BHP Says Work Underway to Fix Iron Ore Infrastructure Hiccup -- Commodity Comment

April 18 2018 - 8:48PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--BHP Billiton Ltd., the world's largest listed mining

company by market value, released its third-quarter operational

report on Thursday. BHP trimmed its fiscal-year iron-ore production

estimate because of an infrastructure-linked setback, and also cut

forecast production from its Olympic Dam copper mine. Here are some

remarks from the company's report:

On iron ore production:

"At WAIO [Western Australia Iron Ore], increased production was

supported by record production at Jimblebar and Mining Area C, and

improved rail reliability. This was partially offset by the impact

of lower opening stockpile levels following the Mt Whaleback fire

in June 2017, planned maintenance and port debottlenecking

activities in the first half of the financial year. Volumes

decreased by 6% from the December 2017 quarter reflecting impacts

from Cyclone Joyce and unplanned car dumper maintenance, despite

improved rail reliability and an increase in peak performance in

the number of rakes per day. With the system constraint now at the

port, a program of work is underway to improve car dumper

availability and performance."

On metallurgical coal output:

"At Queensland Coal, production was lower due to challenging

roof conditions at Broadmeadow and geotechnical issues triggered by

wet weather at Blackwater. This was partially offset by record

production at four mines, underpinned by improved stripping and

truck performance, higher wash-plant throughput from

debottlenecking activities and utilisation of latent dragline

capacity at Caval Ridge. Mining operations at Blackwater stabilized

in the current quarter and are expected to return to full capacity

during the June 2018 quarter as inventory levels are rebuilt."

On Olympic Dam:

"Olympic Dam copper production decreased by 18% to 95,000 tons

as a result of the planned major smelter maintenance campaign in

the first half of the financial year. Production guidance for the

2018 financial year has been reduced from 150,000 tons to

approximately 135,000 tons due to a slower than planned ramp-up

during the March 2018 quarter. A return to full capacity is now

expected over the course of the June 2018 quarter."

On petroleum operations:

"Onshore U.S. drilling and development expenditure for the nine

months ended March 2018 was US$648 million. Our operated rig count

declined from nine to seven during the March 2018 quarter. In the

Permian, we continue to see strong results from larger completions.

We expect rig count to remain unchanged through the June 2018

quarter as we focus on meeting 'hold by production' obligations and

progressing sub-surface trials. In the Eagle Ford, early trial

results from wells with longer laterals in the Hawkville have

exceeded expectations and early results in the Austin Chalk horizon

have been positive."

-Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

April 18, 2018 21:33 ET (01:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

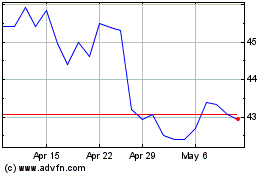

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

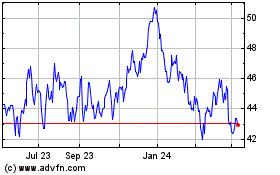

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024