BHP Billiton Net Profit Hit by Charges; Earnings, Dividend Jump

August 20 2018 - 6:13PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--BHP Billiton Ltd. (BHP.AU) said fiscal-year net profit

fell 37% because of one-time charges, but the world's biggest miner

by market value recorded a 33% rise in underlying profit and a

record final dividend, aided by higher prices and production for

most of its commodities.

BHP on Tuesday reported a net profit of US$3.71 billion for the

year through June, down from US$5.89 billion in the 12 months

prior. Weighing on the company's bottom line were US$5.2 billion in

impairment charges, mainly tied to the company's U.S. onshore

oil-and-gas assets, which it has struck deals to sell.

The miner recorded an underlying profit, stripping out one-time

charges, of US$9.62 billion. That was ahead of a US$8.80-billion

median of nine analyst forecasts.

Directors declared a final dividend of 63 U.S. cents a share,

taking BHP's full-year payout to US$1.18 a share, up from 83 cents

a piece the year prior.

"Across our dramatically simplified portfolio of tier one

assets, we see this year's strong momentum carried into the medium

term as our leadership, technology and culture drive further

increases in productivity, value and returns," said Chief Executive

Andrew Mackenzie.

BHP has been enjoying tail winds from stronger commodity prices.

Average prices for its oil, copper and steelmaking coal were up

26%, 23% and 9%, respectively. Iron ore prices were slightly weaker

during the 12-month period, down 3%.

The company has also been producing more. Full-year output of

copper jumped 32%, while production of iron ore was 3% higher and

steelmaking coal was up 7%. Its petroleum division was the outlier,

with an 8% fall in output.

BHP isn't alone in lifting returns to investors. Rio Tinto PLC

(RIO.LN) earlier this month pledged US$7.2 billion in shareholder

returns, including a record interim dividend.

In July, BHP said BP PLC (BP) would buy the bulk of its U.S.

onshore oil-and-gas unit for US$10.5 billion, while it also penned

a separate US$300 million agreement to sell its Fayetteville shale

business in Arkansas to closely held Merit Energy Co.

The company at the time said it would also use that cash for

dividends or share buy backs once the deals were completed in

October. On Tuesday, it reiterated it would confirm how and when

that cash will be used once the sales are completed.

BHP joined the chorus of miners cautioning on cost inflation, as

the industry faces pressure from rising bills for energy and other

necessities.

It also lowered its projection for productivity gains, saying it

now expects savings of US$1 billion in the 2019 fiscal year from a

prior forecast of US$2 billion in the two years through June, 2019.

BHP said the guidance was lowered because of asset sales and

challenging operating conditions at some Australian coal mines.

The company said threats to global economic growth have

increased due to rising trade protectionism.

"Near-term prospects for the U.S. economy are sound, with

cyclical fundamentals solid," BHP said. "However, we expect the

increase in protectionism to weigh on consumer purchasing power and

international competitiveness."

The miner also forecast China's growth to slow modestly in 2018.

Commodity producers face challenges from an easing economy in

China, the top buyer of a lot of natural resources, where spending

on so-called fixed assets such as factory machinery has fallen to

its lowest in nearly two decades.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

August 20, 2018 18:58 ET (22:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

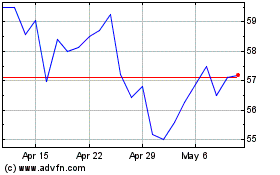

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

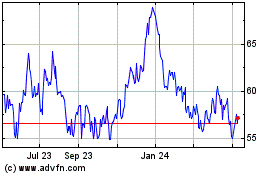

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024