Loonie Slides As Canada Inflation Holds Steady, Retail Sales Drop Unexpectedly

June 22 2018 - 4:56AM

RTTF2

The Canadian dollar weakened against its major counterparts in

the European session on Friday, as Canadian retail sales fell

unexpectedly in April and inflation steadied in May, paring hopes

for a Bank of Canada rate hike this year.

Data from Statistics Canada showed that consumer prices edged up

0.1 percent on a seasonally adjusted monthly basis in May, the same

rate as seen in the previous month.

The rate was expected to rise to 0.4 percent.

Core inflation slipped 0.1 percent on month, after a flat

reading seen in the previous month.

Separate data showed that retail sales declined in April,

primarily due to lower sales at motor vehicle and parts

dealers.

The retail sales fell 1.2 percent on month in April, following a

revised 0.8 percent growth in the previous month.

Economists had expected sales to be flat.

Core retail sales fell 0.1 percent following a revised flat

reading last month.

Core retail sales have been expected to climb by 0.5

percent.

The currency showed mixed trading against its major counterparts

in the Asian session. While the loonie rose against the greenback

and the yen, it fell against the euro and the aussie.

The loonie declined to 0.9933 against the aussie, its lowest

since June 6. The next likely support for the loonie is seen around

the 1.01 level.

Having advanced to 1.5434 against the euro at 9:45 pm ET, the

loonie reversed direction and fell to near a 2-month low of 1.5584.

On the downside, 1.57 is possibly seen as the next support level

for the loonie.

Flash data from IHS Markit showed that the euro area private

sector expanded at a faster pace in June.

The composite output index rose unexpectedly to 54.8 in June

from 54.1 in May. The score was forecast to fall to 53.9.

Pulling away from an early high of 83.04 against the yen, the

loonie weakened to a 2-1/2-month low of 82.26. The loonie is seen

finding support around the 80.5 region.

The loonie reversed from an early 3-day high of 1.3263 against

the greenback, falling to a 1-year low of 1.3382. Next key support

for the loonie is likely seen around the 1.35 level.

Data from the Ministry of Internal Affairs and Communications

showed that Japan consumer prices rose 0.7 percent on year in

May.

That exceeded estimates for an increase of 0.6 percent, which

would have been unchanged from the April reading.

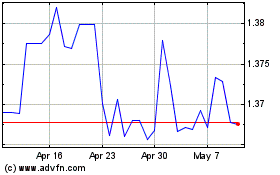

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024