Securities Registration: Employee Benefit Plan (s-8)

September 14 2018 - 8:24AM

Edgar (US Regulatory)

Registration Statement

No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Anheuser-Busch InBev SA/NV

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Belgium

|

|

None

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification Number)

|

Brouwerijplein 1,

3000 Leuven, Belgium

(Address of Principal Executive Offices)

Five-Year

Performance Restricted Stock Units Plan

Ten-Year

Performance Restricted Stock Units Plan

(Full Title of Plans)

John Blood

c/o Anheuser-Busch InBev Services, LLC

250 Park Avenue

New

York, New York 10017

Tel. No.: (212)

573-8800

(Name, Address and Telephone Number of Agent for Service)

Copies to:

John

Horsfield-Bradbury

Sullivan & Cromwell LLP

1 New Fetter Lane

London

EC4A 1AN

United Kingdom

Tel. No.:

+44-20-7959-8900

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and an “emerging growth company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

2

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

To Be Registered

(1)

|

|

Amount To Be

Registered

(2)

|

|

Proposed Maximum

Offering Price Per

Share

(3)

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration

Fee

(2)

|

|

Ordinary shares of Anheuser-Busch InBev SA/NV without nominal value (“

Ordinary Shares

”) (granted pursuant to the Five-Year Performance Restricted Stock Units Plan)

|

|

150,000

|

|

$90.32

|

|

$13,548,000.00

|

|

$1,686.73

|

|

Ordinary Shares (granted pursuant to the

Ten-Year

Performance Restricted Stock Units Plan)

|

|

400,000

|

|

$90.32

|

|

$36,128,000.00

|

|

$4,497.94

|

|

Total

|

|

|

|

|

|

$49,676,000.00

|

|

$6,184.67

|

|

(1)

|

Ordinary Shares may be represented by American Depositary Shares (“

ADSs

”), each of which

represents one Ordinary Share and may be evidenced by American Depository Receipts (“

ADRs

”). A separate registration statement on Form

F-6

(File

No. 333-214027)

was filed with the Securities and Exchange Commission (the “

Commission

”) 7 October 2016, as amended by Post-Effective Amendment No. 1, filed on 16 March

2018, in respect of Anheuser-Busch InBev SA/NV, a public limited liability company (

société anonyme/naamloze vennootschap

) incorporated in Belgium (“

AB InBev

” or the “

Registrant

”), for the

registration of ADSs evidenced by ADRs issuable upon deposit of Ordinary Shares.

|

|

(2)

|

Pursuant to Rule 416 of the Securities Act of 1933, as amended (the “

Securities Act

”), the

amount being registered also includes an indeterminate number of Ordinary Shares, which may be issuable under the plans as a result of variations in share capital, share splits, share dividends or similar transactions.

|

|

(3)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and (h) of

the Securities Act and based on the high and low prices of Ordinary Shares as reported on Euronext Brussels on 11 September 2018, and converted at the cross rate of €1.00 = $1.1606, as reported by Bloomberg at 5:00 p.m., New York City

time, on 11 September 2018.

|

3

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing the information specified in Part I of Form

S-8

will be sent or given to participants in

the plans covered by this registration statement as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”). Such documents need not be filed with the Commission either as part of this registration

statement or as prospectuses or prospectus supplements pursuant to Rule 424. These documents and the documents incorporated herein by reference pursuant to Item 3 of Part II of this registration statement, taken together, constitute a

prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

Item 3.

|

Incorporation of Documents by Reference

|

The following documents that AB InBev has filed with the Commission are incorporated in this registration statement by reference and made a part hereof:

|

|

•

|

|

AB InBev’s Annual Report on Form

20-F

for the year ended

31 December 2017 filed with the Commission on 19 March 2018 (“Annual Report”);

|

|

|

•

|

|

AB InBev’s Form

F-4

(File

No. 333-213328)

filed with the Commission on 26 August 2016 (the “Form

F-4”)

solely with respect to any amendment or report filed for the purpose of

updating the descriptions of Ordinary Shares and ADSs contained under the headings “Description of Newbelco Ordinary Shares and Newbelco ADSs—Description of the Rights and Benefits Attached to Newbelco Ordinary Shares” and

“Description of Newbelco Ordinary Shares and Newbelco ADSs—Description of the Rights and Benefits Attached to Newbelco ADSs” in the Form

F-4;

and

|

|

|

•

|

|

Current Reports on Form

6-K

filed with the Commission on each of the

following dates:

|

|

|

o

|

26 July 2018, regarding organizational changes; and

|

|

|

o

|

27 July 2018, regarding AB InBev’s unaudited interim report for the

six-month

period ended 30 June 2018.

|

Each document incorporated by reference is current

only as of the date of such document, and the incorporation by reference of such document shall not create any implication that there has been no change in the affairs of AB InBev since its date or that the information contained in it is current as

of any time subsequent to its date.

All documents filed by AB InBev pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of

1934 subsequent to the date hereof and prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold shall be deemed to be incorporated by

reference herein and to be a part hereof from the date of filing of such documents. Reports on Form

6-K

that AB InBev furnishes to the Commission subsequent to the date hereof will only be deemed incorporated

by reference into this Registration Statement if such Report on Form

6-K

expressly states that it is incorporated by reference herein.

Any statement contained in such a document shall be deemed to be modified or superseded for the purpose of this Registration Statement to the extent that a

subsequent statement contained herein or in a subsequently filed or furnished document incorporated by reference herein, modifies or supersedes that statement. Any such statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this Registration Statement. In addition, any statement contained in any such document shall be deemed to be superseded for the purpose of this Registration Statement to the extent that a discussion contained

herein covering the same subject matter omits such statement. Any such statement omitted shall not be deemed to constitute a part of this Registration Statement.

4

|

Item 4.

|

Description of Securities

|

Please refer to “Description of Newbelco Ordinary Shares and Newbelco ADSs—Description of the Rights and Benefits Attached to Newbelco Ordinary

Shares” in the Form

F-4

for a description of Ordinary Shares.

Please refer to “Description of Newbelco

Ordinary Shares and Newbelco ADSs—Description of the Rights and Benefits Attached to Newbelco ADSs” in the Form

F-4

for a description of American Depositary Shares.

|

Item 5.

|

Interests of Named Experts and Counsel

|

None. Because no original issuance Ordinary Shares are to be registered hereunder, no opinion of counsel regarding the legality of the Ordinary Shares being

registered hereunder is required.

|

Item 6.

|

Indemnification of Directors and Officers

|

Group Coverage and Policy

As the parent company of the Anheuser-Busch InBev Group, AB InBev has undertaken to indemnify its directors, officers and employees against

any and all expenses (including, without limitation, attorneys’ fees and any expenses of establishing a right to indemnification by AB InBev), judgments, fines, penalties, settlements and other amounts actually and reasonably incurred by any

such director, officer and employee in connection with the defense or settlement of any proceeding brought (i) by a third party or (ii) by AB InBev or by shareholders or other third parties in the right of AB InBev. Such indemnification

applies if, with respect to the acts or omissions of such director, officer and employee, he or she acted in good faith and in a manner he or she reasonably believed to be in the best interests of AB InBev and, in the case of a criminal action or

proceeding, he or she had no reason to believe that his or her conduct was unlawful. For these purposes, “proceeding” refers to any threatened, pending or completed action or proceeding, whether civil, criminal, administrative or

investigative to which a director, officer or employee is a party or is threatened to be made a party by reason of the fact that he or she was a director or an agent of AB InBev or of one of its subsidiaries or by reason of anything done or not done

by him or her in such capacity.

No determination in any proceeding by judgment, order, settlement or conviction or otherwise shall, of

itself, create a presumption that such director, officer or employee did not act in good faith and in a manner which he or she reasonably believed to be in the best interests of AB InBev and, with respect to any criminal action or proceeding, he or

she had reasonable cause to believe that his or her conduct was unlawful.

In addition, AB InBev has a liability insurance policy that covers all past,

present and future directors and officers of AB InBev and its subsidiaries, which are those entities in which it holds more than 50% of the voting rights, or of which it can individually, or under a written shareholders’ agreement, appoint the

majority of the board of directors. The insurance covers defense costs and financial damages such directors or officers are legally obliged to pay as a result of any claim against them. A “claim” for these purposes includes all requests

against the directors and officers, including (i) a civil proceeding, (ii) a criminal proceeding, (iii) a formal administrative or regulatory proceeding and (iv) a written request by a third party.

|

Item 7.

|

Exemption from Registration Claimed

|

Not applicable.

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

4.1*

|

|

Articles of Association of Anheuser-Busch InBev SA/NV (English-language translation) (incorporated by reference to Exhibit 99.4 to the Form

6-K

filed with the Commission on 11 October

2016 at 5:07 p.m. EDT

).

|

|

|

|

|

4.2

|

|

Amended and Restated Deposit Agreement, by and among AB InBev and The Bank of New York Mellon, as Depositary and Owners and Holders of American Depositary Shares, dated as of 23 March 2018.

|

|

|

|

|

4.3

|

|

Terms and Conditions of the Five-Year Performance Restricted Stock Units Plan.

|

|

|

|

|

4.4

|

|

Terms and Conditions of the

Ten-Year

Performance Restricted Stock Units Plan.

|

5

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

23.1

|

|

Consent of Deloitte Bedrijfsrevisoren / Reviseurs d’Entreprises /BV o.v.v.e. CVBA/ SC s.f.d. SCRL (Zaventem), relating to the financial statements of Anheuser-Busch InBev SA/NV for the financial years ended 31 December

2017 and 2016.

|

|

|

|

|

23.2

|

|

Consent of PwC Bedrijfsrevisoren BCVBA relating to the financial statements of Anheuser-Busch InBev SA/NV for the financial year ended 31 December 2015.

|

|

|

|

|

23.3

|

|

Consent of Deloitte Touche Tohmatsu Auditores Independentes (São Paulo, Brazil), relating to the financial statements of Ambev S.A. for the year ended 31 December 2015.

|

|

|

|

|

24.1

|

|

Powers of Attorney of Certain Directors and Officers of Anheuser-Busch InBev SA/NV.

|

|

|

|

|

24.2

|

|

Power of Attorney of Authorized Representative in the United States.

|

|

|

|

|

|

|

|

|

*

|

|

Previously filed.

|

|

(a)

|

The undersigned registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this

registration statement:

|

|

|

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

to reflect in the prospectus any facts or events arising after the effective date of the registration statement

(or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in

volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus

filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement;

|

|

|

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the

registration statement or any material change to such information in the registration statement;

|

provided however, that

paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is on Form

S-8,

and the information required to be included in a post-effective amendment by those paragraphs is contained in

reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference into the registration statement.

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective

amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which

remain unsold at the termination of the offering.

|

|

(b)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the

Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual

report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to

directors, officers and controlling persons of the registrant pursuant to the foregoing provisions or otherwise, the registrant has been advised

|

6

|

|

that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the

event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or

proceeding) is asserted by such director, officer or controlling person against the registrant in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

|

|

(d)

|

The undersigned registrant hereby undertakes that:

|

|

|

(1)

|

For purposes of determining any liability under the Securities Act of 1933, the information omitted from the

form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be

part of this registration statement as of the time it was declared effective.

|

|

|

(2)

|

For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment

that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

7

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form

S-8

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Leuven, Belgium, on 14 September 2018.

|

|

|

|

|

Anheuser-Busch InBev SA/NV

|

|

|

|

|

By:

|

|

/s/ Jan Vandermeersch

|

|

Name:

|

|

Jan Vandermeersch

|

|

Title:

|

|

Global Legal Director Corporate

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by

the following persons in the capacities indicated below on 14 September 2018.

|

|

|

|

|

|

|

Signature

|

|

|

|

Title

|

|

|

|

|

|

*

Carlos Brito

|

|

|

|

Chief Executive Officer

(Principal Executive Officer)

|

|

|

|

|

|

*

Felipe Dutra

|

|

|

|

Chief Financial and Solutions Officer

(Principal Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

*

Oliver Goudet

|

|

|

|

Chairman of the Board of Directors

|

|

|

|

|

|

*

María Asuncion Aramburuzabala

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

Alexandre Behring

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

M. Michele Burns

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Paul Cornet de Ways Ruart

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Stéfan Descheemaeker

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Paulo Alberto Lemann

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Elio Leoni Sceti

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

Carlos Alberto Sicupira

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Grégoire de Spoelberch

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

|

|

|

|

|

|

*

Marcel Herrmann Telles

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Alexandre Van Damme

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

William F. Gifford, Jr.

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Martin J. Barrington

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Alejandro Santo Domingo Dávila

|

|

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

Bryan Warner

|

|

|

|

Authorized Representative in the United States

|

|

|

|

|

|

*By:

|

|

/s/ Jan Vandermeersch

|

|

Name:

|

|

Jan Vandermeersch

|

|

Title:

|

|

Attorney-in-Fact

|

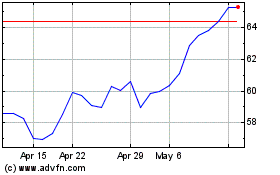

Anheuser Busch Inbev SA NV (PK) (USOTC:BUDFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

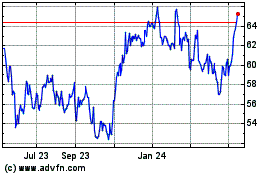

Anheuser Busch Inbev SA NV (PK) (USOTC:BUDFF)

Historical Stock Chart

From Apr 2023 to Apr 2024