Canadian Dollar Slides Amid Risk Aversion

August 15 2018 - 2:37AM

RTTF2

The Canadian dollar declined against its major counterparts in

the European session on Wednesday amid risk aversion, as investors

fretted over contagion effects from financial crisis in Turkey.

Turkey raised tariffs on imports of certain American products,

widening its rift with the United States.

Turkey's new tariffs are targeted on imports of products,

including rice, tobacco products, vehicles, alcohol, coal and

cosmetics.

Oil prices declined following an industry data showing a build

in U.S. crude inventories last week.

Crude for September delivery fell $0.85 to $66.19 per

barrel.

Data from the American Petroleum Institute showed that U.S.

crude inventories rose by 3.7 million barrels to 410.8 million

barrels in the week ended August 10. Economists were expecting a

fall of 2.5 million barrels.

The Energy Information Administration will release its official

inventory data later in the day.

The loonie traded mixed against its major rivals in the Asian

session. While it rose against the aussie and the yen, it fell

against the greenback. Against the euro, it held steady.

The loonie weakened to 0.9463 against the aussie, from more than

a 2-year high of 0.9418 hit at 11:20 pm ET. The loonie is likely to

challenge support around the 0.96 level.

Data from the Australian Bureau of Statistics showed that

Australia's wage prices rose a seasonally adjusted 0.6 percent on

quarter in the second three months of 2018.

That was in line with expectations and up from 0.5 percent in

the three months prior.

The loonie dropped to 84.77 against the yen and 1.3109 against

the greenback, reversing from its early 6-day high of 85.32 and a

5-day high of 1.3050, respectively. If the loonie falls further,

83.00 and 1.33 are likely seen as its next support levels against

the yen and the greenback, respectively.

Pulling away from a 9-month high of 1.4799 touched at 11:40 pm

ET, the loonie reversed direction and dropped to 1.4833 against the

euro. On the downside, 1.33 is possibly seen as the next support

level for the loonie.

Looking ahead, U.S. business inventories for June, NAHB housing

market index and New York Fed's empire manufacturing survey for

August, retail sales and industrial production for July, as well as

Canada existing home sales for the same month are due in the New

York session.

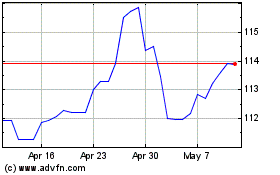

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

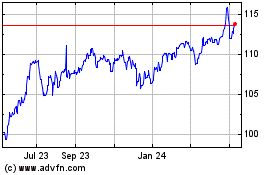

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024