For immediate

release 22

December 2017

Serabi Gold plc("Serabi" or the

"Company")Completion of acquisition of the Coringa gold

project, Brazil

Serabi Gold plc (AIM:SRB, TSX:SBI), the

Brazilian-focused gold mining and development company, is pleased

to report that it has now completed the acquisition of 100 per cent

of the issued share capital and inter-company debt of Chapleau

Resources Ltd ("Chapleau"), a Canadian registered company

previously wholly-owned by Anfield Gold Corp

("Anfield"). Chapleau holds the Coringa gold project

("Coringa") located in the Tapajos gold province in Para,

Brazil.

Coringa hosts a mineral resource estimate of

376,000 ounces of gold, including an Indicated Resource of 195,000

ounces of gold with an average grade of 8.4 grammes per tonne

("g/t"), which has been prepared in accordance with the reporting

requirements of the standards of NI 43-101. Estimated mineral

reserves, included with the mineral resource, are 160,000 ounces of

gold. Coringa is located some 70 kilometres to the south-east

of the town of Novo Progresso which is approximately 130 kilometres

by road to the south of Serabi's current mining operations at

Palito.

Completion of the acquisition occurred on 21

December 2017 ("Closing"). Serabi has made an initial

payment to Anfield on Closing of US$5 million in cash ("Initial

Consideration"). A further US$5 million in cash is

payable within three months of Closing and a final payment of US$12

million in cash will be due upon the earlier of either the first

gold being produced or 24 months from the date of Closing (both

payments together being the "Deferred Consideration"). The

total proposed consideration for the acquisition amounts to US$22

million in aggregate.

Significant Benefits of the

transaction

The Board of Serabi believes that the

acquisition of the Coringa gold project has a number of key

benefits including:

- Coringa hosts an Indicated Mineral Resource of 195,000 ounces

of gold at 8.36 g/t and an Inferred Mineral Resource of 181,000

ounces gold at 4.32 g/t (the "Coringa Mineral Resource

Estimate") prepared in accordance with the reporting

requirements of the standards of NI 43-101.

- Coringa is located only 200 kilometres from Serabi's current

Palito mining operation and process plant, allowing synergies for

management and infrastructure and potential reduction of unit

operating costs.

- The Coringa project is a near 'carbon-copy' of Serabi's current

operation, which has been in production since 2014. The

similarities mean Serabi is very well placed to expedite the

successful development and future production potential of the

project.

- Past gold discoveries at Coringa including the Mae de Leite,

Come Quieto, Demetrio and Valdette veins, have not been included in

the current Coringa Mineral Resource Estimate and provide scope for

growing the resources and expanding the life of the project.

- A feasibility report on Coringa issued by Anfield in September

2017 (the "Coringa Feasibility Study"), prepared in

accordance with the reporting requirements of the standards

of NI 43-101, estimated:

- an average production rate of 32,000 ounces per annum and a

total mineable reserve of approximately 160,000 ounces of

gold;

- average all-in sustaining costs of US$783 per ounce; and

- a post-tax IRR of 30.8 per cent.

- Serabi considers that scope exists to reduce capital and

operating costs at Coringa by utilising Serabi's existing gold

processing facilities at Palito.

- Book value, as at 30 September 2017, attributed by Anfield to

property, plant and equipment being acquired, including a 750

tonnes per day crushing, milling and CIP process plant, is C$20.8

million.

Michael Hodgson, CEO of Serabi

commented.

"Coringa is an asset we have been

trying to secure for some time now, and its proximity, and

similarity to the Palito and Sao Chico ore-bodies make this

acquisition something of a 'must have' for us.

"We pride ourselves on being the best at what

we do in Brazil. The existing Palito and Sao Chico operations

demonstrate our strong credentials as high-grade, quality,

underground operators, and we see Coringa as the next 'cab off the

rank'.

"The Coringa project brings with it

approximately 400,000 ounces of high grade resources which,

combined with our own recently updated resource estimation for the

Palito and Sao Chico ore-bodies, brings the Group close to having

one million ounces of gold resources. This is a key milestone

for any junior gold company, and within this resource we have a

total combined mineral reserve of approximately 350,000

ounces.

"However, we very much see Coringa as an

asset that can be grown, and grown quickly, into what can become a

significant, long-life asset. The strike extent and

continuity of the historical artisanal gold mining activity shows

the deposit has very significant upside, with abundant drilling

targets. We therefore consider the current and maiden mineral

reserve at Coringa as very much just the start of what we believe

to be a very exciting opportunity.

"With our experience, team and the knowledge

acquired from building Palito and then Sao Chico, we feel very well

positioned to develop Coringa quickly and efficiently. The

orebody, the mining, the processing and environmental management of

the operation are all so similar to Palito and Sao Chico, that it

fits perfectly with our known strengths. Our management and key

personnel in Serabi will be able to accelerate project advancement

and this will be the third time that they will have worked together

on developing such an operation.

"Coringa is ready to build once the final

permits are in place and the early part of 2018 will be a key time

for advancing the issuance of the necessary approvals and

licences. With Coringa being located in the state of Para, we

can benefit from the excellent relationships we already enjoy with

such agencies as the Departamento Nacional de Produção Mineral

("DNPM") and Secretaria de Estado de Meio Ambiente e

Sustentabilidade ("SEMAS") to get the operation permitted

efficiently and into production.

"The proximity of the project to the current

Palito complex also brings obvious operational synergies.

Senior management, finance, H.R. and maintenance, are all obvious

areas where resources can be shared.

"With exploration drilling now underway at

Palito and shortly to begin at Sao Chico, we see excellent organic

growth prospects there, where we feel confident we can quickly turn

exploration success into increased production ounces. At

Palito the 27 veins that comprise the mineral resource are

currently within an overall one kilometre strike length.

However, numerous intersections suggest the veins are traceable for

up to four kilometres, so the current step-out drilling is

essential. The story is much the same at Sao Chico where the

main vein remains open in all directions along strike and at

depth.

"Over the next 12-24 months, we aim to see

the fruits of our organic growth effort at Palito and Sao Chico

along with the development of Coringa, place Serabi in amongst the

100,000 ounces per annum producers, but, I emphasise, not at the

expense of compromising on quality. Our niche is quality,

high grade mining and our aim, is to do more of it."

An interview with Michael Hodgson of Serabi,

discussing the acquisition of Coringa, can be accessed by using the

following link:

https://www.brrmedia.co.uk/broadcasts-embed/5a3943e115a38759b1b01bc7/event/?livelink=true&popup=true

Acquisition Agreement

The acquisition agreement initially signed on 13

November provided for Serabi to acquire 100 per cent of the issued

share capital of Chapleau and to be assigned the benefit of all of

Chapleau's outstanding inter-company debts that had been advanced

by Anfield and other Anfield group companies (the

"Agreement"). Chapleau owns 100 per cent of the shares

of Chapleau Exploração Mineral Ltda ("Chapleau Brazil").

Chapleau Brazil holds mineral rights consisting of seven

concessions totalling 13,648 hectares, including Coringa. Chapleau

also owns 100 per cent of the shares of Chapleau Resources (USA)

Limited ("Chapleau USA") which holds a 10 per cent interest

in the Patty JV covering 616 mining claims in Nevada,

USA. The other JV participants are Barrick Gold US Inc.

and McEwen Mining Inc. The projected costs to Chapleau USA

for 2018, in respect of the JV, are approximately US$20,000.

Serabi has paid the Initial Consideration from

its existing cash resources. Following Closing a completion balance

sheet will now be prepared and the Initial Consideration will be

adjusted dollar-for-dollar for the amount, if any, by which the

working capital on Closing exceeds or is less than US$nil. Anfield

has assigned to Serabi all the benefit of all outstanding

intercompany loans between Chapleau and Anfield, and Chapleau is

now obliged to repay these to Serabi.

A further US$17 million is the Deferred

Consideration, of which an initial payment of US$5 million in

cash is payable within three months of Closing and a final payment

of US$12 million in cash will be due upon the earlier of either the

first gold being produced or 24 months from the date of Closing.

The total consideration for the acquisition amounts to US$22

million in aggregate (before any working capital adjustments).

Anfield has provided Serabi with certain

indemnities in respect of future claims relating to activities

prior to Closing, including labour and tax liabilities and the

Agreement includes representations and warranties from Anfield in

favour of Serabi as would be customary for a transaction of this

nature.

Serabi has, with the approval of Serabi's

secured lender and sub-ordinated to the security granted by Serabi

to its secured lender, granted to Anfield a pledge over the shares

of Chapleau as security for the full and irrevocable payment of the

Deferred Consideration.

Further information on Coringa

Coringa is located in north-central Brazil, in

the State of Pará, 70 kilometres southeast of the city of Novo

Progresso. Access to the property is provided by paved

(National Highway BR-163) and gravel roads. Coringa is in the

south eastern part of the Tapajós gold district, Brazil's main

source of gold from the late 1970s to the late 1990s. Artisanal

mining at Coringa produced an estimated 10 tonnes of gold (322,600

ounces) from alluvial and primary sources within the deep saprolite

or oxidized parts of shear zones being mined using high-pressure

water hoses or hand-cobbing to depths of 15 metres. Other than the

artisanal workings, no other production has occurred at Coringa.

Artisanal mining activity ceased in 1991 and a local Brazilian

company (Tamin Mineração Ltda.) staked the area in 1990.

Subsequently, the concessions were optioned to Chapleau (via its

then subsidiary, Chapleau Brazil) in August 2006. On 1 September

2009, Magellan Minerals Ltd. ("Magellan Minerals") acquired

Chapleau. Between 2007 and 2013, extensive exploration

programmes were completed on the property, including airborne

magnetic, radiometric and electro-magnetic surveys; surface IP

surveys; stream, soil, and rock sampling; and trenching and diamond

drilling (179 holes for a total length of 28,437 meters). On

9 May 2016, Anfield acquired Magellan Minerals. Anfield

subsequently completed an infill drill programme (183 holes for a

total length of 26,413 meters) for the Serra and Meio veins in 2016

and 2017.

Coringa is an advanced project currently at the

resource development stage.

Following completion of the drilling programme

undertaken by Anfield and the Coringa Feasibility Study, activity

has been significantly reduced whilst Anfield has progressed the

licencing and permitting process. There are currently

approximately 35 personnel employed by Chapleau Brazil.

The Coringa Feasibility Study has an effective

date of 1 July 2017 and it incorporates all expenditures prior to

that date. The base case economics are based on a gold price of

US$1,250 per ounce, silver price of US$18 per ounce and an exchange

rate of 3.2 (US$ to Brazilian Real). The Coringa Feasibility Study

highlights included the following estimates:

· Gold production

of approximately 32,000 ouncse per year averaged over a 4.8 year

mine life;

· Average life of

mine process fully-diluted gold grade of 6.5 g/t;

· Post-tax

internal rate of return of 30.8 per cent;

· Post-tax net

present value of US$31.0 million at a 5 per cent discount rate;

· Remaining

capital costs of US$28.8 million;

· Average net

cash operating costs of US$585 per ounce and all-in sustaining

costs of US$783 per ounce; and

· Probable

mineral reserves of 161,000 ounces of gold and 324,000 ounces of

silver.

The total fully-diluted estimate of mineral

resources for Coringa, prepared in accordance with the reporting

requirements of the standards of NI 43-101, included in the Coringa

Feasibility Study were reported as follows:

|

Classification |

Tonnes ('000's) |

Au grade (g/t) |

Ag grade (g/t) |

Contained gold (oz) |

Contained Silver (oz) |

Cut-off grade (g/t Au) |

| Serra Probable

Reserves |

498 |

6.0 |

12.8 |

97,000 |

204,000 |

2.50 |

| Meio Probable

Reserves |

196 |

7.4 |

14.6 |

46,000 |

92,000 |

2.38 |

| Galena Probable

Reserves |

74 |

7.1 |

11.2 |

17,000 |

27,000 |

2.50 |

|

Total Probable Reserves |

769 |

6.5 |

13.1 |

161,000 |

324,000 |

|

| |

|

|

|

|

|

|

| Indicated Resource |

726 |

8.4 |

17.0 |

195,000 |

396,000 |

2.00 |

|

Inferred Resource |

1,301 |

4.3 |

5.1 |

181,000 |

215,000 |

2.00 |

Notes:

- Additional information, including with respect to the mineral

resource estimate, metallurgy, data verification and quality

control measures, can be found in Anfield's technical report titled

"Coringa Gold Project, Brazil, Feasibility Study NI 43-101

Technical Report" with an effective date of 1 July 2017, which is

filed on SEDAR at www.sedar.com The mineral resource estimate was

prepared in accordance with the standard of CIM and NI 43-101.

- Totals in the above table may not add due to rounding.

- Grades are reported on a fully-diluted basis.

- Chapleau Brazil is the Operator and owns 100% of Coringa such

that gross and net attributable resources are the same.

- Serabi has not independently verified the information.

There are approximately 40,000 ounces of

estimated inferred mineral resource, which are not included in the

Coringa Feasibility Study's mine plan, that are adjacent to areas

mined as part of the Coringa Feasibility Study. In addition,

Chapleau Brazil controls a 20 kilometre area in the district with

delineated gold soil anomalies, of which, the drill-defined mineral

resource strike length is approximately two kilometres.

On 14 August 2017, Anfield announced that it had

received key permits required to commence construction of the

Coringa project, being (1) the license of operation for exploration

and trial mining, (2) the vegetation suppression permit and (3)

fauna capture permit, all issued by the SEMAS. The SEMAS permits

contain a list of conditions for the conservation and protection of

fauna and flora. In addition, Chapleau Brazil is required to comply

with requirements related to: fuel storage; waste storage;

transportation, storage and use of explosives; surface water

drainage; archaeology; and worker health and safety programmes. The

Company is also required to submit regular reports on operational,

environmental, and social performance. These conditions and

requirements will be met as part of normal course operations.

The next step in the permitting process will be

for a formal trial mining licence to be issued by the DNPM.

The trial mining licence will authorise the Company to commence

mine development and production from Coringa. The trial

mining license will authorise mining and processing of up to 50,000

tonnes of ore per year at Coringa. Under applicable regulations,

once the mine is operational, Chapleau Brazil may apply to the DNPM

to increase the processing limit.

On 27 September 2017, Anfield announced that it

understood the Brazilian Ministério Público Federal ("MPF")

was bringing an action against SEMAS, the DNPM and Chapleau Brazil.

The action seeks to nullify the operating license previously

granted to Chapleau Brazil by SEMAS and states that SEMAS should

not have granted the license without requiring Chapleau Brazil to

prepare a full socio-economic analysis and Environmental Impact

Study ("EIS") for Coringa. Anfield and its legal counsel

believe that Chapleau Brazil has complied with all applicable

regulations. At an initial hearing the court denied a request

from the MPF to cancel the operating licence and requested

submissions from SEMAS, DNPM and Chapleau Brazil. A further

hearing has not yet been scheduled. Anfield and Chapleau Brazil

have in the meantime continued to progress the completion of a full

EIS and this was submitted to SEMAS for approval on 24 November

2017.

Serabi and its legal advisers have considered

the position adopted by the MPF, and believe that the completion of

the EIS should significantly address the main concerns of the MPF

and have concluded, based on the current available information,

that there is a low risk of significant delay to the licencing and

permitting process.

Progress has also been made in several other

areas relating to the development of Coringa. Applications for

required camp and start-up water were submitted prior to the date

of the Agreement and the tailings storage permit request was

submitted on 11 December 2017. Discussions for long-term land

access agreements are underway with the Instituto Nacional de

Colonização e Reforma Agrária ("INCRA"), a government agency

which claims ownership of the surface rights where the project is

situated.

Serabi's plans for Coringa following Closing

of the Acquisition

Serabi intends to continue the work started by

Anfield on the permitting and licencing process and will pursue the

formal approval of the EIS and undertake any supplementary work or

reports that may be requested. Serabi will review the cost

estimates contained in the Coringa Feasibility Study and optimise

these, prepare its own development plan and evaluate alternative

construction development and processing options that Serabi's

management could enhance the economics of the project.

Following Closing, development and construction

at Coringa will be placed on care and maintenance whilst the

permitting process is completed.

Additional disclosures pursuant to the AIM

Rules

Chapleau is not required to prepare audited

financial statements. Based on information provided by

Anfield and extracted from the unaudited consolidated financial

statements of Anfield to 31 December 2016, Chapleau on a

consolidated basis, reported a loss before taxation of C$22.3

million for the 12 month period ended 31 December 2016 after (i)

expensing exploration and evaluation expenditure of C$7.9 million,

(ii) recognising a foreign exchange loss of the capitalisation of

intergroup loans into shares of Chapleau Brazil of C$13.7 million,

and (iii) other one-off costs estimated at C$1.3 million. Chapleau

had no revenues. As at 30 June 2017 total assets and shareholders'

equity amounted to C$19.6 million and C$(20.3 million) respectively

with shareholder loans totalling C$38.6 million. The balance sheet

carrying value of property, plant and equipment associated with the

Coringa project as at 30 June 2017 amounted to C$16.6 million which

excludes past exploration costs as these have been

expensed. As at 30 June 2017 Chapleau had net cash and

cash equivalents of C$2.5 million and except for intercompany loans

(amounting to C$38.6 million), which will be assigned to Serabi on

Closing, had no borrowings.

Enquiries:

Serabi Gold plc Michael

Hodgson

Tel: +44 (0)20 7246 6830Chief Executive

Mobile: +44 (0)7799 473621Clive

Line

Tel: +44 (0)20 7246 6830Finance

Director

Mobile: +44 (0)7710 151692 Email: contact@serabigold.com

Website: www.serabigold.com

Beaumont Cornish LimitedNominated

Adviser and Financial

Adviser

Roland Cornish

Tel: +44 (0)20 7628 3396Michael

Cornish

Tel: +44 (0)20 7628 3396

Peel Hunt LLPUK

Broker

Ross Allister

Tel: +44 (0)20 7418 9000Chris Burrows

Tel: +44 (0)20 7418 9000

Blytheweigh Public

Relations

Tim

Blythe

Tel: +44 (0)20 7138 3204Camilla Horsfall

Tel: +44 (0)20 7138 3224

Copies of this announcement are available from

the Company's website at www.serabigold.com.

Neither the Toronto Stock Exchange, nor any

other securities regulatory authority, has approved or disapproved

of the contents of this announcement.

This announcement is inside information for the

purposes of Article 7 of Regulation 596/2014.

GLOSSARY OF TERMSThe following is a

glossary of technical terms:

"Au" means gold.

"assay" in economic geology, means to

analyse the proportions of metal in a rock or overburden sample; to

test an ore or mineral for composition, purity, weight or other

properties of commercial interest.

"CIM" is the Canadian Institute of Mining,

Metallurgy and Petroleum.

"development" - excavations used to

establish access to the mineralised rock and other workings.

"doré - a semi-pure alloy of gold silver and

other metals produced by the smelting process at a mine that will

be subject to further refining.

"DNPM" is the Departamento Nacional de Produção

Mineral.

"grade" is the concentration of mineral within

the host rock typically quoted as grams per tonne (g/t), parts per

million (ppm) or parts per billion (ppb).

"g/t" means grams per tonne.

"granodiorite" is an igneous intrusive rock

similar to granite.

"igneous" is a rock that has solidified from

molten material or magma.

"Indicated Mineral Resource" is that part of a

Mineral Resource for which quantity, grade or quality, densities,

shape and physical characteristics, can be estimated with a level

of confidence sufficient to allow the appropriate application of

technical and economic parameters, to support mine planning and

evaluation of the economic viability of the deposit. The estimate

is based on detailed and reliable exploration and testing

information gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes that are

spaced closely enough for geological and grade continuity to be

reasonably assumed.

"Inferred Mineral Resource" is that part of a

Mineral Resource for which quantity and grade or quality can be

estimated on the basis of geological evidence and limited sampling

and reasonably assumed, but not verified, geological and grade

continuity. The estimate is based on limited information and

sampling gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes.

"Intrusive" is a body of igneous rock that

invades older rocks.

"Induced polarization" or "IP" is a geophysical

imaging technique used to identify the electrical chargeability of

subsurface materials, such as ore.

"Measured Mineral Resource" is that part of a

Mineral Resource for which quantity, grade or quality, densities,

shape, and physical characteristics are so well established that

they can be estimated with confidence sufficient to allow the

appropriate application of technical and economic parameters, to

support production planning and evaluation of the economic

viability of the deposit. The estimate is based on detailed and

reliable exploration, sampling and testing information gathered

through appropriate techniques from locations such as outcrops,

trenches, pits, workings and drill holes that are spaced closely

enough to confirm both geological and grade continuity.

"Mineral Resource" is a concentration or

occurrence of diamonds, natural solid inorganic material, or

natural solid fossilized organic material including base and

precious metals, coal, and industrial minerals in or on the Earth's

crust in such form and quantity and of such a grade or quality that

it has reasonable prospects for economic extraction. The location,

quantity, grade, geological characteristics and continuity of a

Mineral Resource are known, estimated or interpreted from specific

geological evidence and knowledge.

"Mineral Reserve" is the economically mineable

part of a Measured or Indicated Mineral Resource demonstrated by at

least a Preliminary Feasibility Study. This Study must include

adequate information on mining, processing, metallurgical, economic

and other relevant factors that demonstrate, at the time of

reporting, that economic extraction can be justified. A Mineral

Reserve includes diluting materials and allowances for losses that

may occur when the material is mined.

"Probable Mineral Reserve" is the economically

mineable part of an Indicated and, in some circumstances, a

Measured Mineral Resource demonstrated by at least a Preliminary

Feasibility Study. This Study must include adequate information on

mining, processing, metallurgical, economic, and other relevant

factors that demonstrate, at the time of reporting, that economic

extraction can be justified.

"saprolite" is a weathered or decomposed

clay-rich rock.

"Vein" is a generic term to describe an

occurrence of mineralised rock within an area of non-mineralised

rock.

Qualified Persons StatementThe scientific

and technical information contained within this announcement has

been reviewed and approved by Michael Hodgson, a Director of the

Company. Mr Hodgson is an Economic Geologist by training with over

30 years' experience in the mining industry. He holds a BSc (Hons)

Geology, University of London, a MSc Mining Geology, University of

Leicester and is a Fellow of the Institute of Materials, Minerals

and Mining and a Chartered Engineer of the Engineering Council of

UK, recognising him as both a Qualified Person for the purposes of

Canadian National Instrument 43-101 and by the AIM Guidance Note on

Mining and Oil & Gas Companies dated June 2009.

Forward Looking StatementsCertain

statements in this announcement are, or may be deemed to be,

forward looking statements. Forward looking statements are

identified by their use of terms and phrases such as ''believe'',

''could'', "should" ''envisage'', ''estimate'', ''intend'',

''may'', ''plan'', ''will'' or the negative of those, variations or

comparable expressions, including references to assumptions. These

forward looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions

regarding the Company's future growth, results of operations,

performance, future capital and other expenditures (including the

amount, nature and sources of funding thereof), competitive

advantages, business prospects and opportunities. Such forward

looking statements reflect the Directors' current beliefs and

assumptions and are based on information currently available to the

Directors. A number of factors could cause actual results to differ

materially from the results discussed in the forward looking

statements including risks associated with vulnerability to general

economic and business conditions, competition, environmental and

other regulatory changes, actions by governmental authorities, the

availability of capital markets, reliance on key personnel,

uninsured and underinsured losses and other factors, many of which

are beyond the control of the Company. Although any forward looking

statements contained in this announcement are based upon what the

Directors believe to be reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with such

forward looking statements.

ENDS

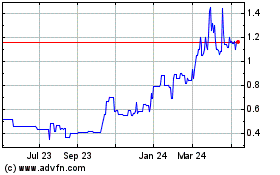

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

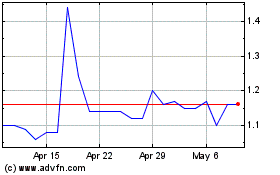

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Apr 2023 to Apr 2024