Pharnext Announces €20.5 Million Bond Loan

June 13 2018 - 11:05AM

Business Wire

- Supports research and development

through the end of 2019

- Pharnext has raised over €36.5

million since April 2018

Regulatory News:

Pharnext SA (Paris:ALPHA) (FR0011191287 - ALPHA),

a biopharmaceutical company pioneering a new approach to the

development of innovative drug combinations based on big data

genomics and artificial intelligence, today announced a financing

of up to €20 million through a bond loan with IPF Partners, one of

the top providers of alternative financings in the healthcare

sector.

“This financing with IPF Partners, in combination with the

private placement announced earlier this year, strengthens our

financial position and enables us to continue advancing the

clinical development and commercial preparation for our innovative

drug combinations,” said Prof. Daniel Cohen, M.D., Ph.D.,

Co-Founder and Chief Executive Officer of Pharnext. “We are

grateful for the continued support from our shareholders and

financial partners, and we look forward to reporting top-line

results from our Phase 3 trial of PXT3003 in Charcot-Marie-Tooth

disease type 1A later this year.”

The financing consists of three tranches of bonds with an annual

interest rate of EURIBOR+11%. The first tranche of €11.5 million

will be issued on June 30, 2018 at the latest, the second tranche

of €3.5 million will be issued on July 30, 2018 at the latest and

the third tranche of €5 million could be issued at Pharnext’s will

and following top-line results from Pharnext’s ongoing pivotal

Phase 3 trial of PXT3003, its lead drug candidate for the treatment

of Charcot-Marie-Tooth disease type 1A (CMT1A), expected in the

second half of 2018.

Additionaly, a line of convertible bonds will be also issued

with Yorkville Advidors for up to €0.5 million in convertible

securities, with a maturity date of one year following their date

of issue.

The transaction closed today concludes a series of successive

financings for Pharnext which began in April 2018, for total

proceeds of €36.5 million.

CHARACTERISTICS OF THE PRIVATE PLACEMENT

IPF Partners. The bonds have been issued in accordance

with the approval of the Board of Directors implemented according

to the Eighth Resolution of the Shareholders’ Meeting of June 28,

2017 (the “Shareholders’ Meeting”), without pre-emptive

subscription rights, to the company IPF Fund I SCA, SICAV FIS et

IPF Fund II SCA.

A total of 20,000,000 bonds could be issued via private

placement, with a price of each equal to €1, and each comprising an

ordinary warrant (“Warrant”). Warrants entitle to subscribe a total

of 574.372 ordinary shares for the two firsts tranches and 53.968

ordinary shares for the third tranche. Such total of new shares

will be entirely assimilated into existing Pharnext shares with an

exercise price equal to the volume-weighted average price of an

ordinary share of Pharnext on Euronext Paris for the last three

days prior to the date of issuance of each tranche minus a five (5)

percent discount and will represent approximately 4.81% of the

number of outstanding shares in the event of their exercise by IPF.

The Warrants may be exercised until July 31, 2026.

YorkVille. Convertible Bonds (“CB”) has been

issued in accordance with the approval of the Board of Directors

implemented according to the Eighth Resolution of the Shareholders’

Meeting, without pre-emptive subscription rights, to YA II PN, LTD,

an investment funds managed by a portfolio management company

Yorkville Advisors Global, LP. A total of 50 CB will be issued,

each with a par value of €10,000, representing a total aggregate

nominal amount of €500,000 and will be subscribed at 98% of par.

The convertible bonds have a maturity of 12 months from their date

of issue. The CB holder may convert all or any of the CB into a

number of ordinary shares equal to the corresponding aggregate

principal amount divided by 92% of the lowest daily volume weighted

average price over the 10 trading days prior to each conversion

date. The CB will not be listed or admitted for trading on the

Euronext Growth Paris market. Trading Days during which the CB

holder has sold any share of Pharnext in the market will be

excluded from the 10 trading days preceding the Conversion

Date.

Pursuant to Article 211-3 of the AMF (Autorité des Marchés

Financiers) General Regulations, it should be noted that neither of

the above-mentioned issues has resulted or will result in the

drafting of a prospectus submitted to the AMF for approval.

About PharnextPharnext is an advanced clinical-stage

biopharmaceutical company developing novel therapeutics for orphan

and common neurodegenerative diseases that currently lack curative

and/or disease-modifying treatments. Pharnext has two lead products

in clinical development. PXT3003 is currently in an international

Phase 3 trial for the treatment of Charcot-Marie-Tooth disease type

1A and benefits from orphan drug status in Europe and the United

States. The results of this trial are expected in the second half

of 2018. PXT864 has generated positive Phase 2 results in

Alzheimer’s disease. Pharnext has developed a new drug discovery

paradigm based on big genomic data and artificial intelligence:

PLEOTHERAPY™. The Company identifies and develops synergic

combinations of drugs called PLEODRUG™ offering several key

advantages: efficacy, safety and robust intellectual property. The

Company was founded by renowned scientists and entrepreneurs

including Professor Daniel Cohen, a pioneer in modern genomics and

is supported by a world-class scientific team.

Pharnext is listed on Euronext Growth Stock Exchange in Paris

(ISIN code: FR0011191287).For more information, visit

http://www.pharnext.com/

IPF PartnersIPF Partners is a leading alternative

financing provider focused on the healthcare sector with over €200m

under management. IPF invests directly in emerging pharma/biotech,

medtech and diagnostics companies. Founded in 2011 by a seasoned

multi-disciplinary team combining over fifty years of finance and

investment and over thirty years of healthcare experience, IPF is

providing bespoke, long-term financing.

For more information visit www.ipfpartners.com.

DisclaimerThis press release has been issued to fulfil

Pharnext's permanent reporting obligations. It does not constitute

a public offering, subscription offering or a solicitation in view

of a public offering.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180613005878/en/

PharnextFrançois Chamoun, +33 (0)1 41 09 22 30Legal

Officercontact@pharnext.comorFinancial Communication

(France)ActifinStéphane Ruiz, +33 (0)1 56 88 11

15sruiz@actifin.frorInvestor Relations (U.S.)Stern Investor

Relations, Inc.Matthew Shinseki, +1 212 362

1200matthew@sternir.comorInvestor Relations (Europe)MC

Services AGAnne Hennecke, +49 211 529252

22anne.hennecke@mc-services.euorMedia Relations

(Europe)Ulysse CommunicationBruno Arabian, +33 (0)1 81 70 96

30barabian@ulysse-communication.comorMedia

Relations (U.S.)RooneyPartnersKate L. Barrette, +1 212 223

0561kbarrette@rooneyco.com

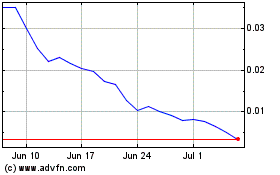

Pharnext (EU:ALPHA)

Historical Stock Chart

From Mar 2024 to Apr 2024

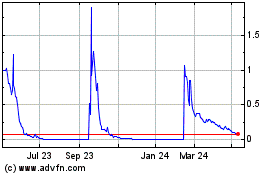

Pharnext (EU:ALPHA)

Historical Stock Chart

From Apr 2023 to Apr 2024