Big Consumer Brands Like Raising Prices, but It Is Getting Harder -- Update

April 19 2018 - 8:03AM

Dow Jones News

By Saabira Chaudhuri and Brian Blackstone

The world's biggest brands struggled to raise prices in the

latest quarter as increasingly fierce competition kept a lid on

sales growth.

Procter & Gamble Co., the make Tide and Bounty, said

Thursday prices fell by 2% for the three months to March 31. The

company attributed the decline to its Gillette shaving brand, which

has slashed prices to fend off low-cost rivals Dollar Shave Club,

owned by rival Unilever PLC, and Harry's.

Unilever, which sells Dove soap and Ben & Jerry's ice cream,

said prices rose just 0.1% in the first quarter, while Nestlé SA

reported price growth of 0.2%. The growth rates were the weakest

for those European companies since 2010 and 2000, respectively,

according to analysts at Bernstein.

The industry has long relied on selling new or improved versions

of products at higher prices to boost growth. That's now challenged

by weak inflation, Amazon.com Inc.'s rising prowess selling more

household staples and less brand loyalty as consumers use the

internet to shop around.

All three consumer-goods giants had to rely, instead, on selling

more products to lift sales.

P&G reported a 4.3% rise in net sales to $16.28 billion,

helped by currency movements. Stripping out foreign exchange and

deal making, sales rose 1%, thanks to a volume increase of 2%. Net

profits dropped 0.4%, however, as input costs rose.

Unilever earlier Thursday reported a 3.4% rise in first quarter

underlying sales, which strip out foreign-exchange movements.

Nestlé posted 2.8% growth in organic sales, which exclude currency

fluctuations, acquisitions and divestments.

"Pricing is the big theme for this morning," Unilever's finance

chief, Graeme Pitkethly, said in an interview. "It looks like we've

gone from all price and no volume to all volume and no price."

Prices for the Anglo-Dutch maker of Hellmann's mayonnaise were

held back by a handful of big markets like India, Brazil, Indonesia

and the U.K., which together make up 25% of Unilever's sales, Mr.

Pitkethly said. He also said it was harder to charge more in the

U.S., which accounts for 15% of sales, where there was heavy

discounting.

Mr. Pitkethly said Unilever was able to raise prices in other

markets like Turkey, Mexico, the Netherlands and Eastern Europe. He

said he expects the company to strike a better balance between

volume and price growth in the second half of the year.

"We're not concerned about relatively low pricing in aggregate,"

he said on an investor call. "It's really not worth overthinking

the price growth in any given quarter."

Unilever is less exposed to the price wars hitting some of its

big U.S.-based rivals because it doesn't sell products like diapers

and toilet paper that have been fiercely hit by Amazon and the rise

of discounters Aldi and Lidl.

The company also announced a share-buyback program of up to EUR6

billion ($7.43 billion) starting next month to return cash accrued

from the sale of its spreads business. Unilever in December agreed

to sell the unit to U.S. private-equity firm KKR for EUR6.83

billion after years of declines.

It reported a 5.2% fall in first-quarter revenue to EUR12.6

billion from a year earlier.

Nestlé blamed weak price growth on lower levels of inflation in

emerging markets, saying prices declined in Brazil as well as

Western and Eastern Europe. Prices in North America were slightly

positive. The owner of Purina pet food and Nescafe coffee said

total sales for the three months to March 31 were 21.26 billion

Swiss francs ($21.97 billion), compared with 21 billion francs a

year earlier.

Like other consumer good companies, Nestlé has struggled to keep

pace with changing consumer tastes toward locally grown, organic

food while at the same time being limited in raising prices amid a

weak inflation trend globally.

On Thursday, Nestlé reported a return to growth in its biggest

market, the U.S., with the company citing "an improved performance

in pet care, particularly in the natural segment and the e-commerce

channel."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

April 19, 2018 08:48 ET (12:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

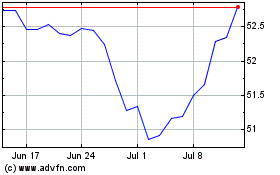

Unilever (EU:UNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

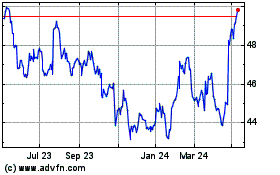

Unilever (EU:UNA)

Historical Stock Chart

From Apr 2023 to Apr 2024