China Cuts Reserve Requirement Ratio

April 17 2018 - 3:42AM

RTTF2

China's central bank lowered the reserve requirement ratio for

most commercial banks on Tuesday, to free up funds for lending and

improve liquidity as the economy sustained growth momentum in the

first quarter.

In a statement, the People's Bank of China said it reduced the

ratio of cash that banks should hold as reserves, by 100 basis

points, with effect from April 25. The rate is currently at 17

percent and 15 percent.

The central bank said banks could utilize the funds released due

to the RRR cut to repay borrowing from the PBoC.

The central bank also required financial institutions to provide

loans to small and micro businesses and to lower funding costs.

In order to prevent financial risks, the bank noted that it is

necessary to maintain a relatively high reserve requirement

ratio.

The stable and neutral monetary policy will remain unchanged,

the bank added.

Data released earlier in the day showed that the economy

expanded at a steady pace of 6.8 percent in the first quarter of

2018, helped by consumer spending amid moderation in industrial

output and fixed asset investment growth.

However, the government targets slower growth of about 6.5

percent for the whole year as it intends to bring stability in the

financial system and curb corporate debt and combat pollution.

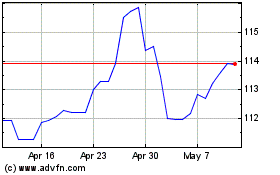

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

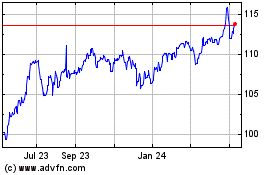

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024