By Ian Talley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 20, 2018).

WASHINGTON -- An Iranian airline under sanctions by the U.S. for

ferrying weapons and fighters into Syria repeatedly bought

U.S.-made jet engines and parts through Turkish front companies

over the past several years, most recently in December, federal

investigators said in a new U.S. government filing.

The U.S. says in the filing that a Turkish woman set up a series

of shell companies to buy needed equipment from U.S. suppliers for

Iran's Mahan Air, helping the airline circumvent the longstanding

sanctions and fueling suspicions about Iran within the Trump

administration.

The revelation could bolster a case by some within the Trump

administration against granting Boeing Co. licenses to sell Iran

scores of new planes, a multibillion-dollar deal inked after Tehran

signed the landmark 2015 nuclear agreement. The filing documents

purchases from September 2016 through December 2017.

The Trump administration is considering whether to grant the

Boeing licenses to sell planes to another airline, Iran Air, as the

White House takes a more aggressive stance on Iran and steps up

sanctions. Administration officials are concerned the nuclear

accord is inadequate and that Tehran's growing influence is fueling

war and militancy in the region. The U.S. also has accused Iran of

violating international bans on ballistic missile development.

Iran has disputed evidence cited by the U.S. and the United

Nations that it is violating weapon bans, and said U.S. efforts to

change the nuclear deal and escalate sanctions against Tehran

undermine the agreement and violate its terms.

Although the Boeing deal would benefit U.S. firms, some in the

administration are uneasy about the signal it would send to

Tehran.

At the same time, scuttling the Boeing deal could have

far-reaching consequences, both for the nuclear accord and the jet

makers. Boeing and Airbus, the European firm reliant on U.S.

licensing for its own deal with Iran because of the large U.S.

content on its aircraft, stand to lose an estimated $40 billion in

contracts if the licenses are rejected.

Supporters of the nuclear accord, including those inside the

Trump administration, have worried it could fall apart if Iran

doesn't see benefits from a relaxation of sanctions, including the

Boeing aircraft deal.

Iran's need for new aircraft and parts has fueled safety

concerns, rekindled by Sunday's crash of a turboprop plane in a

mountainous region of the country. The operator, Aseman Airlines,

which isn't under sanctions, last year signed a purchase agreement

for up to 60 Boeing 737 planes.

Outside critics of the Boeing licenses have argued that a

Boeing-Iran Air deal could indirectly benefit Mahan Air. As Iran

Air updates its fleet with the new Boeing aircraft, those critics

argue, some of the old planes and parts would go to Mahan Air.

While sanctions against Iran Air have been eased, Mahan has

remained on U.S. sanction lists for a decade because of its alleged

collaboration with Iran's Islamic Revolutionary Guard Corps and for

allegedly ferrying fighters, weapons and cash throughout the

region. The U.S. calls the IRGC, Tehran's elite military group, a

terror organization central to Iran's Middle East involvements.

Mahan is sorely in need of new engines and parts for its aging

fleet, analysts say. The airline repeatedly has sought to buy

Boeing jet engines and airplane parts, but doing so would violate

export controls and sanction laws, U.S. officials say.

So Mahan has used Turkish front companies to purchases its

parts, according to a little-noticed filing earlier this month by

the Department of Commerce's Bureau of Industry and Security, or

BIS, the small agency tasked with controlling exports of

high-technology and other goods important to national security.

The U.S. says in the filing a Turkish woman, Gulnihal Yegane,

has been prominent in that effort, setting up a series of Turkish

shell companies to buy needed equipment for Mahan from U.S.

suppliers. The filing also orders a ban on U.S. exports to Ms.

Yegane and entities affiliated with her.

In a cat-and-mouse game between the BIS and Mahan's Turkish

front companies, Ms. Yegane and her corporate cohorts sometimes

were successful, while other times, the BIS caught the transactions

before the parts made it into Iran, the filing said.

Mahan Air didn't respond to a request for comment. Boeing and

Airbus have said they would comply with U.S. laws and regulations.

Boeing declined to comment for this article. Iran Air didn't

respond to requests for comment.

An official at the Iranian mission at the U.N. declined to

immediately comment.

Trigron Lojistik Kargo and RA Havacilik are two of the Turkish

firms the BIS said Ms. Yegane owned or ran. In December, for

example, Havacilik bought and shipped gaskets and other parts for

Mahan's Boeing aircraft to Iran, U.S. officials said. Ms. Yegane,

through other firms, also managed to buy and ship to Iran two kinds

of jet engines used on Boeing planes, the agency said.

An official reached at Trigron directed questions to Ms. Yegane

in Turkey, who told The Wall Street Journal she had "a general

understanding of the matter" but was unaware of the export ban.

She said she would review the export ban with a company lawyer

but didn't respond to additional requests for comment.

A Treasury spokesman declined to comment about the BIS filing in

particular and about the department's review of the Boeing

licenses.

The spokesman said, "We take into account a variety of factors

when evaluating requests and we make determinations consistent with

our national security and foreign policy goals."

He added: "Should the U.S. determine that any licensed aircraft,

goods, or services have been used for purposes other than

exclusively commercial passenger aviation end-use, or have

transferred to sanctioned persons, we reserved the right under the

[nuclear deal] to cease issuing -- or to revoke -- aircraft

licenses."

Matthew Levitt, a former senior official in the U.S. Treasury's

terrorism and financial intelligence office, said the BIS filing

could lend weight to those opposing the Boeing sale.

"There's no question people will be able to point to this as

evidence that illicit actors in Iran are seeking Boeing

components," said Mr. Levitt, now at the Washington Institute for

Near East Policy, a think tank that is a critic of Iran.

"Therefore, one could make the case that it would be difficult to

know where everything was going in a Boeing deal."

Emanuele Ottolenghi, an Iran expert at the Foundation for

Defense of Democracies, which has long criticized the nuclear deal,

says U.S. intelligence cited in the Iran sanctions and other

publicly available research show there's a likelihood that planes

or parts approved under a new Iran-related license would be used in

violation of U.S. law.

He also points to an increase in commercial flights from Iran

into Syria since the summer of 2015, when Tehran and Russia

coordinated their efforts to boost support for the regime of Syrian

President Bashar al-Assad amid the country's civil war, he said.

His suspicion is that "These airlines are not ferrying civilian

passengers between Tehran and Damascus," he said.

--Erdem Aydin contributed to this article.

Write to Ian Talley at ian.talley@wsj.com

(END) Dow Jones Newswires

February 20, 2018 13:04 ET (18:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

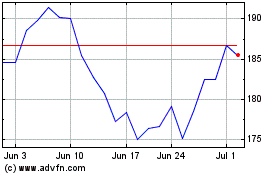

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024