JPMorgan, Citi Lobby GOP Lawmakers to Relax Swap Rules

May 23 2018 - 2:01PM

Dow Jones News

By Gabriel T. Rubin

WASHINGTON -- On the heels of a legislative victory this week

for small and midsize banks, bigger banks including JPMorgan Chase

& Co. and Citigroup Inc. are lobbying congressional Republicans

in an effort to ensure a victory of their own.

Large banks are pushing Congress to redefine swap transactions

made between different affiliates of the same company so that they

aren't subject to certain rules stemming from the 2010 Dodd-Frank

Act. The move would prevent regulators from forcing banks to post

collateral for those transactions, potentially saving banks

hundreds of millions of dollars in compliance costs.

Legislation that would legally change the definitions of those

transactions -- exempting them from Dodd-Frank collateral rules --

has passed the House, but has died in the Senate due to Democratic

opposition.

Now, House Republicans have taken a harder-line approach to push

the legislation through. In recent budget negotiations, they linked

the exemption to increased funding for the Commodity Futures

Trading Commission, the primary swaps regulator that hasn't seen a

funding increase since 2014. When some Senate Democrats objected to

the exemption, it was stripped from the budget. The CFTC ended up

having its funding cut by $1 million.

"My colleagues in the minority and particularly over in the

Senate have refused to discuss any reasonable bipartisan offers for

long-overdue policy changes unless they increase funding," said

Rep. Robert Aderholt (R., Ala.), a senior member of the House

Appropriations Committee, at a committee hearing last week.

Swaps, contracts in which two parties agree to exchange payments

based on fluctuations in interest rates or other benchmarks, were

targeted by U.S. lawmakers for greater oversight and transparency

after they played a central role in the 2008 financial crisis.

Companies use the multitrillion-dollar swaps market to hedge risks

or make bets in areas such as fuel prices or interest rates.

Last week's appropriations hearing was unusual for its frank

discussion of policy riders, the sort of sausage-making that tends

to remain behind closed doors.

"The will of the House and of this committee cannot be ignored,"

said Rep. Steve Womack (R., Ark.), a sponsor of legislation similar

to the swaps rider.

Republicans are sticking to the strategy of linking a

significant bump in the CFTC's budget to the swaps-rule exemption,

despite complaints from Trump-appointed regulators at the CFTC, who

have warned of an extended hiring freeze and possible buyouts.

JPMorgan and Citigroup have lobbied extensively on legislation

that would change the swaps definition, according to congressional

aides and lobbying disclosures, though congressional aides say it

was House Republicans who decided to pair the issue with a CFTC

budget increase to put pressure on Senate Democrats.

Representatives for JPMorgan and Citigroup declined to

comment.

The potential deal bears a striking similarity to the "swaps

pushout" deal, a policy rider attached to a 2014 spending bill that

repealed part of Dodd-Frank's swaps rules. The measure was also

linked to the CFTC's budget, and the regulator got its most recent

funding boost at that time. That rider attracted surprising popular

opposition led by Sen. Elizabeth Warren but also celebrities

including Cher, who warned in colorful language that it could lead

to another financial crisis. The deal ultimately passed, though

some liberal Democrats, including Ms. Warren, voted against it.

Regulators have been playing whack-a-mole with firms on the

issue for several years, closing loopholes that allowed banks to

transfer risk to subsidiaries that, because of location or the

nature of their business, faced less stringent regulatory

requirements.

Supporters of the legislation contend that interaffiliate swaps

don't pose the same risks as swaps between unrelated companies, and

therefore shouldn't be subject to the same rules. Major trade

groups like the U.S. Chamber of Commerce have made the case to

Congress that the primary beneficiary of such a rule change would

be derivatives end-users, like energy companies and farmers.

Write to Gabriel T. Rubin at gabriel.rubin@wsj.com

(END) Dow Jones Newswires

May 23, 2018 14:46 ET (18:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

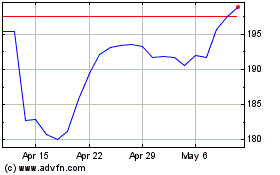

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

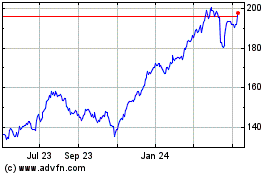

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024