Emphasis on designs and game machines helps bolster revenue at

hardware maker

By Jay Greene

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 22, 2018).

Shortly after Dion Weisler took over Hewlett-Packard Co.'s

computer business in 2013, he assembled his charges to survey

nearly 40 of its PCs, a hodgepodge of styles, sizes and colors

splayed out in a conference room. He wanted the employees to feel

embarrassed.

"There was nothing quite as telling as having the whole

portfolio on a great big table and forcing our team to look at it,"

said Mr. Weisler in a recent interview. He became chief executive

of HP Inc., the personal-computer and printer business that emerged

from the carving of Hewlett-Packard into two pieces in 2015.

By focusing on sleeker designs and high-performance game

machines, HP managed to boost revenue and gobble market share from

smaller competitors even as the PC market shrank. The bet has paid

off so far, sending HP's stock up 77% since the company's

split.

With the stagnant PC market largely condensed into a handful of

giants, the questions for HP are how long it can make the formula

last and what comes next.

HP is set to report fiscal second-quarter results on May 29.

Analysts surveyed by S&P Global Market Intelligence expect

revenue rose 10% to $13.58 billion, with adjusted per-share

earnings up 20% at 48 cents.

When Hewlett-Packard split in 2015, pundits figured HP Inc.

would be the runt of the litter, while its sibling Hewlett Packard

Enterprise Co. was freed to focus on more attractive markets such

as selling corporate technology services. In the U.S., only Apple

Inc. thrived selling hardware and it did so innovating with

smartphones.

Mr. Weisler was stuck in shrinking markets with a musty hardware

brand at the same time much of tech's growth was generated by

internet companies selling services, such as Facebook Inc. and

Alphabet Inc.'s Google. Today, even Apple emphasizes the growth of

its services businesses.

Unio Capital LLC, which holds $5.2 million in HP stock, or about

4.5% of its portfolio, believes there is still vitality in the PC

business as employers value gains in worker productivity, said John

Allison, the New York asset-management firm's CEO. "We think this

is a company that is reinventing itself, so the growth is going to

come," he said.

Even though the number of PCs shipped annually world-wide has

dropped 9.1% since Hewlett-Packard's split, HP's annual PC

shipments have climbed 5%, according to market-research firm

Gartner Inc. Last year, HP leapfrogged Lenovo Group Ltd. to become

the top PC seller in the world with 21% share of the global market,

up from 18.2% in 2015.

In that time, HP's annual revenue from its PC business has

increased 6% and its operating profit has climbed 9%, helping to

buffer an 11% drop in revenue and an 18% tumble in operating profit

at its printing business.

A reckoning could still be in store. When Mr. Weisler took over

the PC business, the top five PC makers held 59% of the global

market, according to Toni Sacconaghi, an analyst at Sanford C.

Bernstein. By last year, it was 71%. HP's top PC rivals -- Lenovo,

Dell Technologies Inc., Asustek Computer Inc. and Acer Inc. -- have

all expanded their market share as well. Mr. Sacconaghi said he

expects the major PC makers to seize about 85% of the market share

"over time."

HP's market-share gains will be difficult to sustain, said

Mikako Kitagawa, an analyst at Gartner, which expects PC shipments

to be flat in 2018 and decline about 6% by 2021. The company's

"real success will be measured in 2018," when results are compared

with the prior year's strong growth, she said.

Mr. Weisler acknowledged consolidation will continue, but he

expects HP to take share from bigger rivals.

To do so, HP started using premium materials to make its PCs

more appealing and introduced technologies such as one that dims a

laptop screen's visible light when viewed from an angle, so nosy

neighbors can't snoop.

Much of HP's success comes from making PCs "sexy" again,

including laptops that convert to tablet computers, said Scott

DeTota, a vice president at CDW Corp., which sells tech products to

businesses. At CDW, HP surpassed Lenovo in PC sales last year as

well.

"It's no longer your traditional stale-looking laptop," Mr.

DeTota says.

Mr. Weisler said he has focused HP less on "empty-calorie"

entry-level PCs and toward higher-margin businesses such as game

machines, a market HP had abandoned years ago where buyers pay

premiums for powerful rigs. HP launched a new brand, Omen, in 2016.

An Omen PC with the priciest components can cost more than

$6,000.

Game PCs are a $1 billion-a-year business for HP, Mr. Weisler

said. That is still a relatively small piece of HP's overall PC

business, which totaled $33.37 billion in its latest fiscal year.

But to Mr. Weisler, it represents the kinds of moves HP needs to

make in a contracting market.

HP also has profit from printing, its other legacy business, as

a financial cushion. In the latest fiscal year, the printing

business posted $18.8 billion in revenue, about 56% the size of

HP's PC business. Operating profit of $3.2 billion was nearly

triple that of the PC segment.

Still, "it's another challenged market," Mr. Sacconaghi said.

"It's really unclear that people are going to print more going

forward."

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

May 22, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

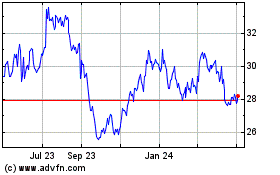

HP (NYSE:HPQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

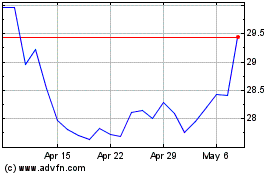

HP (NYSE:HPQ)

Historical Stock Chart

From Apr 2023 to Apr 2024