U.S. Dollar Climbs As Trade Fears Reduce

March 05 2018 - 11:11PM

RTTF2

The U.S. dollar strengthened against its key counterparts in

early European deals on Tuesday, as worries about a trade war waned

after U.S. President Donald Trump appeared to soften his position

on tariff measures, amid mounting pressure from political

allies.

U.S. House of Representatives Speaker Paul Ryan urged Trump to

rethink the planned tariffs on steel and aluminum as confusion

persisted about the timing and extent of the planned tariffs.

Ryan said that he was "extremely worried about the consequences

of a global trade war and urged the White House to not advance with

this plan," according to a statement issued by his office.

Trump took to Twitter on Monday to highlight trade deficits with

Mexico and Canada.

Trump indicated that the tariffs would be removed if the U.S.

negotiates a "new & fair" NAFTA agreement.

Stocks staged a rally following Trump's statement, as investors

doubt that fears were overstated.

The currency traded mixed against its major rivals in the Asian

session. While it rose against the yen and the pound, it held

steady against the franc and the euro.

The greenback climbed to a 4-day high of 0.9419 against the

franc, from a low of 0.9386 hit at 8:30 pm ET. On the upside, 0.97

is seen as the next resistance level for the greenback.

Figures from the Federal Statistical Office showed that

Switzerland's consumer price inflation weakened to a six-month low

in February.

Inflation eased to 0.6 percent in February, as expected, from

0.7 percent in January. This was the lowest since last August, when

prices climbed 0.5 percent.

The greenback reversed from an early low of 1.2363 against the

euro, rising to 1.2328. The greenback is poised to find resistance

around the 1.22 level.

Data from IHS Markit showed that Germany's construction sector

grew at the weakest pace in 13 months in February.

The headline construction Purchasing Managers' Index fell to

52.7 in February from an 82-month high of 59.8 in January.

The greenback edged up to 1.3817 against the pound, off its

early low of 1.3863. The greenback is likely to test resistance

around the 1.35 region.

The greenback bounced off to 1.2995 against the loonie and

0.7757 against the aussie, off its early low of 1.2962 and a

multi-day low of 0.7792, respectively. If the greenback rises

further, it may find resistance around 1.31 against the loonie and

0.76 against the aussie.

On the flip side, the greenback pulled back to 105.96 against

the yen, reversing from an early 5-day high of 106.46. The

greenback is seen finding support around the 103.00 region.

The greenback dropped to a 4-day low of 0.7248 against the kiwi,

compared to 0.7226 hit late New York Monday. Next likely support

for the greenback is seen around the 0.74 level.

At 7:30 am ET, New York Fed President William Dudley speaks

about the economic impact of the 2017 hurricanes at the United

States Virgin Islands Nonprofit Leaders Breakfast Roundtable in St.

Thomas.

U.S. factory orders and durable goods orders for January, as

well as Canada Ivey PMI for February are set for release in the New

York session.

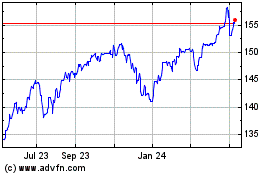

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

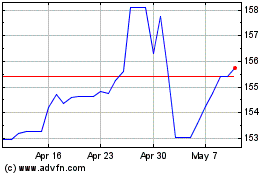

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024