Billions of Dollars Pour Into Tech Funds Powering Stock-Market Gains

March 15 2018 - 12:55PM

Dow Jones News

By Michael Wursthorn

Investors are increasing their bets on shares of technology

companies, renewing concerns that the market is becoming too

dependent on a few big stocks to power its gains.

Nearly $5 billion has poured into tech-focused stock funds so

far this year, the most of any major sector, according to Thomson

Reuters Lipper data. That figure represents nearly half of what the

group pulled in for all of 2017. In January alone, tech funds

received $3.9 billion in inflows, the most in a single month for

such funds since March 2000 -- the peak of the dot-com bubble.

Tech shares have gained 13% since major indexes fell into

correction territory on Feb. 8, compared with a 7.1% gain for the

S&P 500 index.

Some investors worry that valuations for blue-chip tech stocks

such as Amazon.com Inc., Google parent Alphabet Inc. and Netflix

Inc. could become stretched as more money pours into the sector.

Amazon, for example, trades at 162 times its forward earnings over

the next 12 months, while Netflix is changing hands at 106 times,

according to FactSet. For the S&P 500, that metric is at

17.

Tech stocks have already enjoyed a huge run-up in prices over

the last several years, and some investors may unload those shares

to protect their gains, analysts said. With the S&P 500 index

increasingly supported by the biggest tech names, any selloff in

the sector could drag down the index with it.

"Investors tend to want to be in the names with the best growth

and best visibility," said Michael Balkin, a portfolio manager with

fund company William Blair. "It's been a worry for a while."

A half dozen tech companies are responsible for more than half

of the S&P 500's gains so far this year: Microsoft Corp., Apple

Inc., Cisco Systems, Nvidia Corp., Alphabet and Adobe Systems Inc.

Including online retail giant Amazon and streaming service Netflix,

both of which are tech companies that sit among other consumer

discretionary stocks, those eight companies have contributed more

than half of the S&P 500's gains in 2018.

"It's really only a few companies in tech that lead the rally,"

said Jon Mackay, investment strategist at Schroders. "The others

haven't done so well."

Major stock indexes rapidly declined last month, jolting

investors who had grown accustomed to the market's calm, steady

rise. The Dow Jones Industrial Average and the S&P 500 tumbled

more than 10% in early February in what was the worst month in more

than two years for the major indexes.

Stocks have gyrated wildly since then, and major indexes have

managed to recoup much of their losses thanks in large part to tech

stocks. Firms tied to technology in the S&P 500 have risen more

than 10% this year, the best performers of the broad index's 11

major sectors, and largely on the back of the group's biggest

companies.

While the selloff was broad during the worst of last month's

pullback, outflows among so-called value stocks, or shares of

companies that generally generate steady profits when the economy

slows down, exacerbated the declines. Roughly $3.9 billion has been

pulled from real estate focused funds so far this year, more than

$900 million from utility funds and about $326 million from

energy-related funds, according to Lipper's data.

Some active managers are looking at stocks beaten down by the

return of volatility. "Value investing has been a little bit harder

than it has been in the past because there's more uncertainty

attached to it," said Thomas Digenan, head of U.S. Intrinsic Value

Equities at UBS Asset Management. "That's where the returns come

from."

But many investors continue favoring tech -- especially after

companies like Microsoft and Amazon reported strong earnings -- as

they try to gauge whether the historic upswing is nearing its end,

money managers say.

Investors continue embracing stocks when the Trump

administration's plan to impose tariffs on steel and aluminum is

stirring up volatility in industrial sectors. Shares of

manufacturers that use steel and aluminum have reeled, as investors

yanked hundreds of millions of dollars from those stocks, according

to Lipper.

Tech has fared better, but if the Trump administration proceeds

with additional tariffs, such as potential sanctions against China,

those stocks -- especially shares of chip makers -- will suffer,

some analysts added.

"It's buying blindly," William Blair's Mr. Balkin said of

investors snapping up tech stocks. "Once the flows reverse, [those

stocks] can drop very quickly."

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

March 15, 2018 13:40 ET (17:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

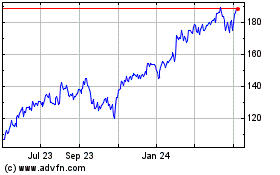

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024