TIDMAPTD

RNS Number : 7076R

Aptitude Software Group PLC

10 March 2021

10 March 2021

APTITUDE SOFTWARE GROUP plc

('Aptitude Software' or 'the Group')

Audited Preliminary Results for the Year Ended

31 December 2020

Aptitude Software Group plc (LSE: APTD), a specialist provider

of powerful financial management software to large global

businesses, reports its Audited Preliminary Results for the year

ended 31 December 2020.

Financial Highlights

Year ended 31 December 2020 2019(1) % Change

Annual Recurring Revenue (2) at year end GBP31.2m GBP28.1m(3) 11%

---------- ------------- ----------

* Software and subscription revenue GBP30.5m GBP28.5m 7%

---------- ------------- ----------

* Implementation and solution management services

revenue GBP26.8m GBP31.2m (14%)

---------- ------------- ----------

Total Revenue GBP57.3m GBP59.7m (4%)

---------- ------------- ----------

Cash and cash equivalents at year end GBP44.8m GBP33.0m 36%

---------- ------------- ----------

Adjusted Operating Profit(4) GBP9.1m GBP10.5m (13%)

---------- ------------- ----------

Statutory operating profit GBP8.1m GBP8.9m (9%)

---------- ------------- ----------

Adjusted Basic Earnings per Share(4) 13.2p 12.8p 3%

---------- ------------- ----------

Basic Earnings per Share 12.5p 11.2p 12%

---------- ------------- ----------

-- The Group has remained agile and resilient to the impact of

the pandemic despite the initial disruption to a number of our key

markets in the second and third quarter of 2020

-- Year on year growth in Annual Recurring Revenue ('ARR') of

11% on a constant currency(3) basis driven by new business wins and

the expansion of existing customer relationships

-- Highlighting both the strength of our client relationships

and quality of product suite, net retention(5) in the year despite

the impact of Covid was 102% (2019: 98%)

-- Software and subscription revenue, the strategic focus of the

Group, now represents 53% of total revenue (2019: 48%) with growth

of 7% to GBP30.5 million for the year ended 31 December 2020 (2019:

GBP28.5 million)

-- Strong balance sheet with cash of GBP44.8 million (2019:

GBP33.0 million), net funds(6) of GBP42.9 million (2019: GBP30.8

million (5) ) and no bank loans. This financial strength provides

confidence to our clients and prospects whilst positioning the

business well for potential acquisition opportunities

Strategic and Operational Highlights:

-- Launch of Aptitude Accounting Hub and Aptitude Insurance

Calculation Engine as Software-as-a-Service ('SaaS') offerings,

multi-year SaaS agreements signed with two North American

insurers

-- Multiple sales of Aptitude Revenue Management to North

American technology and telecommunication companies

-- First SaaS agreement for the use of both Aptitude Revenue

Management and Aptitude Lease Accounting Engine with a leading

global medical technology company. This success further

demonstrates the additional capabilities realisable by clients from

combining more than one of the Group's tightly integrated and

complementary applications

-- Expansion of the use of our products in several existing

clients including a North American telecommunications company

licencing its fourth application and a significant Aptitude

Accounting Hub sale to a European bank

-- Strengthening of the global partner network with new

propositions developed in 2020 providing access to new markets

-- Implementation services capacity reduced following market

disruption, future growth in demand for services expected to be

increasingly fulfilled by the Group's strengthening partner

network

-- The pandemic is expected to accelerate the stimulus for

organisations to undertake greater finance automation in the medium

term supporting the Group's investment in the products which

address these requirements

Commenting on the results, Jeremy Suddards, Chief Executive

Officer, said: -

'The Group continued to make good progress in 2020 despite the

challenges arising from the pandemic, with a number of new business

wins in our strategic industries and new adjacent ones,

complemented by an expansion in the use of our applications in

several of our largest existing clients across the globe. With a

strong sales performance in the final quarter of the year and a

growing pipeline, Aptitude Software looks forward to 2021 with

confidence and anticipates a financial outcome at least consistent

with 2020.

Aptitude Software benefits from a focused portfolio of product

and service offerings, an established SaaS capability, increasing

worldwide presence and a strengthening partner network. With Covid

expected to accelerate the drive for greater automation in our

clients' finance functions, these assets and capabilities position

the Group to be able to fully realise the significant opportunity

ahead.'

Contacts

Aptitude Software Group plc

Ivan Martin, Chairman 020-3687-3200

Jeremy Suddards, Chief Executive Officer

Philip Wood, Deputy Chief Executive Officer and Chief Financial

Officer

Alma PR

Caroline Forde, Sam Modlin 020-3405-0205

About Aptitude Software

Aptitude Software's innovative solutions address the growing

trend for finance automation, whether part of a broad finance

transformation by a client or to address specific regulatory

requirements. Our various products take data from complex systems,

typically with multiple siloed data sources across multiple

business entities, perform complex accounting calculations and

create a unified view of finance. This allows our clients to reap

numerous benefits including significant efficiencies, business

insights, enhanced control and regulatory compliance.

Our clients include some of the world's largest companies,

typically organisations with complex financial data and technology

landscapes. Development, together with a growing number of other

services, continues to be performed at the Aptitude Innovation

Centre in Poland with sales, support and implementation services

provided from Aptitude Software's London headquarters and the North

American and Singaporean regional businesses.

www.aptitudesoftware.com

Throughout this announcement:

1 Amounts represent continuing operations which exclude the

results of the Microgen Financial Systems business disposed of on

28 June 2019 and presented as a discontinued operation

(2) Annual Recurring Revenue ('ARR') is the value of Aptitude

Software's software and subscription recurring revenue at a

specific point in time, normalised to a one-year period. ARR

includes recurring revenues contracted but yet to commence and

excludes recurring revenues which are currently being received but

are known to be terminating in the future.

(3) Constant currency is calculated by comparing the 2020

results with 2019 results retranslated at the rates of exchange

prevailing during 2020. Items within the Financial Highlights table

indicated by this superscript reference are calculated on a

constant currency basis.

(4) Adjusted Operating Profit, Adjusted Operating Margin and

Adjusted Basic Earnings per Share exclude non-underlying operating

items, unless stated to the contrary. Further detail in respect of

the non-underlying operating items can be found within Note 2 of

the notes to the Financial Statements.

(5) Net retention is the total value of on-going Annual

Recurring Revenue at the year-end from clients in place at the

start of the year as a percentage of the opening Annual Recurring

Revenue from those clients on a constant currency basis

(6) Net funds represents cash and cash equivalents less finance

obligations, which are currently limited to capital lease

obligations

Certain non-IFRS financial measures (e.g. Adjusted Operating

Profit) are included which assist management in comparing

performance on a consistent basis

Chairman's Statement

Overview

Aptitude Software made strategic and operational progress in a

year in which the Group's key markets were disrupted by the onset

of the pandemic.

In the initial months of Covid, a number of sales and

implementations were slowed as organisations focused on other

priorities, however, a more typical business environment returned

in the final quarter of the year with several new business

contracts completed. Whilst below the pre-pandemic new business

expectations for 2020, overall the Group achieved a good number of

new business wins and contract expansions in the banking, insurance

and technology, media and telecom ('TMT') sectors demonstrating the

strength of the Group's product portfolio and sector diversity.

These additions led to Annual Recurring Revenue increasing to

GBP31.2 million as at 31 December 2020, representing year on year

growth of 11% on a constant currency basis (31 December 2019:

GBP28.1 million, 30 June 2020: GBP29.3 million, both restated for

the prevailing exchange rates at 31 December 2020).

From the onset of the pandemic the Group remained both agile and

resilient with all business functions, including those servicing

our diverse client base, operating seamlessly. This would not have

been possible without the exceptional quality of our people and the

Board wishes to thank our employees for their adaptability,

commitment and the excellent support and dedication they provided,

and continue to provide, to the business and to our clients whilst

working remotely.

Benefitting from the previously planned investment, the Group

launched the Aptitude Accounting Hub and Aptitude Insurance

Calculation Engine as SaaS offerings allowing the business to

capitalise on the accelerated move to cloud experienced in the year

with all key products now available as SaaS. Following this launch

the Group entered into multi-year SaaS agreements with two North

American insurers helping drive the strong final quarter's sales

performance.

Strengthening the Group's high-quality partner network, a

strategic focus, has also been achieved with a number of joint

propositions established in the year providing the business with

access either to new geographies for specific products or to

segments of existing markets not previously accessible.

The Board believes the pandemic will accelerate the stimulus for

organisations to undertake finance automation to further transform

their finance functions, removing manual processes and improving

the quality and regularity of their financial analysis and

planning, a capability which is central to our product

strategy.

Dividend

Having considered the Group's progress and financial performance

in 2020, the Board has proposed to maintain dividend levels. As a

result, a final dividend of 3.60 pence per share is proposed (2019:

3.60 pence), making a total ordinary dividend of 5.40 pence per

share for the year (2019: 5.40 pence). Subject to shareholder

approval at the Group's Annual General Meeting in April 2021, the

proposed final dividend will be paid on 28 May 2021 to shareholders

on the register at 7 May 2021.

The business has not utilised the furlough scheme nor received

any other government support in the United Kingdom nor in any other

country where it operates.

Outlook

Aptitude Software continues to benefit from a focused portfolio

of product and service offerings, an established SaaS capability,

increasing worldwide presence and a strengthening partner network.

The Group's robust set of financials complemented by a strong new

business performance across the final quarter of 2020 provide the

Board with confidence for the year ahead.

Ivan Martin

Chairman

9 March 2021

Chief Executive Officer's Report

Introduction

Aptitude Software is a specialist provider of powerful financial

management software to large global businesses .

Our applications provide data and business insight to our

worldwide client base enabling them to achieve significant benefits

such as automation of their finance function, enhanced financial

control, deeper operational intelligence and regulatory compliance.

Our markets are underpinned by strong fundamentals as technology

advancement both drives and facilitates an increasingly automated

approach to finance operations, augmented by the continuing impetus

of regulatory requirements. Our clients include some of the world's

largest companies, typically organisations with complex financial

data and technology landscapes. Whilst our products are relevant

for all sectors, the Group has established a strong presence in

banking, insurance and technology, media and telecom ('TMT')

complemented by clients in a series of other advanced

industries.

The business generates revenue from its software through a

combination of licence fees (primarily annual recurring licences),

software maintenance/support, software subscriptions for its

cloud-based offerings and implementation and other recurring

support services including the growing solution management service.

Development, together with an increasing number of other client

focused services, continues to be performed at the Aptitude

Innovation Centre in Wroclaw, Poland, with sales, support and

implementation services provided from Aptitude Software's London

headquarters and the North American and Singaporean regional

businesses.

Corporate Strategy

Aptitude Software's strategy is focused on providing powerful

financial management software to large international

businesses.

The Group executed on a number of strategic activities during

2020, with details of these provided in the sections below. These

activities are focused on driving an acceleration of growth in the

software and subscription revenues which now represent 53% of

overall revenue (2019: 48%). The growth in the proportion of such

revenues in the business will, in due course, lead to both an

increase in operating margins, given the higher margins achievable

from these recurring revenues, and even greater future revenue

visibility.

Software-as-a-Service ('SaaS') Progression

A key strategic highlight in the year has been the launch of

Aptitude Accounting Hub ('AAH') and Aptitude Insurance Calculation

Engine ('AICE') as SaaS offerings and the subsequent entry into

multi-year SaaS agreements with two North American insurers for

this new service. The launch expands the Group's existing SaaS

capabilities and allows the business to deploy all its key products

using this service, capitalising on the accelerated move to the

cloud that the industry has experienced in 2020. T he availability

of these solutions as SaaS, reducing the demands on clients'

internal capabilities and reducing implementation times and costs,

is also expected to facilitate the greater use of our technology by

more organisations smaller in size than the Group's current client

profile, thereby expanding our market opportunity.

Most new clients are expected to deploy the Group's software

through our SaaS offering, (though an acceleration in the migration

of existing on-premise clients to SaaS is not anticipated in the

short term given the investment in clients' infrastructure

supporting our technology). This dynamic will lead to further

growth in SaaS subscription fees as a proportion of Annual

Recurring Revenue which had increased to 23% as at 31 December 2020

(2019: 17%).

Whilst the revenue model for Aptitude Software's SaaS agreements

is aligned with the existing licencing of our on-premise software

sales, the margins generated by SaaS deployments are lower than

on-premise software as a result of incurring third-party technology

costs and the provision of a level of embedded technical services

within the SaaS offering. Cost efficiencies are expected to be

realised in the medium term as the Group progresses with its

planned investment in both its cloud infrastructure and the

technical evolution of its products.

Partner Network

A strategic priority for the Group continues to be the growth

and development of Aptitude Software's high-quality partner network

with a number of joint new propositions developed in the year.

These propositions have further strengthened our partner programme

which includes deepening relationships with the Big 4 accounting

firms and provides the business either with access to new

geographies for specific products or with the targeting of segments

of existing markets not previously accessible by the Group.

Whilst many prospects are sourced directly by the Group's own

sales and marketing teams, the global reach of our partners and the

depth of their relationships with large businesses provide Aptitude

Software with an increasing number of opportunities, enhanced

market coverage and intelligence. In addition to the new business

benefits provided by the partner network, the implementation

expertise and capabilities of our partners supports the Group's

strategic drive to increase the proportion of software and

subscription revenues.

Investment has increased in the year in both the partner

management team and the education and enablement of our partners to

sell, implement and support our products. We expect this enablement

to facilitate an uplift in the level of services being performed by

partners leading to a richer revenue mix for the business through

an increased weighting towards software revenue.

Expanding Client Presence

As the number of both our clients and products increases there

is a growing opportunity for add-on sales to existing users. These

sales may consist of either increasing the footprint of products

already in use by clients or the cross-sell of other Aptitude

Software products to an existing user.

Investments in strategic account management teams in each of our

regions has resulted in a number of successes in 2020 including the

entry into a SaaS subscription agreement with an existing client (a

leading North American telecommunications company) for the use of

Aptitude Lease Accounting Engine ('ALAE'). ALAE is the fourth of

Aptitude Software's products licenced by the client and further

demonstrates the additional capabilities realisable by using more

than one of Aptitude Software's tightly integrated and

complementary applications. A further success was the licencing in

the first half of 2020 of Aptitude Accounting Hub ('AAH') to an

existing leading European banking client as a key component of

their finance transformation to support the increased reporting

requirements of up to 18 countries. Sales to existing clients

represented approximately one third of new contract additions to

ARR in 2020.

Product Evolution

The Group continues to evolve its product set to address the

requirements of finance functions that are increasingly being

challenged by the demands of operating in a digital world with

growing regulatory and cost pressures. These demands result in an

increase in the complexity, volume and number of sources of finance

data, and the increasing requirement for decision making to move at

the pace of the business in real time.

Our products are moving towards a deeper focus on user

experience as clients increase their expectations of the

operational intelligence and insights required to support more

forward-looking scenario planning. Investment is being increased to

ensure the Group retains its advantages over its competition, both

in the technology architecture and functionality of existing

products as well as the development of new capability to meet the

evolving market requirements.

Acquisitions

Aptitude Software's corporate strategy is focused on organic

growth, however, the Group's strong financial position, together

with its experience of successfully identifying and integrating

acquisitions, provides the Board with the opportunity to accelerate

growth. Any acquisition will be expected to focus on the

acceleration of the product strategy and / or entry into new

markets for Aptitude Software.

Aptitude Innovation Centre

Investment continues in the team at the Aptitude Innovation

Centre, our long-established integrated centre of excellence in

Poland which continues to be a material differentiator for the

Group. The Aptitude Innovation Centre encompasses the development

of the Group's entire product suite and is also increasingly

becoming a focal point for the Group's cloud operations and support

activities. This single integrated centre improves the

collaboration between our teams as they provide software or

associated services to our clients.

Headcount at the Aptitude Innovation Centre increased by 18% in

the year to 162. In addition to recruitment for activities such as

cloud operations and support, growth continued in both new and

existing product development teams as investment in the evolution

of our technology increased.

Our People

The exceptional quality and adaptability of our people has

ensured all business functions have continued successfully despite

the impact of the pandemic. The team is very talented, committed

and works incredibly hard. The Board wishes to thank its employees

in these difficult times both for their outstanding commitment and

the excellent support they are providing to the business and to our

clients and partners whilst working remotely.

During the year a number of investments in our team were

initiated. Aptitude Software's training and enablement function has

been strengthened whilst a number of initiatives focused on

individuals' career development across the business are progressing

well. The Group will continue to develop its internal talent as

well as recruiting the best external skills to help us capitalise

on the market opportunity

Our Products

Aptitude Accounting Hub

The Group continues to leverage the capabilities of the Aptitude

Accounting Hub ('AAH'), securing new agreements with a number of

organisations as they seek to automate and transform their finance

functions. These successes included subscription agreements with

leading North American insurers

Supplementing this new business growth was the entry into a

strategic contract to licence AAH to the retail arm of an existing

major European banking client. Our technology will be a core

component of a five-year finance transformation programme

automating the bank's finance & reporting processes,

demonstrating once again Aptitude Software's capabilities in

finance automation over and above smart compliance. The contract

provides for increased future growth in Annual Recurring Revenue as

AAH is deployed to countries beyond the initial deployment

scope.

The opportunity for AAH remains significant across all our key

industries and is central to Aptitude Software's approach in

addressing organisations' need to drive finance automation to

continue the transformation of their finance functions . This is

supported by recent publications from industry analysts who have

recognised the increasing importance of an accounting hub in modern

finance architecture. The application centralises and automates

finance, accounting and reporting processes, creating a deep level

of operational intelligence for our clients. It also delivers a

consolidated, yet highly granular, single view of financial data

which enhances business insights to assist decision making. AAH can

be used on a standalone basis or in conjunction with other Aptitude

Software applications. Clients can, and do, choose to implement AAH

either before, at the same time, or after the implementation of a

specialised accounting calculation engine such as Aptitude Revenue

Management.

Aptitude Revenue Management

The Group's two revenue management applications, Aptitude

Revenue Recognition Engine and Aptitude RevStream, collectively

Aptitude Revenue Management ('ARM'), have continued to make good

progress in the year. Included within the new business contracts

signed in the year were material subscription agreements for

Aptitude RevStream with a large North American technology business

and a leading medical technology company who subscribed for the use

of the Aptitude RevStream application concurrently with the

Aptitude Lease Accounting Engine, the first combined SaaS agreement

of its kind . A significant sale of the telco-focused Aptitude

Revenue Recognition Engine into North America was also

achieved.

The two applications within ARM enable finance teams to automate

and simplify the whole revenue lifecycle, from contract order to

revenue recognition, reporting and forecasting. The applications go

significantly beyond core IFRS 15 / ASC 606 compliance to allow

total control over complex revenue management for all contract

types ranging from subscription-based revenue models to complex

multi-part or bundled contracts. This capability allows businesses

to understand and control centrally the financial impact of all

their commercial propositions, the quality of their revenue types

as well as providing new and valuable insights to support future

business decision making such as the introduction of new products

in different markets.

Aptitude Insurance Calculation Engine

Further progress with the Aptitude Insurance Calculation Engine

('AICE') has been achieved in 2020 following the previously

outlined delay to the introduction of IFRS 17 (which will now

become effective for accounting periods commencing 1 January 2023).

In addition to the SaaS agreements signed with North American

insurers in the final quarter of 2020, a further significant sale

was made to a European insurer in the opening months of 2021.

AICE is a strategic, transformational investment providing value

to an insurer beyond compliance. It enables data insights and

decision support delivering long-term business benefits.

Demonstrating the capabilities of AICE, during the year Aptitude

Software was recognised as a category leader in "IFRS 17 Technology

Solutions: Market and Vendor Landscape 2020", a Chartis Research

report that assesses leading vendors of IFRS 17 and Long Duration

Targeted Improvement ('LDTI') solutions.

The compliance-focused elements of the application mean that

opportunities remain for this application as the effective date of

IFRS 17 adoption moves closer, not only in the large insurer market

where successes to date have been achieved but also across small

and mid-sized participants who have yet to finalise their

plans.

AptConnect 2020

After a successful inaugural AptConnect in 2019, the business

hosted the second annual event in November 2020. The event was

hosted via a market-leading virtual event platform, which enabled

the business to welcome guests from 4 continents and some 14

countries, bringing together over 500 people representing our

clients, partners and prospects. The conference covered a range of

topics from the digitisation of the finance department to the

launch of Aptitude Accounting Hub and Aptitude Insurance

Calculation Engine as SaaS. The agenda included speakers from our

existing client base detailing their own successful implementation

journeys of the Aptitude Software product suite along with talks

from our partners covering the post-pandemic need to automate

finance.

Our Services

Implementation Services

Aptitude Software provides implementation services to its

clients, with the scale of such services depending on the nature of

the application, the size of the opportunity and the balance of

responsibilities between Aptitude Software and its partners.

Following on from the investment made in 2020, the business

continues to invest in the expansion and enablement of its partner

network to facilitate their ability to implement Aptitude

Software's product suite reliably and efficiently. Whilst this

enablement will lead to a greater proportion of services being

provided by partners, it remains important to maintain a high

quality delivery capability to ensure that the Group can continue

to provide its expertise to both support partners and to those

clients who wish to receive our services directly.

Whilst utilisation has been resilient, Covid disrupted a number

of sales opportunities during the middle quarters of 2020. Due to

the Group's long implementation cycles, services revenue will be

most impacted by this disruption in 2021 and this has in turn

resulted in a reduction in the Group's implementation services

capacity. The investment in our partner strategy means that we

expect future growth in demand for services to be increasingly

fulfilled by the Group's strengthening partner network. This in

turn will allow the Group to drive future margin progression and

revenue visibility by improving the percentage of revenues from

software and subscription fees.

Solution Management Services

Whilst the majority of overall services revenue is associated

with the implementation of Aptitude Software's applications, there

is a growing percentage of revenues derived from Solution

Management Services ('SMS'), with multiple Aptitude Accounting Hub,

Aptitude Insurance Calculation Engine and Aptitude Revenue

Management clients contracting for this service across the Group's

key sectors and geographies in 2020.

This service extends the responsibilities of Aptitude Software

beyond traditional software maintenance services to include those

that have typically been performed by the clients' own IT teams.

These include the monitoring of system performance, user

administration, release management and functional enhancements. In

turn, clients benefit from the reduced requirement to establish

internal technical teams focused on our applications, providing

them with efficiencies and allowing them to focus on their core

business activities. We expect the service (which continues to be a

focus of investment in the business) to enhance the operation and

longevity of applications within major clients, while the long term

and recurring nature of the associated income is expected to

provide greater certainty and visibility to the Group's services

revenues.

Global Presence

Aptitude Software's opportunity is worldwide with an established

presence in APAC, Europe and its largest market, North America,

which represents 59% of Annual Recurring Revenue ('ARR'). This

global reach is supported by the Group's principal offices in

London, Poland, Boston and Singapore.

Whilst activities in APAC, non-EU European states and North

America are unlikely to be impacted by the United Kingdom's

withdrawal from the European Union, Aptitude Software performs its

development at the Aptitude Innovation Centre in Poland and has a

number of on-going implementation projects within European Union

states (2020 revenue from European Union states excluding the

United Kingdom was GBP8.6 million). Whilst travel requirements have

been limited during 2020 due to Covid, prior to this, certain

employees travelled frequently between these countries.

New country by country guidance took effect from 1 January 2021

and it is our expectation that our travel requirements remain

viable but will necessitate some additional planning and

administration. The business has considerable experience in

obtaining work permits to deploy its highly skilled consultants

across the world, and benefits from the flexibility provided by its

partner network. The remote working arrangements put in place as

part of the pandemic continuity plan will also be of benefit,

providing an alternative to physical travel where appropriate. The

business is continuing to clarify the situation; however, the Group

is well-placed to identify and react quickly to further changes in

the operating conditions. The Group also has the option of

expanding the consulting capability of the Aptitude Innovation

Centre, which is located within the European Union.

Outlook

Benefitting from a strong new business performance in the final

quarter of 2020 and a good pipeline, Aptitude Software looks

forward to 2021 with confidence and anticipates a financial outcome

at least consistent with 2020.

Jeremy Suddards

Chief Executive Officer

9 March 2021

Group Financial Performance and Chief Financial Officer's

Report

Revenue

Software and Subscription Revenues

Aptitude Software's Annual Recurring Revenue ('ARR') at 31

December 2020 totalled GBP31.2 million (31 December 2019: GBP28.1

million, 30 June 2020: GBP29.3 million, both restated for the

prevailing exchange rates at 31 December 2020), representing year

on year growth of 11% on a constant currency basis.

ARR is the key financial metric for the Group. Included within

ARR are Aptitude Software's annual licence fees and maintenance for

its on-premise clients and subscription fees for the Group's SaaS

clients. The proportion of clients deploying software using SaaS

has continued to grow with SaaS subscription fees accounting for

23% of the total ARR at 31 December 2020 (2019: 17%).

Highlighting both the strength of our client relationships and

the quality of our product suite, net retention in the year despite

the impact of the pandemic was 102% (2019: 98%) (measured by the

total value of on-going ARR at the year-end from clients in place

at the start of the year as a percentage of the opening ARR from

those clients on a constant currency basis).

Software and subscription revenues recognised in 2020 increased

by 7% to GBP30.5 million (2019: GBP28.5 million). These now

represent 53% of overall revenue (2019: 48%). It is a key part of

the Group's strategy to increase this percentage whilst maximising

the growth rate of Aptitude Software's ARR, a strategy which in due

course will lead to growth in operating margin given the margin

differential between software and services revenues.

Implementation and Solution Management Services

Services revenue totalled GBP26.8 million for the year ended 31

December 2020 (2019: GBP31.2 million) of which 89% is attributable

to the implementation of our software with the balance of 11%

generated from solution management services which, whilst not

included in the Group's Annual Recurring Revenue, are recurring in

nature. Implementation services revenue reduced in the year due to

the disruption to our key markets related to the pandemic. Due to

the Group's long implementation cycles, some further reduction is

anticipated in 2021.

Research and Development Expenditure

Total expenditure on product management, research and

development in the year ended 31 December 2020 was GBP8.5 million

(2019: GBP9.3 million). Despite an 18% overall headcount increase

at the Aptitude Innovation Centre in 2020, the above costs were

lower than 2019 due to the material savings from relocating

development activities for the Aptitude RevStream product from

California to Poland as well as a reduction in travel costs as a

result of Covid. Investment will continue as previously planned in

2021 with costs expected to increase by approximately 20%.

The Board has continued to determine that none of the internal

research and development costs incurred during the first half of

the year meet the criteria for capitalisation. Consequently, these

have been expensed as incurred through the income statement.

Operating Profit and Margins

Adjusted Operating Profit and operating profit on a statutory

basis for the year ended 31 December 2020 were in line with

management expectations at GBP9.1 million and GBP8.1 million

respectively (2019: GBP10.5 million and GBP8.9 million). Adjusted

Operating Margin for the period remained resilient at 16% (2019:

18%) despite the Group continuing to prioritise essential

investment across a number of functions.

Foreign Exchange

With 52% (2019: 53%) of the Group's revenues being generated

from North American clients, the majority of which are invoiced in

US Dollars, the business is impacted by changes in the US dollar

exchange rate. Aptitude Software's 2019 revenue and Adjusted

Operating Profit would have been reported at GBP59.1 million and

GBP10.3 million respectively on a constant currency basis (compared

to actual result of GBP59.7 million and GBP10.5 million). Constant

currency is calculated by comparing the 2020 results with 2019

results retranslated at the rates of exchange prevailing during

2020.

Whilst the Group's exposure to volatility in the US Dollar

exchange rate in the short term is limited, in the medium term the

impact becomes more material, notwithstanding the Group's

significant US cost base, as the proportion of both fixed US Dollar

software revenue (translated at the point of invoicing) and hedged

US Dollar service revenues reduce. From 30 June 2020 to 9 March

2021, the US Dollar has weakened by 13% against the pound reducing

the value of Aptitude Software's ARR reported at 30 June 2020 by

GBP1.8 million.

Due to the benefits of the Group's US cost base, the policy of

translating software revenue at the point of invoice and hedging

services revenue, the profit impact for 2020 was minimal with 2021

only partially impacted.

Non-Underlying Items

Non-underlying items of GBP1.0 million (2019: GBP1.6 million)

principally comprise intangible amortisation (GBP0.8 million), with

the remaining amount in relation to the final separation costs

incurred as part of the disposal of the Microgen Financial Systems

business in 2019.

Taxation

The total tax charge after adjusting for the impact of

non-underlying items of GBP1.6 million (2019: GBP3.3 million)

represents 18.1% of the Group's profit before tax (2019: 24.2%),

with the reduction against the United Kingdom corporate tax rate of

19% and 2019 levels due to the Group's ability to receive

additional tax relief on its research and development expenditure.

This additional relief is expected to continue into future

years.

Statutory Results

The Group reported a profit for the period attributable to

equity shareholders of GBP7.0 million (2019: GBP29.2 million). The

profit in 2019 includes GBP22.4 million from discontinued

operations in respect of the Microgen Financial Systems business

disposed of on the 28 June 2019.

Earnings per Share

As a result of the return of capital in September 2019 and

accompanying share consolidation, Adjusted Basic Earnings per Share

and Basic Earnings per Share from continuing operations increased

to 13.2 pence and 12.5 pence (2019: 12.8 pence and 11.2 pence),

growth of 3% and 12% respectively.

Dividend

A final ordinary dividend of 3.60 pence per share is proposed

(2019: 3.60 pence), making a total ordinary dividend of 5.40 pence

per share for the year (2019: 5.40 pence). The business has not

utilised the furlough scheme nor received any other government

support in the United Kingdom nor in any other country where it

operates.

Balance Sheet

The Group continues to have a strong balance sheet with net

assets at 31 December 2020 of GBP50.6 million (2019: GBP46.4

million), including cash of GBP44.8 million (2019: GBP33.0

million), net funds of GBP42.9 million (2019: GBP30.8 million) and

no bank loan. Trade receivables (net) have reduced to GBP5.9

million (2019: GBP7.2 million), a reduction of GBP1.3 million due

to both strong year end cash collection and the reduction in

services invoicing in 2020. The growth in the Group's recurring

revenues resulted in deferred income increasing to GBP25.7 million

at 31 December 2020 (2019: GBP22.8 million). The Group's cash

collection disciplines remain strong with DSO (debtor days) at 31

December 2020 of 40 (2019: 60).

Cash Generation

Cash generated from continuing operations improved to GBP16.2

million (2019: GBP18.4 million, of which GBP15.3 million was in

relation to the continuing business), with the Group's overall cash

balance increasing by GBP11.9 million in the year. Whilst this

increase is principally due to the Group continuing to benefit from

a growing recurring revenue base with customers typically paying

annually in advance, the cash position has also improved through a

reduction in tax payments and improved working capital pursuant to

the lower services revenue in the year.

Philip Wood

Deputy Chief Executive Officer and Chief Financial Officer

9 March 2021

Group Income Statement

for the year ended 31 December 2020

Year Ended 31 Dec 2020 Year Ended 31 Dec 2019

Before Before

non-underlying Non-underlying non-underlying Non-underlying

Notes items items Total items items Total

Continuing GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

operations

Revenue 1 57,266 - 57,266 59,652 - 59,652

Operating

costs 2 (48,155) (964) (49,119) (49,150) (1,559) (50,709)

Operating

profit 9,111 (964) 8,147 10,502 (1,559) 8,943

--------------- --------------- ----------------- --------------- --------------- --------------

Finance

income 61 - 61 158 - 158

Finance costs (100) - (100) (326) - (326)

--------------- --------------- ----------------- --------------- --------------- --------------

Net finance

costs (39) - (39) (168) - (168)

--------------- --------------- ----------------- --------------- --------------- --------------

Profit before

income tax 9,072 (964) 8,108 10,334 (1,559) 8,775

Income tax

expense 3 (1,585) 514 (1,071) (2,403) 370 (2,033)

--------------- --------------- ----------------- --------------- --------------- --------------

Profit from

continuing

operations 7,487 (450) 7,037 7,931 (1,189) 6,742

Profit from

discontinued

operations 15 - - - 2,549 19,881 22,430

--------------- --------------- ----------------- --------------- --------------- --------------

Profit for

the

year 7,487 (450) 7,037 10,480 18,692 29,172

=============== =============== ================= =============== =============== ==============

Earnings per share from continuing

operations

Basic 4 12.5p 11.2p

----------------- --------------

Diluted 4 12.3p 11.0p

----------------- --------------

Earnings per

share

Basic 4 12.5p 48.4p

----------------- --------------

Diluted 4 12.3p 47.7p

----------------- --------------

group statement of comprehensive income

For the year ended 31 December 2020

Year ended Year ended

31 Dec 2020 31 Dec 2019

GBP000 GBP000

Profit for the year 7,037 29,172

------------- -------------

Other comprehensive income/(expense)

Items that will or may be reclassified to profit

or loss:

Fair value gain/(loss) on hedged instruments 45 (186)

Currency translation difference (988) (415)

Other comprehensive income from discontinued operations - 22

------------- -------------

Other comprehensive expense for the year, net of

tax (943) (579)

------------- -------------

Total comprehensive income for the year 6,094 28,593

============= =============

Total comprehensive income for the year arising

from:

Continuing operations 6,094 6,141

Discontinued operations - 22,452

------------- -------------

6,094 28,593

============= =============

Group Balance Sheet

For the year ended 31 December 2020

As at As at

31 Dec 2020 31 Dec 2019

Notes GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment including right-of-use

assets 6 2,394 3,207

Goodwill 7 23,787 23,787

Intangible assets 8 5,640 6,486

Other long-term assets 1,472 1,746

Income tax assets 642 944

Deferred tax assets 448 1,198

34,383 37,368

------------------- -------------------

Current assets

Trade and other receivables 9 7,782 9,659

Financial assets - derivative financial instruments 62 4

Current income tax assets 1,161 1,155

Cash and cash equivalents 44,822 32,965

------------------- -------------------

53,827 43,783

Total assets 88,210 81,151

------------------- -------------------

LIABILITIES

Current liabilities

Financial liabilities

- derivative financial instruments (133) (120)

Trade and other payables 10 (33,652) (30,122)

Capital lease obligations 11 (881) (835)

Current income tax liabilities (247) (485)

Provisions 12 - (38)

(34,913) (31,600)

------------------- -------------------

Net current assets 18,914 12,183

------------------- -------------------

Non-current liabilities

Capital lease obligations 11 (972) (1,288)

Provisions 12 (441) (337)

Deferred tax liabilities (1,236) (1,502)

------------------- -------------------

(2,649) (3,127)

------------------- -------------------

NET ASSETS 50,648 46,424

=================== ===================

Group Balance Sheet

For the year ended 31 December 2020

As at As at

31 Dec 2020 31 Dec 2019

Notes GBP000 GBP000

SHAREHOLDERS' EQUITY

Share capital 13 4,143 4,128

Share premium account 7,828 7,660

Capital redemption reserve 12,372 12,372

Other reserves 34,124 34,079

Accumulated losses (6,165) (11,149)

Foreign currency translation reserve (1,654) (666)

TOTAL EQUITY 50,648 46,424

============================= ====================

Group Statement of changes in shareholders' equity

for the Year Ended 31 December 2020

Foreign

currency Capital

Share Share Accumulated translation redemption Total

capital premium losses reserve reserve Other Equity

GBP000 GBP000 GBP000 GBP000 GBP000 reservesGBP000 GBP000

At 1 January

2020 4,128 7,660 (11,149) (666) 12,372 34,079 46,424

========== ========== ============== ============== ============= ================ =========

Profit for the

year - - 7,037 - - - 7,037

Cash flow

hedges

- net fair

value

gains in the

year - - - - - 45 45

Exchange rate

adjustments - - - (988) - - (988)

---------- ---------- -------------- -------------- ------------- ---------------- ---------

Total

comprehensive

income for the

year - - 7,037 (988) - 45 6,094

---------- ---------- -------------- -------------- ------------- ---------------- ---------

Shares issued

under

share option

schemes 15 168 - - - - 183

Share options -

value of

employee

service - - 337 - - - 337

Deferred tax on

financial

instruments - - 9 - - - 9

Deferred tax on

share options - - (118) - - - (118)

Corporation tax

on share

options - - 763 - - - 763

Dividends to

equity

holders of the

company - - (3,044) - - - (3,044)

Total

Contributions

by and

distributions

to owners of

the

company

recognised

directly in

equity

income 15 168 (2,053) - - - (1,870)

---------- ---------- -------------- -------------- ------------- ---------------- ---------

At 31 December

2020 4,143 7,828 (6,165) (1,654) 12,372 34,124 50,648

========== ========== ============== ============== ============= ================ =========

Group Cash Flow Statement

for the Year Ended 31 December 2020

Year ended Year ended

31 Dec 2020 31 Dec 2019

Notes GBP000 GBP000

Cash flows from operating activities

Cash generated from operations 14 16,238 18,420

Interest paid (100) (326)

Income tax received/(paid) 281 (2,077)

Net cash flows generated from operating activities 16,419 16,017

-------------- --------------

Cash flows from investing activities

Purchase of property, plant and equipment,

excluding right-of-use assets (232) (828)

Disposal of subsidiary, net of cash disposed - 47,152

Interest received 61 158

Net cash (used in)/generated from investing

activities (171) 46,482

-------------- --------------

Cash flows from financing activities

Net proceeds from issuance of ordinary share

capital 183 1,368

Dividends paid to company's shareholders 5 (3,044) (3,859)

Repayment of loan - (8,000)

Payment of capital lease obligations (924) (1,127)

Return of value to shareholders - (46,420)

Expenses relating to return of value - (600)

Net cash used in financing activities (3,785) (58,638)

-------------- --------------

Net increase in cash and cash equivalents 12,463 3,861

Cash, cash equivalents and bank overdrafts

at beginning of year 32,965 29,186

Exchange rate losses on cash and cash equivalents (606) (82)

Cash and cash equivalents at end of year 44,822 32,965

============== ==============

Notes to the Audited preliminary results for the year ended 31

December 2020

1. Segmental analysis

Business segments

The Board has determined the operating segments based on the

reports it receives from management to make strategic

decisions.

During the prior year Aptitude Software Group plc operated two

businesses, Aptitude Software and Microgen Financial Systems, both

of which were considered operating segments based on the reports

the Group received from management to make strategic decisions.

With the disposal of Microgen Financial Systems on 28 June 2019,

the only continuing business segment in the year ending 31 December

2020 was Aptitude Software and therefore certain segmental analysis

is no longer required to be provided for this period.

The principal activity of the Group throughout 2019 and 2020 was

the provision of business-critical software and services.

1(a) Geographical analysis

The Group has two geographical segments for reporting purposes,

the United Kingdom and the Rest of the World.

The following table provides an analysis of the Group's sales by

origin and by destination.

Sales revenue by origin Sales revenue by destination

Year ended Year ended Year ended Year ended

31 Dec 2020 31 Dec 2019 31 Dec 2020 31 Dec 2019

Continuing operations GBP000 GBP000 GBP000 GBP000

United Kingdom 32,096 32,194 9,571 8,419

Rest of World 25,170 27,458 47,695 51,233

57,266 59,652 57,266 59,652

============= ============= =============== ==============

2. Non-underlying items

31 Dec 2020 31 Dec 2019

GBP000 GBP000

Continuing operations

Amortisation of intangibles 846 846

Overseas taxation - 713

Group reorganisation costs 118 -

964 1,559

============ ============

3. Income tax expense

Year ended Year ended

31 Dec 2020 31 Dec 2019

Analysis of charge in the year GBP000 GBP000

Current tax:

- tax charge on underlying items (1,114) (3,992)

- tax credit on non-underlying items 22 125

- adjustment to tax in respect of prior

periods 132 145

- adjustment to tax in respect of prior

periods on non-underlying items 255 -

Total current tax (705) (3,722)

------------- -------------

Deferred tax:

- tax (charge)/credit on underlying items (274) 722

- tax credit on non-underlying items 237 361

- adjustment to tax in respect of prior

periods (329) 75

Total deferred tax (366) 1,158

------------- -------------

Income tax expense (1,071) (2,564)

============= =============

Income tax expense is attributable to:

Profit from continuing operations (1,071) (2,033)

Profit from discontinued operations - (531)

------------- -------------

(1,071) (2,564)

============= =============

The adjustment to tax in respect of prior periods on

non-underlying items totalling GBP255,000 has been created through

the benefit from additional research and development relief. The

adjustment to tax in respect of prior periods on underlying items

totalling GBP329,000 relates to the reduction in the assumed

benefit from share option deductions.

The total tax charge of GBP1,071,000 (2019: GBP2,564,000)

represents 13.21% (2019: 8.08%) of the Group profit before tax of

GBP8,108,000 (2019: GBP31,736,000). The prior year reduction in

effective rate is due principally to the impact of the exempt gain

on disposal of Microgen Financial Systems Limited, see note 15 for

details.

After adjusting for the impact of non-underlying items, change

in tax rates, share based payment charge and prior year tax charge,

the tax charge for the year of GBP1,643,000 (2019: GBP3,270,000)

represents 18.11% (2019: 24.17%), which is the tax rate used for

calculating the adjusted earnings per share. The reduction in rate

against the prior year is due to the research and development tax

relief obtained in the year.

At 31 December 2019, the Group had unused tax losses totalling

GBP4,329,000 available for offset against future profits. A

deferred tax asset of GBP742,000 was recognised in respect of these

losses as the Group anticipated being able to utilise these in full

in the year ending 31 December 2020. In line with expectations,

during 2020 these losses were utilised in full. Consequently, no

unused tax losses at 31 December 2020 were available for

offset.

The difference between the total tax charge and the amount

calculated by applying the effective United Kingdom corporation tax

rate of 19.00% (2019: 19.00%) to the profit on ordinary activities

before tax is as follows:

Year ended Year ended

31 Dec 2020 31 Dec 2019

GBP000 GBP000

Profit from continuing operations before

tax 8,108 8,775

Profit from discontinued operations before

tax - 22,961

------------- -------------

8,108 31,736

Tax at the United Kingdom corporation tax

rate of 19.00% (2019: 19.00%) (1,540) (6,030)

Effects of:

Adjustment to tax in respect of prior periods 58 271

Adjustment in respect of foreign tax rates (138) (306)

Expenses not deductible for tax purposes (27) (186)

Exempt gain on disposal - 3,894

Other (29) (135)

Research and development tax relief 618 -

Recognition of tax losses - 25

Change in future tax rates (13) (97)

Total taxation (1,071) (2,564)

============= =============

United Kingdom corporation tax is calculated at 19.00% (2019:

19.00%) of the estimated assessable profit for the year. Taxation

for other jurisdictions is calculated at the rates prevailing in

the respective jurisdictions.

4. Earnings per share

To provide an indication of the underlying operating performance

per share, the adjusted profit after tax figure shown below

excludes non-underlying items and has a tax charge using the

effective rate of 18.11% (2019: 24.17%).

Year ended Year ended

31 Dec 2020 31 Dec 2019

GBP000 GBP000

Profit on continuing operations before tax

and non-underlying items 9,072 10,334

Profit on discontinued operations before

tax and non-underlying items - 3,196

------------- -------------

Profit on ordinary activities before tax

and non-underlying items 9,072 13,530

Tax charge at a rate of 18.11% (2019: 24.17%) (1,643) (3,270)

------------- -------------

7,429 10,260

Prior years' tax charge 58 220

Non-underlying items net of tax (450) 18,692

Profit on ordinary activities after tax 7,037 29,172

============= =============

2020 2019

Number Number

(thousands) (thousands)

Weighted average number of shares 56,339 60,280

Effect of dilutive share options 780 865

57,119 61,145

============= =============

2020 2020 2019 2019

Basic Diluted Basic Diluted

EPS EPS EPS EPS

Pence pence pence pence

Earnings per share 12.5 12.3 48.4 47.7

Non-underlying items net of tax 0.8 0.8 (31.0) (30.6)

Prior years' tax credit (0.1) (0.1) (0.4) (0.4)

Adjusted earnings per share 13.2 13.0 17.0 16.7

======= ========= ======= =========

Basic earnings per share

From continuing operations 12.5 12.3 11.2 11.0

From discontinued operations - - 37.2 36.7

------- --------- ------- ---------

12.5 12.3 48.4 47.7

======= ========= ======= =========

Adjusted earnings per share

From continuing operations 13.2 13.0 12.8 12.5

From discontinued operations - - 4.2 4.2

------- --------- ------- ---------

13.2 13.0 17.0 16.7

======= ========= ======= =========

Adjusted earnings per share are calculated using adjusted profit

after tax.

5. Dividends

2020 pence 2019 pence 2020 2019

per share per share GBP000 GBP000

Dividends paid:

Interim dividend 1.80 1.80 1,015 1,144

Final dividend (prior year) 3.60 4.40 2,029 2,715

5.40 6.20 3,044 3,859

=========== =========== ======== ========

Proposed but not recognised

as a liability:

Final dividend (current year) 3.60 3.60 2,031 2,024

=========== =========== ======== ========

The proposed final dividend for the current year was approved by

the Board on 9 March 2021 but was not included as a liability as at

31 December 2020, in accordance with IAS 10 'Events after the

Balance Sheet date'. If approved by the shareholders at the Annual

General Meeting this final dividend will be payable on 28 May 2021

to shareholders on the register at the close of business on 7 May

2021.

6. Property, plant and equipment including right-of-use

assets

31 Dec 2020 31 Dec

2019

GBP000 GBP000

Opening net book value 1 January 3,207 5,417

Additions 775 925

On disposal of subsidiary (note 15) - (1,213)

Net disposals (41) (67)

Exchange movements 26 (11)

Depreciation (1,573) (1,844)

2,394 3,207

============ ========

7. Goodwill

31 Dec 2020 31 Dec

2019

GBP000 GBP000

Opening net book value 1 January 23,787 48,793

On disposal of subsidiary (note 15) - (25,006)

------------ ---------

23,787 23,787

============ =========

8. Intangible assets

31 Dec 2020 31 Dec

2019

GBP000 GBP000

Opening net book value 1 January 6,486 14,186

On disposal of subsidiary (note 15) - (6,308)

Amortisation (846) (1,392)

------------ --------

5,640 6,486

============ ========

9. Trade and other receivables

31 Dec 2020 31 Dec

2019

GBP000 GBP000

Trade receivables 5,881 7,218

Less: provision for impairment of receivables - (19)

------------ -------

Trade receivables - net 5,881 7,199

Other receivables 499 1,127

Prepayments 791 795

Accrued income 611 538

7,782 9,659

============ =======

Within the trade receivables balance of GBP 5,881,000 (2019: GBP

7,218,000) there are balances totalling GBP 1,453,000 (2019: GBP

1,934,000) which, at 31 December 2020, were overdue for payment. Of

this balance GBP 1,433,000 (2019: GBP1,313,000) has been collected

at 9 March 2021 (2019: 10 March 2020).

10. Trade and other payables

31 Dec 2020 31 Dec

2019

GBP000 GBP000

Trade payables 600 1,509

Other tax and social security payable 2,020 1,549

Other payables 166 92

Accruals 5,163 4,130

Deferred income 25,703 22,842

33,652 30,122

============ =======

11. Capital lease obligations

The Group leases various offices which, following the adoption

of IFRS 16, met the criteria set out to be recognised as capital

lease agreements.

31 Dec 2020 31 Dec

2019

GBP000 GBP000

Amounts payable under capital lease agreements:

Within one year 908 901

Within two to five years 1,084 1,171

After five years - 229

------------ -------

Total 1,992 2,301

Less: future finance charges (139) (178)

------------ -------

Present value of lease obligations 1,853 2,123

Less: Amount due for settlement within 12 months

(shown under current liabilities) (881) (835)

972 1,288

============ =======

31 Dec 2020 31 Dec

2019

GBP000 GBP000

The present value of financial lease liabilities

is split as follows:

Within one year 881 835

Within two to five years 972 1,064

After five years - 224

1,853 2,123

============ =======

12. Provisions for other liabilities and charges

Provisions

31 Dec 2020 31 Dec 2019

GBP000 GBP000

At 1 January 375 424

Charged to income statement 69 90

On disposal of subsidiary - (132)

Foreign exchange movement (3) (7)

At 31 December 441 375

============ ============

Provisions have been analysed between current and non-current as

follows:

Provisions

31 Dec 2020 31 Dec 2019

GBP000 GBP000

Current - 38

Non-current 441 337

441 375

============ ============

GBP 386,000 (2019: GBP 317,000) of the total provision at 31

December 2020 of GBP 441,000 relates to the cost of dilapidations

in respect of its occupied leasehold premises. All of the

non-current provision is expected be utilised within 2 to 5 years

(2019: GBP 337,000).

13. Share capital

Ordinary shares of 7 1/3p each Number GBP000

Issued and fully paid:

At 1 January 2020 56,217,970 4,128

Issued under share option schemes 210,997 15

At 31 December 2020 56,428,967 4,143

=========== =======

14. Cash flows from operating activities

Reconciliation of profit before tax to net cash generated from

operations:

Year ended Year ended

31 Dec 2020 31 Dec 2019

GBP000 GBP000

Profit before tax for the year from

Continuing operations 8,108 8,775

Discontinued operations - 22,961

------------- -------------

Profit before tax including discontinued operations 8,108 31,736

Adjustments for:

Depreciation 1,573 1,844

Amortisation 846 1,392

Overseas taxation provision - 713

Share-based payment expense 337 1,033

Gain on disposal of subsidiary, excluding

direct costs incurred - (23,657)

Finance income (61) (158)

Finance costs 100 326

Changes in working capital excluding the effects

of acquisition:

Decrease in receivables 1,917 1,493

Increase in payables 3,484 3,900

Decrease in provisions (66) (202)

Cash generated from operations 16,238 18,420

============= =============

Cash generated from operations is from:

Continuing operations 16,238 15,295

Discontinued operations - 3,125

------------- -------------

16,238 18,420

============= =============

15. Discontinued operations

15(a) Description

On 30 May 2019, the Group announced that it had entered into an

agreement to sell the entire issued share capital of Microgen

Financial Systems Limited, to Moscow Bidco Limited, a newly

incorporated private limited company controlled by Silverfleet

Capital Partners LLP, for consideration of GBP 51.4 million. The

disposal was approved by Aptitude Software Group plc's shareholders

at a General Meeting held on 24 June 2019, with completion of the

disposal effective on 28 June 2019 and is reported in the current

period as a discontinued operation. Financial information relating

to the discontinued operation for the period to the date of

disposal is set out below, with the gain on disposal being

presented within the profit from discontinued operation (see

analysis in 15(b) below).

15(b) Financial information and cash flow information

The financial performance and cash flow information presented

are for the period 1 January 2019 to 28 June 2019.

Period from

1 Jan 2019

to

28 June 2019

GBP000

Income statement

Revenue 8,089

Operating costs (4,866)

--------------

Adjusted Operating Profit 3,223

Non-underlying items (540)

Gain on disposal of subsidiary -

--------------

Operating profit 2,683

Finance income 2

Finance costs (29)

--------------

Profit before income tax 2,656

Income tax expense (531)

--------------

Profit after tax from discontinued operation 2,125

Gain on disposal of subsidiary after tax (see (c)) 20,305

--------------

Cash generated from operations 22,430

==============

Other comprehensive income

Items that will or may be reclassified to profit or

loss

Currency translation gain 22

--------------

Total comprehensive income for the year arising from

discontinued operations 22,452

--------------

Profit from non-underlying items is generated from:

Non-underlying operating costs (540)

Gain on disposal of subsidiary 20,305

Income tax credit 116

--------------

19,881

==============

Period from

1 Jan 2019

to

28 June 2019

Cash flow statement GBP000

Net cash from operating activities 3,125

Net cash generated from investing activities (includes an

inflow of GBP47,152,000 from the sale) 47,078

Net cash generated from financing activities 554

--------------------

Net increase in cash generated by the subsidiary 50,757

====================

15(c) Details of the sale of the subsidiary

Book value

GBP000

Net assets disposed

Property, plant and equipment 1,213

Goodwill 25,006

Intangible assets 6,308

Other long-term assets 257

Deferred income tax assets 302

Trade and other receivables 3,267

Cash and cash equivalents 4,259

Trade and other payables (9,299)

Capital lease obligations (815)

Current income tax liabilities (1,298)

Provisions for liabilities and charges (132)

Deferred tax liabilities (1,314)

-----------

NET ASSETS 27,754

===========

Consideration received

Proceeds received on completion 51,411

Less: direct costs incurred (3,352)

-----------

48,059

===========

Gain on disposal excluding direct costs incurred 23,657

===========

Gain on disposal 20,305

===========

16. Post balance sheet events

Since the year end, new country by country guidance took effect

in respect of the United Kingdom's withdrawal from the European

Union. The withdrawal represents a non-adjusting event for the

purposes of these financial statements and, even if it had

represented an adjusting event the Directors believe the impact of

this would have been immaterial. This is based on the conclusions

set out within the Chief Executive Officer's Report.

In addition, the Group continues to be affected by the global

restrictions implemented by governments in response to the COVID-19

outbreak detailed within the Chief Executive Officer's Report. This

impact remains unchanged since the year end.

17. Statement by the directors

The preliminary results for the year ended 31 December 2020 and

the results for the year ended 31 December 2019 are prepared under

International Financial Reporting Standards as adopted for use in

the EU ("IFRS"). The accounting policies adopted in this

preliminary announcement are consistent with the Annual Report for

the year ended 31 December 2020.

The financial information set out in this preliminary

announcement does not constitute the Company's statutory accounts

for the years ended 31 December 2020 or 31 December 2019. The

financial information for the year ended 31 December 2019 is

derived from the Annual Report delivered to the Registrar of

Companies. The Annual Report for 2020 will be delivered to the

Registrar of Companies in due course. The auditors' report on those

accounts was unqualified and neither drew attention to any matters

by way of emphasis nor contained a statement under either section

498(2) of Companies Act 2006 (accounting records or returns

inadequate or accounts not agreeing with records and returns), or

section 498(3) of Companies Act 2006 (failure to obtain necessary

information and explanations).

The Board of Aptitude Software Group plc approved the release of

this audited preliminary announcement on 10 March 2021.

The Annual Report for the year ended 31 December 2020 will be

posted to shareholders in due course and will be delivered to the

Registrar of Companies following the Annual General Meeting of the

Company. The report will also be available on the investor

relations page of our web site (www.aptitudesoftware.com). Further

copies will be available on request and free of charge from the

Company Secretary at Old Change House, 128 Queen Victoria Street,

London, EC4V 4BJ.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFVDVRIAIIL

(END) Dow Jones Newswires

March 10, 2021 02:00 ET (07:00 GMT)

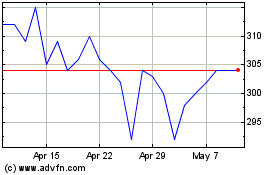

Aptitude Software (LSE:APTD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aptitude Software (LSE:APTD)

Historical Stock Chart

From Apr 2023 to Apr 2024