Canadian Dollar Weakens As NAFTA Talks Turn Sour

August 31 2018 - 6:17AM

RTTF2

The Canadian dollar slipped against its major counterparts in

New York deals on Friday, as talks between the US and Canada over

NAFTA failed to meet the Friday deadline set by U.S. President

Donald Trump.

Both the nations were at loggerheads regarding Chapter 19, which

would allow Canada to dispute punitive American tariffs on imports

before binational panels.

Talks between the U.S. and Canadian negotiators reached a

crucial phase this week, after the US and Mexico announced a

bilateral deal on Monday.

Sentiment soured after a report from Bloomberg said President

Donald Trump intends to move ahead with plans to impose tariffs on

$200 billion in Chinese imports as early as next week.

Citing people familiar with the matter, Bloomberg said Trump

intends to impose the tariffs after a public comment period ends

next Thursday, September 6th.

Bloomberg noted some of the people cautioned that Trump hasn't

made his final decision and may enact the tariffs in

installments.

The loonie dropped to 84.72 against the yen, its lowest since

August 22. If the loonie continues its fall, 83.00 is possibly seen

as its next support level.

Data from the Ministry of Internal Affairs and Communications

showed that overall consumer prices in the Tokyo region climbed 1.2

percent on year in August.

That beat forecasts for 1.0 percent and was up from 0.9 percent

in July. The loonie weakened to a weekly low of 1.3072 against the

greenback from yesterday's closing value of 1.2980. The loonie is

seen challenging support around the 1.32 area.

The loonie retreated to 0.9433 against the aussie, from an early

more than a 2-year high of 0.9396. On the downside, 0.97 is likely

seen as the next support level for the loonie.

Data from the Reserve Bank of Australia showed that Australia's

private sector credit increased more than expected in July.

Private sector credit climbed a seasonally adjusted 0.4 percent

month-over-month in July, following a 0.3 percent rise in June.

Economists had expected the same 0.3 percent increase for the

month.

The loonie fell back to 1.5203 against the euro, not far from

more than a 4-week low of 1.5214 hit at 3:30 am ET. Next key

support for the loonie is likely seen around the 1.54 level.

Flash data from Eurostat showed that Eurozone inflation

moderated in August from a more than five-year high level.

Inflation eased to 2 percent from 2.1 percent in July. The

annual rate was expected to remain at 2.1 percent, which was the

highest since December 2012.

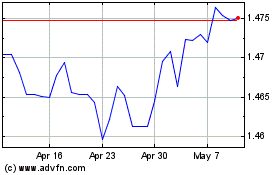

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024