Current Report Filing (8-k)

March 05 2018 - 3:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT

(DATE OF EARLIEST EVENT REPORTED):

March

5, 2018

NEWS CORPORATION

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

|

|

|

|

|

|

Delaware

|

|

001-35769

|

|

46-2950970

|

|

(STATE OR OTHER JURISDICTION

OF INCORPORATION)

|

|

(COMMISSION FILE NO.)

|

|

(IRS EMPLOYER

IDENTIFICATION NO.)

|

1211 Avenue of the Americas, New York, New York 10036

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES, INCLUDING ZIP CODE)

(212) 416-3400

(REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.06

|

Material Impairments.

|

On March 5, 2018, News Corporation (the "Company" or "News Corp") and Telstra Corporation Limited ("Telstra") announced they had entered into definitive agreements to combine Foxtel and FOX SPORTS Australia into a new company in which News Corp will have a 65% interest, with Telstra owning the remaining 35% (the "Transaction").

As a result of the approval of the Transaction and its entry into the related agreements, the Company concluded that it expects to record pre-tax non-cash impairment charges and write-downs in the quarter ending March 31, 2018 in the range of $700 million to $1.1 billion for its investment in Foxtel and long-lived assets at FOX SPORTS Australia. This range reflect its best estimate of the charges at this time; however, the Company continues to evaluate the amount of the write-downs and impairments. Until the evaluation has been finalized, the Company can make no assurances that this range will not change. The Company does not expect that any amount of the write-downs or impairments will result in current or future cash expenditures. Additional information regarding the write-downs and impairments is set forth below.

Foxtel and FOX SPORTS Australia

The Company is required to periodically review the carrying amounts of its long-lived assets and its equity investments to determine whether a significant event or change in circumstances has occurred that may impact the fair value of such assets or investments. If the fair value of its long-lived assets or investments drops below their carrying values, an impairment or write-down is recognized. During the third quarter of fiscal 2018, as part of the long range planning process in preparation for the Transaction, the Company assessed the long-term prospects for Foxtel and FOX SPORTS Australia, on both a stand-alone and combined basis. As a result of lower-than-expected sales of certain new products and broadcast sales at Foxtel, the Company revised its outlook for Foxtel and FOX SPORTS Australia, which resulted in a reduction in expected future cash flows. Based on the revised projections approved in connection with the Transaction, the Company concluded that it expects to recognize a write-down of its Foxtel investment and an impairment of long-lived assets at FOX SPORTS Australia in the range noted above.

On March 5, 2018

, the Company issued a press release announcing the Transaction, a copy of which is attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

Forward-Looking Statements

This document contains forward-looking statements based on current expectations or beliefs, as well as a number of assumptions about future events, and these statements are subject to factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Forward-looking statements can often be identified by words such as "anticipates," "expects," "intends," "plans," "predicts," "believes," "seeks," "estimates," "may," "will," "should," "would," "could," "potential," "continue," "ongoing," similar expressions, and variations or negatives of these words. The reader is cautioned not to place undue reliance on these forward-looking statements, which are not a guarantee of future performance and are subject to a number of uncertainties, risks, assumptions and other factors, many of which are outside the control of the Company. Numerous risks, uncertainties and other factors could cause actual results to differ materially from those described in these forward-looking statements, including the preliminary nature of the estimated charges, the completion of the Company's closing procedures, final adjustments and any other developments or information arising before the Company's financial and operating results for the reporting period are finalized. In addition, actual results are subject to other risks and uncertainties that relate more broadly to the Company's overall business, including those more fully described in the Company's filings with the Securities and Exchange Commission including its annual report on Form 10-K for the fiscal year ended June 30, 2017, and its quarterly reports filed on Form 10-Q for the current fiscal year. The forward-looking statements in this document speak only as of this date. Except as required by law, the Company expressly disclaims any current intention to update or revise any forward-looking statements contained in this document to reflect any change of expectations with regard thereto or to reflect any change in events, conditions, or circumstances on which any such forward-looking statement is based, in whole or in part.

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

NEWS CORPORATION

(REGISTRANT)

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Michael L. Bunder

|

|

|

|

|

Michael L. Bunder

|

|

|

|

|

Senior Vice President, Deputy General Counsel and Corporate Secretary

|

Dated: March 5, 2018

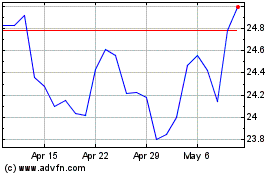

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

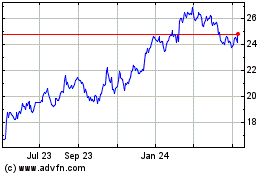

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024