Raiffeisen Bank International Sells Polish Unit's Core Banking to BNP

April 10 2018 - 1:56AM

Dow Jones News

By Max Bernhard

Raiffeisen Bank International AG (RBI.VI) has agreed to sell its

Polish subsidiary's core banking operations to BNP Paribas SA's

(BNP.FR) subsidiary, Bank BGZ BNP Paribas SA, for 775 million euros

($953 million).

The sale of Raiffeisen Bank Polska SA will have a positive

impact of about 90 basis points on its common equity tier 1 ratio,

which measures high-quality capital as a share of risk-weighted

assets.

The sale will reduce group profit for RBI by EUR120 million,

excluding potential effects of deconsolidation, it said.

Total assets of around EUR9.5 billion and total risk-weighted

assets of around EUR5.0 billion have been allocated to the core

banking operations as of the end of 2017 as part of the agreement,

RBI said.

The deal is expected to close in the fourth quarter and is

subject to regulatory approvals.

Write to Max Bernhard at Max.Bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

April 10, 2018 02:41 ET (06:41 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

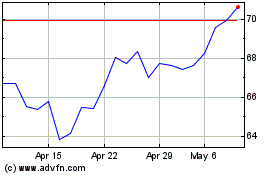

BNP Paribas (EU:BNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

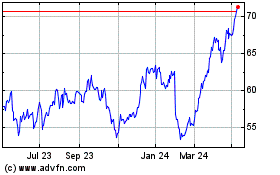

BNP Paribas (EU:BNP)

Historical Stock Chart

From Apr 2023 to Apr 2024