Eurozone Inflation Eases To 14-Month Low

February 28 2018 - 1:27AM

RTTF2

Eurozone inflation slowed to a 14-month low in February on food

and energy prices, flash data from Eurostat showed Wednesday.

Inflation eased to 1.2 percent from 1.3 percent in January. This

was the third consecutive slowdown and the weakest since December

2012, when prices gained 1.1 percent. Nonetheless, the rate came in

line with expectations.

Inflation continues to stay below the European Central Bank's

target of 'below, but close to 2 percent'.

Core inflation that excludes energy, food, alcohol and tobacco,

held steady at 1 percent in February. Final data is due on March

16.

February's decline in headline inflation does not change the

assessment that the ECB will drop the easing bias from its forward

guidance at its meeting on March 8, Jack Allen, an economist at

Capital Economics, said.

But with core inflation still weak and likely to rise only

slowly, interest rate hikes are likely to be a long way off, the

economist added.

Bert Colijn, an ING economist said, with inflation dropping to

1.2 percent and core inflation steady at 1 percent, expectations of

a quick return of inflation seem exaggerated for the Eurozone,

making a cautious ECB next week very likely.

Among major euro area economies, Germany's inflation fell to 1.2

percent in February, the lowest since late 2016, from 1.4 percent a

month ago.

Similarly, France's harmonized inflation weakened to 1.3 percent

from 1.5 percent in January. At the same time, Italy's inflation

dropped markedly to 0.7 percent from 1.2 percent.

On the other hand, Spain's inflation accelerated to 1.2 percent

from 0.7 percent a month ago.

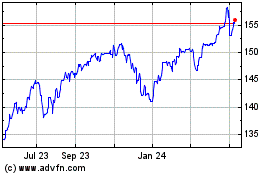

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

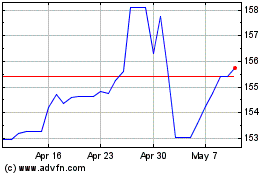

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024