4basebio UK Societas Admission to Trading on AIM and First Day of Dealings

February 17 2021 - 1:00AM

UK Regulatory

TIDM4BB

4basebio UK Societas

("4basebio", the "Company" or the "Group")

Admission to Trading on AIM and First Day of Dealings

4basebio UK Societas (AIM: 4BB), the specialist life sciences group focused on

exploiting its intellectual property in the field of gene therapies and DNA

vaccines, is pleased to announce the admission of its ordinary shares to

trading on the AIM market of the London Stock Exchange. Dealings will commence

at 8.00 a.m. today, Wednesday 17 February 2021, under the ticker 4BB

(ISIN GB00BLD8ZL39).

Upon Admission, the Company will have 12,317,473 ordinary shares in issue and a

market capitalisation of approximately £14.5 million.

Heikki Lanckriet, Chief Executive Officer of 4basebio, commented:

"We are delighted to be admitted to AIM today. As a Cambridge based company

with significant ambitions, we believe AIM is the ideal market to support our

further development. We would also like to extend our thanks to our staff,

advisors and shareholders who continue to support our ongoing growth strategy."

Cairn Financial Advisers LLP is acting as Nominated Adviser to the Company and

finnCap is acting as Broker.

Company Highlights

4basebio is a specialist life sciences group focused on therapeutic DNA for

gene therapies and DNA vaccines and providing solutions for effective and safe

delivery of these DNA based products to patients. It is the intention of the

Company to become a market leader in the manufacture and supply of high purity,

synthetic DNA for research, therapeutic and pharmacological use. The immediate

objectives of 4bb are to validate and scale its DNA synthesis and advance its

collaborations to facilitate the functional validation of its DNA based

products and gene delivery solutions.

The Company divested from 4basebio AG ("4bb AG"), a German company listed on

the Prime Standard segment of the Frankfurt Stock Exchange, following the

disposal by 4bb AG (then named Expedeon AG) of its proteomics and immunology

business to AIM-quoted Abcam plc in January 2020 for ?120million. Following the

disposal, 4bb AG retained its genomics business which owned and licensed

certain intellectual property including its proprietary, patent-protected

technology, TruePrimeT. This is the foundation for building the Company's

synthetic DNA manufacturing business which 4bb AG transferred to the Company

along with funding to continue the Company's development and investment.

On Admission, the Company will have cash reserves of approximately £14.4million

which the Directors consider will provide sufficient working capital for the

development and scale-up of the business to commercialisation.

The Company has a wholly-owned Spanish subsidiary, 4basebio S.L.U. ("4bb

Spain") and a wholly-owned UK subsidiary, 4basebio UK Limited ("4bb UK") which

in turn wholly-owns 4basebio Discovery Limited ("4bb Discovery").

4bb UK focuses on the DNA validation and scaling work required as a

prerequisite to developing Good Manufacturing Practice ("GMP") grade DNA,

suitable for use in gene therapies and DNA vaccines. It is expected that 4bb

UK's operations will continue to expand as it becomes the Group's centre of

large-scale production.

4bb Discovery was created as a particle and indication research and development

arm of the Group with the intention of developing intellectual property around

non-viral delivery platforms.

4bb Spain undertakes primary DNA synthesis research and is involved in the

manufacture of enzymes used in the DNA manufacturing process as well as in

other diagnostic and research applications.

The Admission Document can be found on 4basebio's website: www.4basebio.com

For further enquiries, please contact:

4basebio UK Societas +44 (0)12 2396 7943

Heikki Lanckriet

Nominated Adviser +44 (0)20 7213 0880

Cairn Financial Advisers LLP

Jo Tuner / Sandy Jamieson

Broker +44 (0)20 7220 0500

finnCap Ltd

Geoff Nash

Richard Chambers/Charlotte Sutcliffe

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed to be, forward

looking statements. Forward looking statements are identi?ed by their use of

terms and phrases such as "believe", "could", "should" "envisage",

"estimate", "intend", "may", "plan", "potentially", "expect",

"will" or the negative of those, variations or comparable expressions,

including references to assumptions. These forward-looking statements are not

based on historical facts but rather on the Directors' current expectations and

assumptions regarding the Company's future growth, results of operations,

performance, future capital and other expenditures (including the amount,

nature and sources of funding thereof), competitive advantages, business

prospects and opportunities. Such forward looking statements re?ect the

Directors' current beliefs and assumptions and are based on information

currently available to the Directors.

END

(END) Dow Jones Newswires

February 17, 2021 02:00 ET (07:00 GMT)

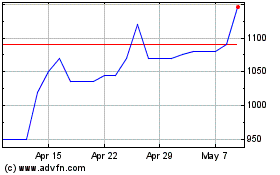

4basebio (LSE:4BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

4basebio (LSE:4BB)

Historical Stock Chart

From Apr 2023 to Apr 2024