Canadian Dollar Drops On Falling Oil Prices

June 15 2018 - 3:26AM

RTTF2

The Canadian dollar slipped against its major counterparts in

the European session on Friday, as oil prices declined on U.S-China

trade war fears, as U.S. President Donald Trump is set to unveil

tariffs on $50 billion in China goods later in the day.

Crude for July delivery fell $0.23 to $66.66 per barrel.

The Trump administration will release details of a revised list

of 800 product categories today.

Beijing vowed that it will retaliate "appropriately" to any

measures imposed by the US.

Investors await a key meeting of the Organization of the

Petroleum Exporting Countries in Vienna on June 22, when the cartel

is expected to make a decision on increasing output.

Following a meeting with the Saudi Arabia energy minister on

Thursday, Russian Energy Minister Alexander Novak remarked that

both nations support a gradual increase in output, although

specifics will be discussed next week.

The currency dropped against its major rivals in the Asian

session, with the exception of the aussie.

The loonie declined to a weekly low of 84.01 against the yen,

from a high of 84.47 seen at 5:45 pm ET. The next likely support

for the loonie is seen around the 82.00 level.

The Bank of Japan kept its monetary stimulus unchanged as widely

expected.

Governor Haruhiko Kuroda and his board members decided by an 8-1

majority vote to hold its target of raising the amount of

outstanding JGB holdings at an annual pace of about JPY 80

trillion.

The loonie weakened to 1.3160 against the greenback, its weakest

since June 2017. The loonie is seen finding support around the 1.34

region.

The loonie slipped to 1.5257 against the euro and 0.9822 against

the aussie, reversing from its early high of 1.5151 and a 2-week

high of 0.9782, respectively. The next possible support for the

loonie is seen around 1.54 against the euro and 1.00 against the

aussie.

Looking ahead, Canada existing home sales for May and

manufacturing sales for April, New York Fed's empire manufacturing

survey for June, U.S. industrial production for May and University

of Michigan's preliminary consumer sentiment index for June are

scheduled for release in the New York session.

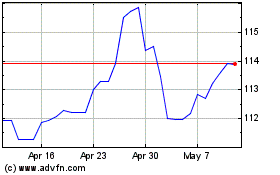

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

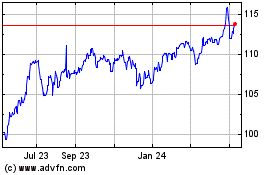

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024