Ford Takes Steps to Rein In Costs -- WSJ

April 23 2018 - 2:02AM

Dow Jones News

By Christina Rogers

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 23, 2018).

Ford Motor Co. Chief Executive Jim Hackett spent his first year

in the job hammering away on the need to cut costs, aiming to slash

$14 billion by 2020 and prodding its 200,000 employees to get more

financially "fit."

When Mr. Hackett took the post in May, he sought to jump-start

Ford's response to a rapidly changing business in which auto makers

are increasingly focusing on electric cars and autonomous vehicles.

To find the money to finance such projects, the new CEO had to look

for savings. Analysts are expecting to see more details on cost

cuts when the No. 2 U.S. auto maker reports quarterly results

Wednesday after the closing bell.

Mr. Hackett is running a company with an operating margin below

that of both General Motors Co. and the smaller Fiat Chrysler

Automobiles NV in the fourth quarter. Ford's annual 5% operating

margin trails GM's 9%, and is lower than its internal long-term

target of 8%.

First-quarter earnings highlight a shift in the Motor City. Ford

emerged from the financial crisis as the healthiest U.S. auto maker

and held that crown for several years. Today, however, Ford's

market value of $43.2 billion is closer to Fiat Chrysler's

valuation than GM's, a trend that has sharply accelerated since Mr.

Hackett took the helm.

Mr. Hackett needs to address Ford's spending habits. In the

critical area of engineering, research and development, Ford's $8

billion budget last year outpaced GM's by nearly 10%, even though

GM sells far more cars globally and has more advanced electric

cars. In addition, Ford also dished out more to cover warranties

and materials. And Ford's overall head count increased in 2017.

"They are burning a lot of cash in a lot of places," said Rod

Lache, an auto analyst with Deutsche Bank Securities. Ford's

automotive operating cash flow slipped 40% last year, and the

company's annual profits are projected by Wall Street analysts to

drop 12% in 2018, even though first-quarter earnings are expected

to increase.

Mr. Lache, who expects Mr. Hackett to elaborate on his

restructuring plan during the earnings call this week, said GM and

Fiat Chrysler have been far more decisive in exiting money-losing

parts of the business, such as unprofitable car lines or geographic

markets that return little or no profit.

"Ford really never went through this," Mr. Lache said. "That's

ultimately come home to roost."

Sinking more money into engineering cars with pricier materials,

engines and features has helped Ford better meet fuel-economy

targets and boost transaction prices of profitable trucks. But the

Lincoln lineup and certain passenger-car lines can require steep

discounts that erode or erase margins.

Mr. Lache estimates 60% of the volume delivered in the U.S. was

sold at a price below the industry average.

"The entire company is intensely focused on improving the

operational fitness of the business to deliver profitable growth

with improved returns, while building toward our vision of the

future," Ford said in a statement.

Mr. Hackett plans to shift about $7 billion in spending away

from small cars and sedans and move it toward development of more

profitable trucks and sport-utility vehicles. He also is increasing

investment in electric, autonomous and internet-connected cars.

If he succeeds, Mr. Hackett could polish Ford's image and

brighten the investment case. The road ahead, however, will be

bumpy.

Ford's own outlook for 2018 calls for a third consecutive year

of earnings decline. Operations in South America and India are

losing money, and sales in China slid 19% in the first quarter, a

decline that could further pressure earnings.

"There won't be much to get excited about with the Ford story

until 2019, or perhaps 2020," Brian Johnson, a Barclays analyst,

wrote in a recent research note.

Write to Christina Rogers at christina.rogers@wsj.com

(END) Dow Jones Newswires

April 23, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

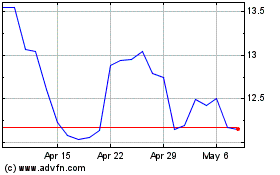

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

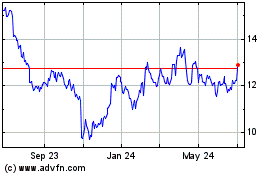

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024