Canadian Dollar Advances On Higher Oil Prices

September 20 2017 - 3:25AM

RTTF2

The Canadian dollar strengthened against its most major

counterparts in the European session on Wednesday amid rising oil

prices, as an industry data showed that U.S. crude inventories rose

less than expected last week.

Crude for November delivery rose $0.56 to $50.48 per barrel.

Data from the American Petroleum Institute showed a build of 1.4

million barrels in U.S. crude stockpiles last week, well short of

expectations for an increase of 2.925 million barrels.

Official data from the Energy Information Administration is due

later in the day, with analysts expecting a build of 2.4 million

barrels in crude inventories.

Market participants await a meeting between OPEC and non-OPEC

producers in Vienna on Friday to review compliance with the output

cut deal.

The Fed concludes its 2-day meeting later in the day, with many

expecting no change in interest rates.

That said, the accompanying statement may offer the details of

how the central bank plans to start shrinking its $4.5 trillion

balance sheet.

The loonie showed mixed performance in the Asian session. While

the currency fell against the aussie and the euro, it rose against

the greenback. Against the yen, it held steady.

The loonie climbed to 1.4692 against the euro, after having

fallen to 1.4759 at 10:15 pm ET. The next possible resistance for

the loonie is seen around the 1.45 region.

Data from Destatis showed that Germany's producer prices

increased at the fastest pace in three months in August.

Producer prices increased 2.6 percent year-on-year in August,

faster than the 2.3 percent rise seen in July.

The loonie hit a 2-day high of 1.2236 against the greenback,

following a decline to 1.2302 at 8:15 pm ET. If the loonie rises

further, 1.21 is likely seen as its next resistance level.

The loonie edged up to 90.95 against the Japanese yen, compared

to 90.77 hit late New York Tuesday. Continuation of the loonie's

uptrend may see it challenging resistance around the 93.00

region.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade surplus of 113.642 billion yen in August.

That beat forecasts for a surplus of 104.4 billion yen, although

it was down from 418.8 billion yen in July.

On the flip side, the loonie held steady against the aussie,

following a 2-week decline to 0.9878 at 2:30 am ET. The pair

finished Tuesday's trading at 0.9844.

Data from the Westpcac Institutional Bank showed that

Australia's leading index remained in negative territory for the

third successive month in August.

The Westpac-Melbourne Institute Leading Index, which indicates

the likely pace of economic activity relative to trend three to

nine months into the future, dropped to -0.19 percent in August

from -0.04 percent in July.

Looking ahead, U.S. existing home sales data for August and

crude oil inventories data are slated for release in the New York

session.

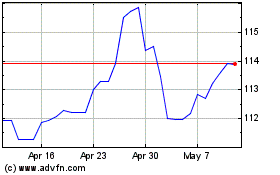

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

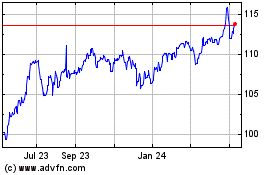

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024