Broadcom Nears Deal to Buy CA Technologies for About $18 Billion -- Update

July 11 2018 - 5:12PM

Dow Jones News

By Dana Cimilluca and Dana Mattioli

Broadcom Inc. is nearing a deal to buy software company CA

Technologies for more than $18 billion, according to people

familiar with the matter, a surprise move that would take the

chip-making giant in a new direction.

Broadcom is to pay $44.50 a share for CA, formerly known as

Computer Associates, the people said. Assuming it doesn't fall

apart at the last minute, the deal could be announced later

Wednesday. CA shares closed at $37.21 Wednesday, meaning Broadcom

would pay about a 20% premium.

The takeover would be a major strategic move for Broadcom,

coming just months after its $117 billion-plus hostile bid for

Qualcomm Inc. was blocked by President Donald Trump.

The impending deal took some industry watchers by surprise,

given that it represents expansion into a whole new area for

Broadcom, which has become a semiconductor powerhouse largely

through acquisitions. CA, based in New York, produces software used

in corporate IT infrastructure like mainframe computers.

Broadcom shares, which were down 2.8% in regular trading, fell

another 5.2% after hours after The Wall Street Journal reported on

the deal. The company's market value stood at $108 billion at the

close of trading. Shares of CA, which have risen steadily in recent

years, jumped 16% to $43.10 after hours.

Broadcom walked away from its pursuit of Qualcomm in March after

the U.S. panel that vets foreign deals said that the bid could have

implications for the U.S.'s broader technological competition with

China. That panel, the Committee on Foreign Investment in the U.S.,

or CFIUS, said it was worried that Broadcom would stymie research

and development at Qualcomm given its reputation as a cost-cutting

behemoth. CFIUS said such a move could weaken Qualcomm -- and

thereby the U.S. -- against foreign rivals racing to develop

next-generation wireless technology known as 5G, such as China's

Huawei Technologies Co.

Broadcom, which launched its hostile bid for Qualcomm in

November in what would have been the technology industry's

biggest-ever deal, was working to redomicile in the U.S. from

Singapore to evade the panel's review. But the presidential order

effectively ended its hopes of clinching the deal.

Broadcom completed the move the next month and is now based in

San Jose, Calif.

Qualcomm had resisted Broadcom's advances, arguing among other

things that the company wasn't offering enough. CFIUS's decision to

review Broadcom's proposed bid came just days before Qualcomm

shareholders were set to vote on whether to replace six of the

company's 11 directors with nominees put forward by Broadcom, a

result that could have helped Broadcom achieve the takeover.

Broadcom was known as Avago Technologies Ltd. before Avago

bought Broadcom in 2016 for roughly $37 billion in cash and stock.

Avago went public in 2009 after incorporating in Singapore, which

is known for having a low corporate tax rate.

(END) Dow Jones Newswires

July 11, 2018 17:57 ET (21:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

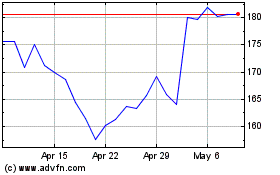

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

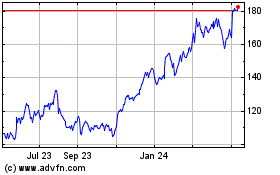

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024