Constellation Brands Expands Investment in Cannabis Company Canopy Growth --3rd Update

August 15 2018 - 9:34AM

Dow Jones News

By Jennifer Maloney and Saabira Chaudhuri

Corona brewer Constellation Brands Inc. is investing $4 billion

into Canadian marijuana grower Canopy Growth Corp., one of the

biggest corporate wagers on the potential global market for

cannabis-infused drinks and other products.

Constellation, which also produces Robert Mondavi wines and

Svedka vodka, has benefited from strong U.S. sales of its Mexican

beer imports, Corona and Modelo. But overall beer consumption in

the U.S. is in decline, as consumers abandon American lagers for

wine, spirits and nonalcoholic beverages.

Over the past year, three big beer companies -- Constellation,

Heineken NV and Molson Coors Brewing Corp. -- have announced

development plans for cannabis-infused beverages in Canada or the

U.S. Heineken's Lagunitas brand launched a cannabis-laced,

hop-flavored sparkling water in California in July.

Constellation's new deal follows an initial investment last

year, when it took a roughly 10% stake in Canopy and said it would

develop nonalcoholic, cannabis-infused beverages for Canada and

other legal markets. The new partnership will include "a full suite

of products," Constellation CEO Rob Sands said Wednesday on a

conference call with analysts, but the company won't introduce

those products in the U.S. until allowed by federal law.

Recreational marijuana use in Canada will be legal in

mid-October, and edible and drinkable cannabis products are

expected to be legalized there by 2019. Independent research firm

Euromonitor International estimates that legal marijuana sales in

2018 will total US$7.5 billion in Canada and $10.2 billion in the

U.S., where it is allowed for recreational use in nine states and

Washington, D.C.

This is "potentially one of the most significant global growth

opportunities of this decade,"Mr. Sands said. Canopy, based in

Smiths Falls, Ontario, will use the capital to build or acquire

assets, he said, noting that about 30 countries are considering

legalizing medical marijuana.

Canopy, which was started in 2013, sells medical marijuana

products--including dried flower, oils and capsules -- in Canada,

Germany and the Czech Republic. It is set to launch recreational

products in Canada in October. Canopy recently agreed to buy

another Canadian company that has licenses to open retail stores in

parts of Canada.

Research on cannabis's impact on alcohol consumption so far has

yielded conflicting results. A handful of big alcohol makers have

begun investing anyway, on the grounds that cannabis is likely to

be a growth engine at a time when alcohol consumption across the

developed world is falling, partly due to health concerns.

Big American brewers in particular are under pressure as

millennials cut back on drinking and when they do drink,

increasingly opt for wine and spirits. U.S. drinkers chose beer

just 49.7% of the time last year, down from 60.8% in the mid-'90s,

according to trade body the Beer Institute.

Gavin Hattersley, chief executive of Molson's U.S. business

MillerCoors, in May described cannabis as one of a number of "micro

cuts," which were hurting beer, already suffering from the shift to

wine and spirits. Molson Coors earlier this month said it is

forming a joint venture with another Canadian cannabis producer to

make nonalcoholic, cannabis-infused beverages for the Canadian

market.

In the four states in which marijuana has been legal for

recreational use for over three years, research firm Bernstein

found that average beer consumption relative to the rest of the

U.S. had climbed 0.9% after legalization.

By contrast Cowen analyst Vivien Azer says her analysis of data

since 2009 shows a consistent decline in U.S. per-capita alcohol

consumption and an increase in reported cannabis incidence. A Cowen

survey of consumers in North America found over 30% of cannabis

consumers report "drinking a lot less."

Constellation said Wednesday it will spend 5.08 billion Canadian

dollars ($3.88 billion) to increase its ownership stake in Canopy

to 38%. The Victor, N.Y.-based company plans to buy 104.6 million

shares of Canopy at C$48.60 each, a 51% premium from its Tuesday

closing price in Toronto trading.

In the deal Constellation will also receive warrants in Canopy

that, if exercised over the next three years, would give it a more

than 50% stake in the company. Constellation will also nominate

four directors to Canopy's seven-member board.

Constellation, conscious of its investment-grade credit rating,

said it won't engage in mergers, acquisitions or share buybacks for

at least 18 months after the deal closes, giving it time to reduce

its debt load.

Canopy shares are listed in both Toronto and New York.

Write to Jennifer Maloney at jennifer.maloney@wsj.com and

Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

August 15, 2018 10:19 ET (14:19 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

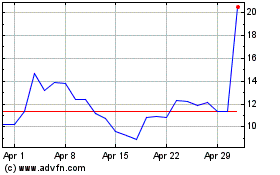

Canopy Growth (TSX:WEED)

Historical Stock Chart

From Mar 2024 to Apr 2024

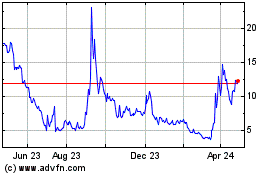

Canopy Growth (TSX:WEED)

Historical Stock Chart

From Apr 2023 to Apr 2024