Canadian Dollar Rises On Higher Oil Prices

January 26 2018 - 1:56AM

RTTF2

The Canadian dollar advanced against its major counterparts in

the European session on Friday, as oil prices rose in the wake of a

weak dollar.

Crude for March delivery rose $0.16 to $65.67 per barrel.

The dollar fell despite U.S. President Donald Trump backing

strong currency, contradicting comments made by Treasury Secretary

Steven Mnuchin a day earlier.

A weaker dollar makes dollar denominated commodities more

attractive to holders of other currency, supporting oil prices.

Investors also awaited Trump's long-awaited speech at the World

Economic Forum amid growing concerns about U.S. policy on

trade.

Trump is expected to assure U.S. commitment to free and open

markets, endorse the need of strong ties with allies and

determination to promote investment in the United States.

Canadian inflation data for December is due shortly, with

economists expecting a fall of 0.3 percent on month.

The currency dropped against its major rivals in the Asian

session, with the exception of the greenback.

Reversing from an early low of 1.5383 against the euro, the

loonie edged up to 1.5319. The next possible resistance for the

loonie is seen around the 1.52 area.

Survey of Professional Forecasters published by the European

Central Bank showed that the near term inflation is expected to

rise more than previously projected.

Forecasters raised their inflation outlook for 2018 to 1.5

percent from 1.4 percent. Likewise, the outlook for 2019 was lifted

to 1.7 percent from 1.6 percent. Inflation is seen at 1.8 percent

in 2020.

The loonie hit a 2-day high of 88.77 against the yen, from a low

of 88.36 hit at 5:00 pm ET. If the loonie rises further, 90.00 is

possibly seen as its next resistance level.

Data from the Ministry of Internal Affairs and Communications

showed that Japan consumer prices rose 1.0 percent on year in

December.

That was unchanged from the November reading, although it came

in beneath expectations for a gain of 1.1 percent.

The loonie advanced to 1.2305 against the greenback, after

having dropped to 1.2390 at 6:00 pm ET. The loonie is poised to

challenge resistance around the 1.21 region.

The loonie held steady against the aussie, following a decline

to 0.9963 at 6:00 am ET. The pair closed Thursday's deals at

0.9928.

Looking ahead, Canada consumer prices, U.S. wholesale

inventories and durable goods orders, all for December, as well as

U.S. advanced GDP for the fourth quarter are set for release in the

New York session.

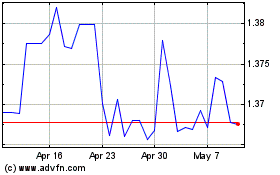

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024