Andy Jassy's Climb to Amazon CEO Shows the Cloud's Rising Power

February 03 2021 - 9:10AM

Dow Jones News

By Aaron Tilley

The elevation of Andy Jassy to become the next chief executive

of Amazon.com Inc. is one of the clearest signs yet that fortunes

in the tech industry are increasingly made in the cloud.

Mr. Jassy was instrumental in helping the online retailing giant

he joined in 1997 to also become a juggernaut in cloud-computing,

the business of renting servers and software to customers largely

on a pay-as-you-go model. It is a market that could top $300

billion globally this year, according to research firm Gartner

Inc., and pits Amazon against tech giants like Microsoft Corp. and

Alphabet Inc.'s Google.

The battle for the cloud is playing out across industries --

from videogames to cars to space -- and companies large and

small.

For Amazon, cloud computing has been a booming business that is

massively lucrative. Amazon Web Services, or AWS, generated little

more than 10% of Amazon's total sales in the final quarter of last

year but yielded more than half the company's operating profit in

the period. AWS revenue advanced 28% over those three months from

the year prior to $12.7 billion, and its operating profit was $3.6

billion.

For executives, the cloud is increasingly becoming a

steppingstone on the corporate ladder. Microsoft CEO Satya Nadella

ran the software giant's cloud business before his elevation in

2014 to the top job. International Business Machines Corp. last

year turned to its cloud chief when it came to naming a new CEO to

help revive growth.

Mr. Jassy's appointment is particularly noteworthy because he is

taking over not just a tech company but one of the world's largest

retailers. "This speaks to how important the cloud is becoming to

our economy," said Rishi Jaluria, an analyst for investment

research firm D.A. Davidson & Co. "With Andy Jassy in charge of

all of Amazon, it shows how the company wants to bring that DNA at

the core of AWS to all of Amazon."

The breadth of tools now offered by Amazon and others via the

cloud has exploded as companies across industries collect more data

on their products, customers and employees. Cloud vendors now

provide applications to, for instance, help manage and analyze that

trove of information, increasingly using artificial intelligence

software to automate the processes.

Investors increasingly are rewarding businesses that have

embraced cloud-computing, and they have taken a dimmer view of

those struggling to adapt.

Snowflake Inc., a company that offers tools to help companies

manage their data across multiple clouds, went public last year in

a blockbuster public offering. Shares, down from their December

highs, are up about 18% since their debut. Data-analytics startup

Databricks Inc. recently raised $1 billion, giving the San

Francisco-based company a $28 billion valuation. Salesforce.com

Inc., launched more than 20 years ago as a cloud-based software

company, has grown into one of America's biggest providers of

enterprise tools and has used its rising fortunes to help fund

deals, including an agreement late last year to buy cloud-based

workplace collaboration software provider Slack Technologies

Inc.

Companies that were slow to embrace the cloud are trying to

catch up. Larry Ellison, the founder and executive chairman of

database provider Oracle Corp., once dismissed cloud computing as a

fad. In recent years Oracle has ramped up its cloud-computing

efforts and poached staff from AWS. Mr. Ellison now regularly

trumpets the company's cloud exploits on earnings calls and last

year landed popular videoconference company Zoom Video

Communications Inc. as a cloud customer to burnish Oracle's

credentials.

Early in the pandemic, when American businesses hunkered down,

the multiyear growth run in cloud spending seemed at risk.

Salesforce cut its full-year outlook as it provided some struggling

customers a payment holiday. IBM in April withdrew its full-year

guidance.

But reality played out differently. The pandemic has

supercharged the cloud as businesses rushed to adopt tools to help

them cope with remote working and other challenges during the

health crisis. Microsoft's Azure cloud before the pandemic had seen

a slowing rate of growth as it gained scale. That reversed in

recent months. Azure sales increased 50% year-over-year in the

December quarter, up from 48% during the prior quarter.

"What we have witnessed over the past year is the dawn of a

second wave of digital transformation sweeping every company and

every industry," Mr. Nadella said last month.

Amazon is the clear leader in the cloud by sales, though

companies differ in how they calculate revenue generated through

those activities. AWS had a market share of around 34% at the end

of last year, according to Synergy Research Group. Microsoft was

second with a 20% slice but has been narrowing the gap, according

to Synergy Research.

Amazon's rise in cloud hasn't been without challenges. In

addition to the increased competition, some retailers -- like

Walmart Inc. -- are shunning AWS and teaming with rivals because of

concerns about giving Amazon more business and might.

The cloud also is increasingly a political minefield as it

becomes more center stage in daily life. Amazon last month was

caught in the fraught question of what content to allow or bar on

its platform. AWS kicked conservative social network Parler off its

cloud, saying the customer didn't adequately police its content and

failed to remove content that violated Amazon's terms of service.

Parler is suing Amazon over the action.

When the House panel last year issued a report on antitrust

concerns around big tech companies, it said AWS provides key

infrastructure for businesses that compete with Amazon. "This

creates the potential for a conflict of interest where cloud

customers are forced to consider patronizing a competitor, as

opposed to selecting the best technology for their business," the

committee wrote. Amazon has said it doesn't use AWS to advantage

its retail arm.

Amazon also drew lawmaker attention when a former employee was

arrested in 2019 for orchestrating the hack of Capital One

Financial Corp.

Write to Aaron Tilley at aaron.tilley@wsj.com

(END) Dow Jones Newswires

February 03, 2021 09:55 ET (14:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

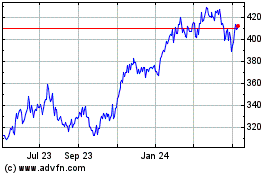

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

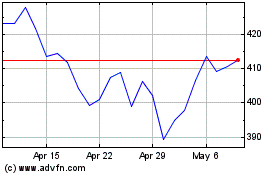

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024