therefore, may be deemed to share beneficial ownership of these securities. Mr. Gellman has also served on our board of directors

since the closing of the Business Combination in July 2016.

|

|

|

(6)

|

Represents (i) 1,356,355 shares of Common Stock, (ii) 525,322 warrants, each exercisable for one

share of common stock at an exercise price of $12.50 per share and (iii) 787,982 warrants, each exercisable for one share of common

stock at an exercise price of $11.50 per share.

|

|

|

(7)

|

Represents (i) 217,977 shares of Common Stock, (ii) shares of common stock underlying 66,138 warrants,

each exercisable for one share of common stock at an exercise price of $12.50 per share and (iii) shares of common stock underlying

99,207 warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share.

|

|

|

(8)

|

Represents (i) 10,900 shares of Common Stock, (ii) shares of common stock underlying 3,308 warrants,

each exercisable for one share of common stock at an exercise price of $12.50 per share and (iii) shares underlying 4,963 warrants,

each exercisable for one share of common stock at an exercise price of $11.50 per share. Mr. Young has served on our board of directors

since the closing of the Business Combination in July 2016.

|

|

|

(9)

|

Represents (i) 2,145 shares of common stock, (ii) shares of common stock underlying 620 warrants,

each exercisable for one share of common stock at an exercise price of $12.50 per share and (iii) shares of common stock underlying

931 warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share. Mr. Thorne as served as

our chief operating officer since the closing of the Business Combination in July 2016.

|

Material Relationships with Selling Stockholders

Selling stockholders

who acquired shares of common stock and warrants from us in a private placement prior to or concurrently with the IPO, selling

stockholders who acquired our securities in a private placement immediately prior to the closing of the Business Combination and

selling stockholders who acquired shares of common stock that we issued under the Agreement and Plan of Merger, dated March 23,

2016, by and among 1347 Capital Corp., Limbach Holdings LLC and F

d

G HVAC LLC (as amended, the “Merger Agreement”),

pursuant to which we consummated the Business Combination, have registration rights with respect those shares of common stock and

the shares of common stock issuable upon exercise of those warrants. A description of these registration rights is set forth below

under the section titled “Description of Securities—Registration Rights.”

1347 Investors

In connection with

the closing of the Business Combination, we issued 400,000 shares of preferred stock to 1347 Investors for a purchase price of

$25.00 per share, or $10 million in the aggregate. On July 14, 2017, the Company repurchased an aggregate of 120,000 shares of

its Preferred Stock from 1347 Investors for an aggregate sum of approximately $4,092,153 in cash. As part of the agreement, 1347

Investors also agreed to a three-month extension of the lock-up period on 509,500 common shares it holds, which was due to expire

on July 20, 2017..

In April 2014, our

officers, directors and initial stockholders, including 1347 Investors, purchased an aggregate of 1,150,000 shares of our common

stock which is subject to transfer restrictions (except to certain permitted transferees) under an escrow agreement until, with

respect to 50% of such shares, the earlier of July 20, 2017 and the date on which the closing price our common stock equals or

exceeds $12.50 per share for any 20 trading days within a 30-trading day period following July 20, 2016, and with respect to the

remaining 50% of the shares, July 20, 2017.

1347 Investors also

purchased an aggregate of 198,000 units at $10.00 per unit and 600,000 $15 Exercise Price Warrants (as defined below under the

section entitled “Description of Securities”) at a price of $0.50 per warrant (for a total purchase price of $2,280,000)

from us. These purchases took place on a private placement basis concurrently with the consummation of our IPO. These units were

identical to the units sold in our IPO.

The holders of the

foregoing securities are entitled to registration rights with respect to such securities, as described in “Description of

Our Securities — Registration Rights.”

As of April 17, 2014,

1347 Investors loaned to us an aggregate of $125,000 to cover expenses related to the IPO. The terms of this loan were amended

and restated as of April 18, 2014. The loan was repaid without interest upon consummation of the Business Combination.

An affiliate of 1347

Investors, from July 2014 through the closing of the Business Combination on July 20, 2016, made available certain general and

administrative services, including office space, utilities and administrative support, as we required from time to time. We paid

$10,000 per month for these services, which amount was paid upon the closing of the Business Combination.

PLAN OF DISTRIBUTION

We are registering

the shares of our common stock covered by this prospectus to permit the selling stockholders to sell shares of our common stock

directly to purchasers or through underwriters, broker-dealers or agents from time to time after the date of this prospectus. We

will not receive any of the proceeds of the sale of the shares offered by this prospectus. The aggregate proceeds to the selling

stockholders from the sale of the shares will be the purchase price of the shares less any discounts and commissions borne by the

selling stockholders. Each selling stockholder reserves the right to accept and, together with its respective agents, to reject,

any proposed purchases of shares to be made directly or through agents. Unless the context otherwise requires, as used in this

prospectus, “selling stockholders” includes the selling stockholders named in the table above in the section titled

“Selling Stockholders” and donees, pledgees, transferees or other successors-in-interest selling shares received from

the selling stockholders as a gift, pledge, partnership distribution or other transfer after the date of this prospectus.

The selling stockholders

and any of their permitted transferees may offer and sell all or a portion of the shares covered by this prospectus from time to

time on any stock exchange, market or trading facility on which the shares are traded or in private transactions. Subject to the

limitations set forth in any applicable registration rights agreement, the selling stockholders may use any one or more of the

following methods when selling the shares offered by this prospectus:

|

|

·

|

on the Nasdaq Capital Market, in the over-the-counter market or on any other national securities

exchange on which our shares are listed or traded;

|

|

|

·

|

to or through underwriters or broker-dealers;

|

|

|

·

|

in privately negotiated transactions;

|

|

|

·

|

in a block trade in which a broker-dealer will attempt to sell the offered shares as agent but

may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

through purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

in an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

in ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

|

|

·

|

through the writing of options (including put or call options), whether the options are listed

on an options exchange or otherwise;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling stockholders

may sell the shares at prices then prevailing or related to the then current market price or at negotiated prices. The offering

price of the shares from time to time will be determined by the selling stockholders and, at the time of the determination, may

be higher or lower than the market price of our common stock on The Nasdaq Capital Market or any other exchange or market.

The shares may be sold

directly or through broker-dealers acting as principal or agent, or pursuant to a distribution by one or more underwriters on a

firm commitment or best-efforts basis. The selling stockholders may also enter into hedging transactions with underwriters, broker-dealers

or other financial institutions that in turn may engage in short sales of our common stock in the course of hedging the positions

they assume with the selling stockholders. The selling stockholders may also sell shares of the common stock short after the effective

date of the registration statement of which this prospectus is a part and deliver these shares to close out their short positions,

or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also

enter into options or other transactions with broker-dealers or other financial institutions which require the delivery to such

broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial

institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). In connection with

an underwritten offering, underwriters or agents may receive compensation in the form of discounts, concessions or commissions

from the selling stockholders or from purchasers of the offered shares for whom they may act as agents. In addition, underwriters

may sell the shares to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or

commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents.

The selling stockholders

and any underwriters, broker-dealers or agents participating in a distribution of the shares may be deemed to be “underwriters”

within the meaning of Section 2(a)(11) of the Securities Act, and any discounts, commissions, concessions or profit they earn on

any resale of those shares may be underwriting discounts and commissions under the Securities Act.

Under the Registration

Rights Agreement, we have agreed to indemnify the selling stockholders against certain liabilities related to the sale of the common

stock, including liabilities arising under the Securities Act. For additional details on the Registration Rights Agreement see

“Description of Securities—Registration Rights.”

Agents, broker-dealers

and underwriters may be entitled to indemnification by us and the selling stockholders against certain civil liabilities related

to the selling of the common stock, including liabilities under the Securities Act, or to contribution with respect to payments

which the agents, broker-dealers or underwriters may be required to make in respect thereof. The selling stockholders have advised

us that they have not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding

the sale of their shares. Upon our notification by a selling stockholder that any material arrangement has been entered into with

an underwriter or broker-dealer for the sale of shares through a block trade, special offering, exchange distribution, secondary

distribution or a purchase by an underwriter or broker-dealer, we will file a supplement to this prospectus, if required, pursuant

to Rule 424(b) under the Securities Act, disclosing certain material information, including:

|

|

·

|

the name of the selling stockholder;

|

|

|

·

|

the number of shares being offered;

|

|

|

·

|

the respective purchase prices and public offering prices of the offering;

|

|

|

·

|

the names of the participating underwriters, broker-dealers or agents;

|

|

|

·

|

any discounts, commissions, concessions or other compensation paid to underwriters or broker-dealers

and any discounts, commissions or concessions allowed or reallowed or paid by any underwriters to dealers;

|

|

|

·

|

any writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise;

|

|

|

·

|

any settlement of short sales entered into after the date of this prospectus;

|

|

|

·

|

any distribution of common stock by any selling stockholder to its partners, members or stockholders;

and

|

|

|

·

|

other material terms of the offering.

|

Broker-dealers engaged

by the selling stockholders may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser)

in amounts to be negotiated.

In addition, upon being

notified by a selling stockholder that a donee, pledgee, transferee, other successor-in-interest intends to sell shares, we will,

to the extent required, promptly file a supplement to this prospectus to name specifically such person as a selling stockholder.

The selling stockholders

may from time to time pledge or grant a security interest in some or all of their shares of common stock to their broker-dealers

under the margin provisions of customer agreements or to other parties to secure other obligations. If a selling stockholder defaults

on a margin loan or other secured obligation, the broker-dealer or secured party may, from time to time, offer and sell the shares

of common stock pledged or secured thereby pursuant to this prospectus.

The selling stockholders

are subject to the applicable provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and

the rules and regulations under the Exchange Act, including Regulation M. These provisions may limit the timing of purchases and

sales of any of the shares of common stock offered in this prospectus by the selling stockholders. The anti-manipulation rules

under the Exchange Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates.

Furthermore, Regulation M may restrict the ability of any person engaged in the distribution of the shares to engage in market-making

activities for the particular securities being distributed for a period of up to five business days before the distribution. The

restrictions may affect the marketability of the shares and the ability of any person or entity to engage in market-making activities

for the shares.

We have advised the

selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares

of our common stock in the market and to the activities of the selling stockholders and their affiliates. In addition, to the extent

applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling

stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act.

In compliance with

guidelines of the Financial Industry Regulatory Authority (“FINRA”), the maximum compensation or discount to be received

by any FINRA member or independent broker or dealer may not exceed 8% of the aggregate amount of the securities offered pursuant

to this prospectus.

To the extent required,

this prospectus may be amended and/or supplemented from time to time to describe a specific plan of distribution. Instead of selling

the shares of common stock under this prospectus, the selling stockholders may sell the shares of common stock in compliance with

the provisions of Rule 144 under the Securities Act, if available, or pursuant to other available exemptions from the registration

requirements of the Securities Act. There can be no assurance that the selling stockholders will sell all or any of the shares

of common stock offered by this prospectus. The selling stockholders have the sole and absolute discretion not to accept any purchase

offer or make any sale of securities if they deem the purchase price to be unsatisfactory at any particular time.

A selling stockholder

that is an entity may elect to make a pro rata in-kind distribution of the shares of common stock to its members, partners or shareholders

pursuant to the registration statement of which this prospectus is a part by delivering a prospectus. To the extent that such members,

partners or shareholders are not affiliates of ours, such members, partners or shareholders would thereby receive freely tradable

shares of common stock pursuant to the distribution through a registration statement.

Our common stock is

listed on The Nasdaq Capital Market under the symbol “LMB.”

DESCRIPTION OF SECURITIES

The following summary

of the material terms of our securities is not intended to be a complete summary of the rights and preferences of such securities.

We urge you to read our Second Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”)

in its entirety for a complete description of the rights and preferences of our securities.

Authorized and Outstanding Stock

Our Certificate of

Incorporation authorizes the issuance of 101,000,000 shares, consisting of 100,000,000 shares of common stock, $0.0001 par value

per share and 1,000,000 shares of undesignated preferred stock, $0.0001 par value. As of August 29, 2017, there were 7,454,602

shares of common stock outstanding, held of record by 91 holders, no outstanding options and 4,664,901 shares of common stock issuable

upon exercise of outstanding warrants. The number of record holders does not include DTC participants or beneficial owners holding

shares through nominee names. In addition, there were 280,000 shares of Class A preferred stock outstanding, as described below.

Common Stock

Our Certificate of

Incorporation provides that the common stock will have identical rights, powers, preferences and privileges.

Holders of our common

stock are entitled to one vote for each share held on all matters to be voted on by our stockholders.

Holders of common stock

will be entitled to receive such dividends, if any, as may be declared from time to time by our board of directors in its discretion

out of funds legally available therefor. In no event will any stock dividends or stock splits or combinations of stock be declared

or made on common stock unless the shares of common stock at the time outstanding are treated equally and identically.

Our board of directors

is divided into three classes, each of which generally serves for a term of three years with only one class of directors being

elected in each year. There is no cumulative voting with respect to the election of directors, with the result that the holders

of more than 50% of the shares eligible to vote for the election of directors can elect all of the directors.

Our stockholders have

no conversion, preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to the

shares of common stock.

In the event of our

voluntary or involuntary liquidation, dissolution, distribution of assets or winding-up, the holders of the common stock will be

entitled to receive an equal amount per share of all of our assets of whatever kind available for distribution to stockholders,

after the rights of the holders of the preferred stock have been satisfied.

Preferred Stock

Our Certificate of

Incorporation authorizes the issuance of 1,000,000 shares of preferred stock with such designation, rights and preferences as may

be determined from time to time by our board of directors. Accordingly, our board of directors is empowered, without stockholder

approval, to issue preferred stock with dividend, liquidation, conversion, voting or other rights which could adversely affect

the voting power or other rights of the holders of common stock.

In connection with

the Business Combination, we issued and sold to 1347 Investors 400,000 shares of Preferred Stock. Each share of Preferred Stock

may be converted (at the holder’s election) into 2.0 shares of our common stock (as may be adjusted for any stock splits,

reverse stock splits or similar transactions), representing a conversion price of $12.50 per share of our common stock; provided,

that such conversion is in compliance with stock exchange listing requirements. On July 14, 2017, the Company repurchased an aggregate

of 120,000 shares of Preferred Stock from 1347 Investors for an aggregate sum of approximately $4,092,153 in cash.

The Preferred Stock

ranks senior to all classes and series of our outstanding capital stock. Under the Merger Agreement, we have agreed to not issue

any other shares of capital stock that rank senior or pari passu to the Preferred Stock while the Preferred Stock is outstanding,

unless 30% of the proceeds from such issuance are used to redeem the Preferred Stock.

The holders of the

Preferred Stock will, in priority to any other class or series of capital stock, be entitled to receive, as and when declared by

our board of directors, fixed, cumulative, preferential dividends at a rate of: (i) 8% per annum in years one through three from

issuance; (ii) 10% per annum in years four through five from issuance; and (iii) 12% per annum thereafter, payable in equal quarterly

installments. Dividends on outstanding Preferred Stock will accrue from day to day from the date of issuance of the Preferred Stock,

whether or not such dividends are declared by the board of directors. No dividends may be paid in excess of the accrued and unpaid

preferred yield in respect of the Preferred Stock.

Under the Merger Agreement,

we agreed that, for so long as the Preferred Stock is outstanding, we will not repurchase, redeem or retire any shares of our capital

stock other than the Preferred Stock. We have no restriction on repayments of our outstanding debt or repurchases of our stock

from former employees, officers, directors, consultants or other persons who performed services for us or any subsidiary in connection

with the cessation of such employment or service at the lower of the original purchase price or the then-current fair market value

thereof.

In the event of a liquidation,

dissolution or winding up of the Company, the holders of the Preferred Stock will be entitled to receive $25.00 per share of Preferred

Stock, plus accrued but unpaid dividends thereon, whether declared or not, before any amount shall be paid or any assets distributed

to holders of shares of the Company ranking junior as to the return of capital to the Preferred Stock. After payment to the holders

of Preferred Stock of the amounts so payable to them, such holders shall not be entitled to share in any further payment in respect

of the distribution of the assets of the Company.

We will redeem all

outstanding shares of Preferred Stock on July 20, 2022 for the price of $25.00 per share of Preferred Stock (as may be adjusted

for any stock splits, reverse stock splits or similar transactions), plus accrued but unpaid dividends thereon, whether or not

declared, up to and including the date specified for redemption.

The holders of Preferred

Shares will not be entitled to receive notice of, or to attend, any meeting of stockholders of the Company and will not be entitled

to vote at any such meeting.

The number of shares

of our common stock into which the shares of Preferred Stock will be convertible will be subject to corporate structural anti-dilution

(and not price protection anti-dilution) adjustments, including adjustments in the event of certain stock dividends, subdivisions

and consolidations, rights offerings, special distributions, capital reorganizations and reclassifications of shares of the Company’s

common stock; provided, however, there will not be any adjustment in connection with (i) securities issuable upon conversion of

any of the shares of Preferred Stock, or as a dividend or distribution on the Preferred Stock; (ii) securities issued upon the

conversion of any debenture, warrant, option, or other convertible security outstanding as of the date of the closing; (iii) shares

of our common stock (or options to purchase such shares of common stock) issued or issuable to employees, directors or consultants

of the Company pursuant to any equity incentive plan approved by the board of directors; (v) shares of our common stock issued

or issuable to banks, equipment lessors pursuant to a debt financing, equipment leasing or real property leasing transaction approved

by the board of directors; and (vi) shares of our common stock issued or issuable for consideration other than cash pursuant to

a business combination, strategic partnership or joint venture transaction approved by the board of directors.

We also agreed to register

the resale of the shares of our common stock underlying the Preferred Stock, none of which have been issued as of the date of this

prospectus.

Although we do not

currently intend to issue any other shares of preferred stock, we reserve the right to do so in the future.

Warrants

We have 7,063,901 outstanding

warrants exercisable for 4,664,901 shares of common stock, comprised of: (i) 4,600,000 warrants, each exercisable for one-half

of one share of common stock at an exercise price of $5.75 per half share ($11.50 per whole share) (“Public Warrants”);

(ii) 198,000 warrants, each exercisable for one-half of one share of common stock at an exercise price of $5.75 per half share

($11.50 per whole share) (“Sponsor Warrants”); (iii) 600,000 warrants, each exercisable for one share of common stock

at an exercise price of $15.00 per share (“$15 Exercise Price Warrants”); (iv) 666,360 Merger Warrants, each exercisable

for one share of common stock at an exercise price of $12.50 per share; (v) 999,541 Additional Merger Warrants, each exercisable

for one share of common stock at an exercise price of $11.50 per share. On May 2, 2017, the Company issued 111 shares of common

stock in connection with the cashless exercise of 310 Merger Warrants and 465 Additional Merger Warrants.

The Public Warrants,

Sponsor Warrants and $15 Exercise Price Warrants were issued under a warrant agreement dated July 15, 2014, between Continental

Stock Transfer & Trust Company, as warrant agent, and us. You should review a copy of the warrant agreement, which is filed

as an exhibit to the registration statement of which this prospectus forms a part, for a complete description of the terms and

conditions applicable to such warrants. The Merger Warrants and Additional Merger Warrants were issued to the sellers in the Business

Combination pursuant to individual agreements the forms of which are filed as exhibits to the registration statement of which this

prospectus forms a part. You should review the full text of the Merger Warrants and Additional Merger Warrants for a complete description

of the terms and conditions thereof.

Public Warrants

Each Public Warrant

entitles the holder thereof to purchase from the Company one-half of one share of common stock, at a price of $5.75 per half-share

($11.50 per whole share), subject to adjustment as discussed below, at any time commencing on August 19, 2016. Pursuant to the

warrant agreement, a holder of Public Warrants may exercise its Public Warrants only for a whole number of shares of common stock.

The Public Warrants will expire on August 19, 2021, at 5:00 p.m., New York time, or earlier upon their redemption or liquidation.

We may call such warrants

for redemption:

|

|

•

|

in whole and not in part;

|

|

|

•

|

at a price of $0.01 per warrant;

|

|

|

•

|

upon not less than 30 days’ prior written notice of redemption (the “30-day redemption

period”) to each holder of Public Warrants; and

|

|

|

•

|

if, and only if, the last reported sale price of the common stock equals or exceeds $24.00 per

share for any 20 trading days within a 30 trading day period ending three business days before the Company sends the notice of

redemption to the warrantholders. We will not redeem the warrants unless either (i) an effective registration statement covering

the shares of common stock issuable upon exercise of the warrants is current and available throughout the 30-day redemption period

or (ii) the Company elects to permit “cashless exercise” of the warrants.

|

If the foregoing conditions

are satisfied and the Company issues a notice of redemption of the Public Warrants, each holder of Public Warrants will be entitled

to exercise his, her or its Public Warrant prior to the scheduled redemption date. However, the price of our common stock may fall

below the $24.00 redemption trigger price as well as the $11.50 per whole share warrant exercise price after the redemption notice

is issued.

We will not redeem

the Public Warrants unless an effective registration statement under the Securities Act covering the shares of common stock issuable

upon exercise of the Public Warrants is effective and a current prospectus relating to those shares of common stock is available

throughout the 30-day redemption period, except if the Public Warrants may be exercised on a cashless basis and such cashless exercise

is exempt from registration under the Securities Act. If and when the Public Warrants become redeemable by us, we may exercise

this redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state

securities laws.

If we call the Public

Warrants for redemption as described above, our management will have the option to require all holders that wish to exercise Public

Warrants to do so on a “cashless basis.” In determining whether to require all holders to exercise their Public Warrants

on a “cashless basis,” our management will consider, among other factors, our cash position, the number of Public Warrants

that are outstanding and the dilutive effect on our stockholders of issuing the maximum number of shares of common stock issuable

upon the exercise of our Public Warrants. In such event, each holder would pay the exercise price by surrendering the Public Warrants

for that number of shares of common stock equal to the quotient obtained by dividing (x) the product of the number of shares of

common stock underlying the Public Warrants, multiplied by the difference between the exercise price of the Public Warrants and

the “fair market value” (defined below) by (y) the fair market value. The “fair market value” means the

average reported closing price of the common stock for the 10 trading days ending on the third trading day prior to the date on

which the notice of redemption is sent to the holders of Public Warrants.

We have filed a registration

statement for the registration under the Securities Act of the shares of common stock issuable upon exercise of the Public Warrants.

We have agreed to use our best efforts to maintain the effectiveness of such registration statement under the Securities Act, and

a current prospectus relating thereto, until the expiration of such warrants in accordance with the provisions of the warrant agreement,

except in the circumstances discussed below. In addition, we have agreed to use our best efforts to register the shares of common

stock that are issuable upon exercise of the Public Warrants under state blue sky laws, to the extent an exemption is not available.

Notwithstanding the foregoing, if a registration statement covering the shares of common stock issuable upon exercise of these

warrants has not been declared effective by the 60

th

business day following the closing of the Business Combination

and during any period when we have failed to maintain an effective registration statement, holders of such warrants may, until

such time as there is an effective registration statement, exercise such warrants on a cashless basis pursuant to the exemption

provided by Section 3(a)(9) of the Securities Act.

We are not obligated

to deliver any shares of common stock pursuant to the exercise of the Public Warrants and have no obligation to settle such warrant

exercise unless a registration statement under the Securities Act with respect to the shares of common stock underlying the Public

Warrants is effective and a prospectus relating thereto is current, subject to the Company satisfying its obligations described

above with respect to registration. No Public Warrant is exercisable and we are not obligated to issue shares of common stock upon

exercise of a warrant unless common stock issuable upon such warrant exercise has been registered, qualified or deemed to be exempt

under the securities laws of the state of residence of the registered holder of the Public Warrants. In the event that the conditions

in the two immediately preceding sentences are not satisfied with respect to a Public Warrant, the holder of such Public Warrant

will not be entitled to exercise such Public Warrant and such Public Warrant may have no value and expire worthless. In no event

will the Company be required to net cash settle any Public Warrant.

A holder of the Public

Warrants may notify the Company in writing in the event it elects to be subject to a requirement that such holder will not have

the right to exercise such Public Warrants, to the extent that after giving effect to such exercise, such person (together with

such person’s affiliates), to the warrant agent’s actual knowledge, would beneficially own in excess of 9.8% of the

shares of the Company’s common stock outstanding immediately after giving effect to such exercise.

If the number of outstanding

shares of common stock is increased by a stock dividend payable in shares of common stock, or by a split-up of shares of common

stock or other similar event, then, on the effective date of such stock dividend, split-up or similar event, the number of shares

of common stock issuable on exercise of each Public Warrant will be increased in proportion to such increase in the outstanding

shares of common stock. A rights offering to holders of common stock entitling holders to purchase shares of common stock at a

price less than the fair market value will be deemed a stock dividend of a number of shares of common stock equal to the product

of (i) the number of shares of common stock actually sold in such rights offering (or issuable under any other equity securities

sold in such rights offering that are convertible into or exercisable for common stock) multiplied by (ii) the quotient of (x)

the price per share of common stock paid in such rights offering divided by (y) the “fair market value.” For these

purposes (i) if the rights offering is for securities convertible into or exercisable for common stock, in determining the price

payable for common stock, there will be taken into account any consideration received for such rights, as well as any additional

amount payable upon exercise or conversion and (ii) for this purpose “fair market value” means the volume weighted

average price of common stock as reported during the 10 trading day period ending on the trading day prior to the first date on

which the shares of common stock trade on the applicable exchange or in the applicable market without the right to receive such

rights.

If the number of outstanding

shares of common stock is decreased by a consolidation, combination, reverse stock split or reclassification of shares of common

stock or other similar event, then, on the effective date of such consolidation, combination, reverse stock split, reclassification

or similar event, the number of shares of common stock issuable on exercise of each Public Warrant will be decreased in proportion

to such decrease in outstanding shares of common stock.

Whenever the number

of shares of common stock purchasable upon the exercise of the warrants is adjusted, as described above, the warrant exercise price

will be adjusted by multiplying the Public Warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator

of which will be the number of shares of common stock purchasable upon the exercise of the Public Warrants immediately prior to

such adjustment, and (y) the denominator of which will be the number of shares of common stock so purchasable immediately thereafter.

In case of any reclassification

or reorganization of the outstanding shares of common stock (other than those described above or that solely affects the par value

of such shares of common stock), or in the case of any merger or consolidation of us with or into another corporation (other than

a consolidation or merger in which we are the continuing corporation and that does not result in any reclassification or reorganization

of our outstanding shares of common stock), or in the case of any sale or conveyance to another corporation or entity of the assets

or other property of us as an entirety or substantially as an entirety in connection with which we are dissolved, the holders of

the Public Warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified

in the Public Warrants and in lieu of the shares of our common stock immediately theretofore purchasable and receivable upon the

exercise of the rights represented thereby, the kind and amount of shares of stock or other securities or property (including cash)

receivable upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such sale or

transfer, that the holder of the Public Warrants would have received if such holder had exercised their warrants immediately prior

to such event. The warrant agreement provides for certain modifications to what holders of Public Warrants will have the right

to purchase and receive upon the occurrence of certain events.

The Public Warrants

may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant agent,

with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full

payment of the exercise price (or on a cashless basis, if applicable), by certified or official bank check payable to us, for the

number of Public Warrants being exercised. The warrantholders do not have the rights or privileges of holders of common stock and

any voting rights until they exercise their Public Warrants and receive shares of common stock. After the issuance of shares of

common stock upon exercise of the Public Warrants, each holder will be entitled to one vote for each share held of record on all

matters to be voted on by stockholders.

No fractional shares

will be issued upon exercise of the Public Warrants. If, upon exercise of the Public Warrants, a holder would be entitled to receive

a fractional interest in a share, we will round down to the nearest whole number the number of shares of common stock to be issued

to the warrantholder.

Sponsor Warrants and $15 Exercise Price Warrants

The Sponsor Warrants

and $15 Exercise Price Warrants have the same general terms as the Public Warrants except that (i) each Sponsor Warrant and $15

Exercise Price Warrant is exercisable to purchase one whole share of common stock; (ii) the exercise price of the $15 Exercise

Price Warrants is $15.00 per share; (iii) so long as the Sponsor Warrants and $15 Exercise Price Warrants are held by the initial

purchasers thereof or their permitted transferees, such warrants will not be redeemable by us; (iv) the Sponsor Warrants may be

exercised on a cashless basis and (iv) the $15 Exercise Price Warrants expire on July 20, 2023, at 5:00 p.m., New York time, or

earlier upon their redemption or liquidation.

If holders of the Sponsor

Warrants elect to exercise them on a cashless basis, they would pay the exercise price by surrendering his, her or its warrants

for that number of shares of common stock equal to the quotient obtained by dividing (x) the product of the number of shares of

common stock underlying the warrants, multiplied by the difference between the exercise price of the warrants and the “fair

market value” (defined below) by (y) the fair market value. The “fair market value” means the average reported

last sale price of the common stock for the 10 trading days ending on the third trading day prior to the date on which the notice

of warrant exercise is sent to the warrant agent.

Merger Warrants

In connection with

the Business Combination, we issued to the holders of membership interests and holders of options to acquire membership interests

of Limbach Holdings LLC 666,670 Merger Warrants, of which 666,360 remain unexercised as of August 29, 2017. Each Merger Warrant

entitles the registered holder to purchase one share of our common stock at a price of $12.50 per share, subject to adjustment

as set forth in the form of Merger Warrant, at any time commencing 30 days after the completion of the Business Combination. The

Merger Warrants will expire seven years after the date on which they first became exercisable, at 5:00 p.m., New York time, or

earlier upon their redemption or liquidation.

The Merger Warrants

are not redeemable by the Company.

The Merger Warrants

may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the principal offices of the Company,

with the subscription form attached to the form of Merger Warrant completed and executed as indicated, accompanied by full payment

of the exercise price, in cash, good certified check or good bank draft payable to the order of the Company, for the number of

Merger Warrants being exercised.

The Merger Warrant

holders do not have the rights or privileges of holders of common stock and any voting rights until they exercise their Merger

Warrants and receive shares of common stock. After the issuance of shares of common stock upon exercise of the Merger Warrants,

each holder will be entitled to one vote for each share held of record on all matters to be voted on by stockholders.

The Merger Warrants

may be exercised on a “cashless basis,” subject to adjustment as described in the form of Merger Warrant, at any time

after the earlier of (i) July 20, 2017 and (ii) the completion of the then-applicable period required by Rule 144, if there is

no effective registration statement registering, or no current prospectus available for, the resale of the shares of common stock

underlying the Merger Warrants.

Holders of the Merger

Warrants may elect to be subject to a restriction on the exercise of their Merger Warrants such that an electing Merger Warrant

holder would not be able to exercise its Merger Warrants to the extent that, after giving effect to such exercise, such holder

would beneficially own in excess of 9.8% of our common stock outstanding.

Additional Merger Warrants

In connection with

the Business Combination, we issued to the former equity holders of Limbach Holdings LLC 1,000,006 Additional Merger Warrants,

of which 999,541 remain unexercised as of August 29, 2017. Each Additional Merger Warrant entitles the registered holder to purchase

one share of our common stock at a price of $11.50 per share, subject to adjustment as set forth in the form of Additional Merger

Warrant, at any time commencing 30 days after the completion of the Business Combination. The Additional Merger Warrants have the

same material terms as the Public Warrants and will expire on August 19, 2021, at 5:00 p.m., New York time, or earlier upon their

redemption or liquidation.

The Additional Merger

Warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the principal offices

of the Company, with the subscription form attached to the form of Additional Merger Warrant completed and executed as indicated,

accompanied by full payment of the exercise price, in cash, good certified check or good bank draft payable to the order of the

Company, for the number of Additional Merger Warrants being exercised.

The Additional Merger

Warrants may be exercised on a “cashless basis,” subject to adjustment as described in the form of Additional Merger

Warrant, at any time after the earlier of (i) July 20, 2017 and (ii) the completion of the then-applicable period required by Rule

144, if there is no effective registration statement registering, or no current prospectus available for, the resale of the shares

of common stock underlying the Additional Merger Warrants.

Holders of Additional

Merger Warrants do not have the rights or privileges of holders of common stock and any voting rights until they exercise their

Additional Merger Warrants and receive shares of common stock. After the issuance of shares of common stock upon exercise of the

Additional Merger Warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on

by stockholders.

Purchase Option

In connection with

the IPO, we sold to the underwriters thereof an option to purchase up to a total of 300,000 units of the Company at $10.00 per

unit. The units issuable upon exercise of this option are identical to those sold in the IPO. Accordingly, the purchase option

represents the right to purchase 330,000 shares of common stock, as the rights included therein result in the issuance of 30,000

additional shares of common stock, and 300,000 warrants to purchase 150,000 shares of our common stock at $11.50 per share. In

no event will we be required to net cash settle the exercise of the purchase option or the warrants underlying the purchase option.

The purchase option may be exercised on a “cashless” basis and contains registration rights entitling the holders of

the securities issued pursuant to the exercise thereof to have their securities registered for resale. None of the shares or warrants

underlying the purchase option are being registered by the registration statement of which this prospectus forms a part. On December