Athelney Trust PLC Net Asset Value(s) (5630I)

April 02 2020 - 3:42AM

UK Regulatory

TIDMATY

RNS Number : 5630I

Athelney Trust PLC

02 April 2020

Athelney Trust PLC

Legal Entity Identifier:

213800ON67TJC7F4DL05

The unaudited net asset value of Athelney Trust was 191.7p at 31

March 2020.

Fund Manager's comment for March 2020

The COVID-19 coronavirus continued to hammer financial markets

in March as the virus spread to the US and across the globe. The

economic carnage produced by the abrupt shutdown of economic

activity across the world is evident from the weekly unemployment

claims in the US. In the period prior to the outbreak, jobless

claims had declined to their lowest levels in sixty years. In the

second week of March claims increased suddenly to 282,000 and then

sky rocketed to a record 3.3 million during the week ended March

21. As bad as these figures are, the numbers are likely to climb

even higher next week.

This hibernation of the world's economy was reflected in the

major world stock markets as represented by the MSCI World Index

and the S&P 500 which continued to fall, with both indices

dropping in February by 13.5% and 12.5% respectively. The UK,

European and Asian markets reacted in similar fashion. In the UK,

the FTSE 100 was down by 13.8% in local currency terms while the

indices associated with smaller companies fared much worse. The

Small Cap Index declined by 20.8%, the AIM All Share Index was down

by 21.7% and the Fledgling Index was down by 25.3%.

While our portfolio of investments declined in similar fashion

to that of the overall market, it performed better than the small

to midcap segment of the market, declining by 18.8% during the

month which, after allowing for the expenses resulted in a decline

of 22.6% in the NAV. When analysing the underlying performance of

the portfolio it is interesting to note that the non-REIT component

of the portfolio declined by only 14% with overall performance

dragged down by the REIT exposure. It would appear that the REIT's

have been under additional price pressure due to the selling by

open-ended property funds. These funds have used exposures to

listed REITs, rather than extra cash, to provide liquidity for

excessive redemptions so as to retain an exposure to property. This

is evidenced by a recent RNS announcement by Tritax BigBox (BBOX)

where Aviva (a closed open-ended property fund) announced that it

had reduced its holding.

We sold our holdings in Biffa, VP and Marston's, utilising the

proceeds and some of our surplus cash to add to our position in

Costain, Jarvis, Boohoo, Rightmove, JD Sports and T Clark. Cash

currently comprises 7.9% of the portfolio

Fact Sheet

An accompanying fact sheet which includes the information above

as well as wider details on the portfolio can be found on the

Fund's website www.athelneytrust.co.uk under "Portfolio

Details".

Background Information

Dr. Emmanuel (Manny) Pohl

Manny is Chairman and Chief Investment Officer of E C Pohl &

Co ("ECP"), an investment management company and has been a major

shareholder in Athelney trust for many years.

E C Pohl & co is licensed by the Australian Financial

services (licence no.421704).

www.ecpohl.com

www.ecpam.com

Manny Pohl and the ECP group has over AU$1000m under its

management including four listed investment companies, three listed

in Australia and one in the UK:

-- Flagship Investments (ASX code:FSI)

AUD56m https://flagshipinvestments.com.au

-- Barrack St Investments (ASX code: BST)

AUD25m www.barrackst.com

-- Global Masters Fund Limited (ASX code: GFL)

AUD27m www.globalmastersfund.com.au

-- Athelney Trust plc (LSE code: ATY)

GBP5m www.athelneytrust.co.uk

Athelney Trust plc Investment Policy

The investment objective of the Trust is to provide shareholders

with prospects of long-term capital growth with the risks inherent

in small cap investment minimised through a spread of holdings in

quality small cap companies that operate in various industries and

sectors. The Fund Manager also considers that it is important to

maintain a progressive dividend record.

The assets of the Trust are allocated predominantly to companies

with either a full listing on the London Stock Exchange or a

trading facility on AIM or ISDX. The assets of the Trust have been

allocated in two main ways: first, to the shares of those companies

which have grown steadily over the years in terms of profits and

dividends but, despite this progress, the market rating is

favourable when compared to future earnings and dividends; second,

to those companies whose shares are standing at a favourable level

compared with the value of land, buildings or cash in the balance

sheet.

Athelney Trust was founded in 1994. In 1996 it was one of the

ten pioneer members of the Alternative Investment Market ("AIM").

In 2008 the shares became fully listed on the main market of the

London Stock Exchange. Athelney Trust has a successful progressive

dividend growth record and the dividend has grown every year since

2004. According to the Association of Investment Companies (AIC)

Athelney Trust is one of only "22 investment companies that have

increased their dividend every year between 10 and 20 years - the

next generation of dividend heroes" (as at 20/03/2018). See

link

www.theaic.co.uk/aic/news/press-releases/next-generation-of-dividend-heroes

Website

www.athelneytrust.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVGIGDSDSGDGGD

(END) Dow Jones Newswires

April 02, 2020 04:42 ET (08:42 GMT)

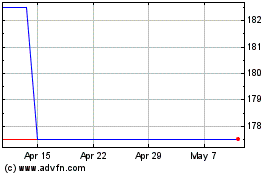

Athelney (LSE:ATY)

Historical Stock Chart

From Mar 2024 to Apr 2024

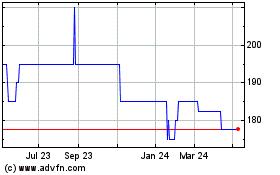

Athelney (LSE:ATY)

Historical Stock Chart

From Apr 2023 to Apr 2024