Yen Falls After BoJ Kuroda's Comments

January 22 2018 - 9:30PM

RTTF2

The Japanese yen reversed direction and weakened against its

major rivals in pre-European deals on Tuesday, after the Bank of

Japan governor Haruhiko Kuroda reiterated his commitment to

continue its current monetary easing policy.

With inflation still far from 2 percent goal, the board is not

in a position yet to debate the timing of an exit from ultra-easy

monetary policy, Kuroda said at the press conference post-BOJ

meeting.

"For Japan's economy, it's important for the BOJ to patiently

continue with powerful monetary easing," he said.

"As for the future, we will decide appropriately looking at the

economy, prices and financial developments from the viewpoint of

achieving 2 percent inflation at the earliest date possible," he

added.

The yen fell back to 111.18 against the greenback, from an early

high of 110.55.

The yen weakened to 4-day lows of 115.50 against the franc and

89.24 against the loonie, from its early highs of 115.03 and 88.81,

respectively.

The yen slipped to a 5-day low of 136.22 against the euro and a

1-1/2-year low of 155.40 against the pound, off its previous highs

of 135.61 and 154.67, respectively.

If the yen falls further, it may find support around 113.00

against the greenback, 138.00 against the euro, 117.00 against the

franc, 158.00 against the pound and 91.00 against the loonie.

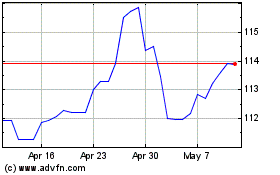

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

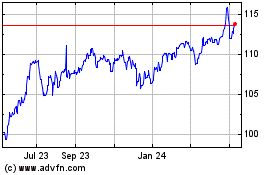

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024