TIDMBRK

RNS Number : 5117V

Brooks Macdonald Group PLC

15 April 2021

15 April 2021

BROOKS MACDONALD GROUP PLC

Quarterly Announcement of Funds under Management

"Positive net flows in UK Investment Management underline

continued strategic momentum"

Brooks Macdonald Group plc ("Brooks Macdonald" or the "Group")

today publishes a n update on Funds under Management ("FUM") for

its third quarter ended 31 March 2021 .

Total FUM increased 0.9% in the quarter, ending the period at

GBP15.6 billion (31 December 2020: GBP15.5 billion) as strategic

momentum continued to build from the first half. The increase was

driven by positive net flows in UK Investment Management ("UKIM"),

particularly in the Managed Portfolio Service ("MPS"), as well as

further positive investment performance.

-- UKIM had its best quarter of the financial year to date

across all its core offerings, delivering net inflows of 0.3%

-- In UKIM discretionary, MPS had strong positive net flows of

7.1%, driven in particular by Investment Solutions and Platform

MPS. Bespoke Portfolio Service ("BPS") net flows continued to

improve despite the ongoing challenges of operating remotely, with

specialist products performing strongly

-- Funds saw net flows of (3.4)%, driven predominantly by the

Defensive Capital Fund which continued to reflect negative trends

in the Targeted Absolute Return sector, although outflows were

lower than in the prior two quarters

-- International experienced increased outflows in the quarter,

with net flows of (3.1)%. The reinvigoration of the business and

integration of the Lloyds Channel Islands acquisition continued to

make progress and medium-term prospects remain positive

-- Q3 investment performance was 1.1%, compared to the benchmark

MSCI PIMFA Private Investor Balanced Index at 1.6%. For the

financial year to date, investment performance was 10.8%, ahead of

the benchmark index which was up 8.2%.

The Group's focus on delivering for intermediaries and clients

throughout the pandemic has generated a strong and growing

pipeline, and the Group continues to expect total net flows to be

modestly positive in H2.

Caroline Connellan, CEO of Brooks Macdonald commented:

"It has been another quarter of delivery against our strategy

evidenced by good performance in our core UKIM business, the

continued positive trend in overall net flows, and a healthy

pipeline. This momentum is testament to our people and I am once

again grateful to them for their relentless commitment to

delivering for intermediaries and clients in challenging

circumstances. We remain on track to achieve full year expectations

and we are well positioned to continue delivering sustainable,

value-enhancing growth."

Analysis of fund flows by service over the period

Quarter to 31 March 2021 (GBPm)

Opening Organic Investment Closing Organic Total

FUM net new performance FUM net new mvmt

1 Jan 21 business in the period 31 Mar 21 business

---------- ---------- --------------- ----------- ---------- -------

BPS 8,910 (26) 134 9,018 (0.3)% 1.2%

---------- ---------- --------------- ----------- ---------- -------

MPS 1,962 139 28 2,129 7.1% 8.5%

---------- ---------- --------------- ----------- ---------- -------

UKIM discretionary 10,872 113 162 11,147 1.0% 2.5%

---------- ---------- --------------- ----------- ---------- -------

Funds - DCF 509 (41) 12 480 (8.1)% (5.7)%

---------- ---------- --------------- ----------- ---------- -------

Funds - Other 1,536 (28) 15 1,523 (1.8)% (0.8)%

---------- ---------- --------------- ----------- ---------- -------

Funds total 2,045 (69) 27 2,003 (3.4)% (2.1)%

---------- ---------- --------------- ----------- ---------- -------

UKIM total 12,917 44 189 13,150 0.3% 1.8%

---------- ---------- --------------- ----------- ---------- -------

International 2,586 (79) (19) 2,488 (3.1)% (3.8)%

---------- ---------- --------------- ----------- ---------- -------

Total 15,503 (35) 170 15,638 (0.2)% 0.9%

---------- ---------- --------------- ----------- ---------- -------

Total investment performance 1.1%

-------------------------------------------------------------------------- -------------------

MSCI PIMFA Private Investor Balanced Index(1) 1.6%

-------------------------------------------------------------------------- -------------------

Nine months to 31 March 2021 (GBPm)

Opening Organic Organic Organic FUM acquired Inv. Closing Total Total

FUM net new net new net new in the Perf. FUM organic mvmt

1 Jul business business business period(2) in the 31 Mar net new

20 Q1 Q2 Q3 period 21 business

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

BPS 8,247 (119) (43) (26) - 959 9,018 (2.3)% 9.3%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

MPS 1,809 (81) 40 139 - 222 2,129 5.4% 17.7%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

UKIM

discretionary 10,056 (200) (3) 113 - 1,181 11,147 (0.9)% (10.8)%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

Funds -

DCF 617 (73) (74) (41) - 51 480 (30.5)% (22.2)%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

Funds -

Other 1,434 (27) (10) (28) - 154 1,523 (4.5)% 6.2%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

Funds total 2,051 (100) (84) (69) - 205 2,003 (12.3)% (2.3)%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

UKIM total 12,107 (300) (87) 44 - 1,386 13,150 (2.8)% 8.6%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

International 1,578 39 (19) (79) 882 87 2,488 (3.7)% 57.7%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

Total 13,685 (261) (106) (35) 882 1,473 15,638 (2.9)% 14.3%

-------- ---------- --------- --------- ------------ -------- -------- ---------- --------

Total investment performance 10.8%

---------------------------------------------------------------------------------------------- --------------------

MSCI PIMFA Private Investor Balanced Index(1) 8.2%

---------------------------------------------------------------------------------------------- --------------------

(1) Capital-only index.

(2) Closing FUM of the acquired Lloyds Bank International's

Channel Islands wealth management and funds business at the

completion date, 30 November 2020.

Enquiries to:

Brooks Macdonald Group plc www.brooksmacdonald.com

Caroline Connellan, CEO 020 7659 3492

Ben Thorpe, Group Finance Director

Peel Hunt LLP (Nominated Adviser and Broker)

Rishi Shah / John Welch 020 7418 8900

FTI Consulting brooksmacdonald@fticonsulting.com

Ed Berry / Laura Ewart / Katherine Bell 07703 330199 / 07711

387085 / 07976 870961

Notes to editors

Brooks Macdonald Group plc, through its various subsidiaries,

provides leading investment management services in the UK and

internationally. The Group, which was founded in 1991 and began

trading on AIM in 2005, had discretionary Funds under Management of

GBP15.6 billion as at 31 March 2021.

Brooks Macdonald offers a range of investment management

services to private high net worth individuals, pension funds,

institutions, charities and trusts. The Group also provides

financial planning as well as international investment management,

and acts as fund manager to a range of onshore and international

funds.

The Group has twelve offices across the UK and the Channel

Islands including London, East Anglia, Hampshire, Leamington Spa,

Leeds, Manchester, Taunton, Tunbridge Wells, Scotland, Wales,

Jersey and Guernsey.

LEI: 213800WRDF8LB8MIEX37

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPUUGCUPGGMC

(END) Dow Jones Newswires

April 15, 2021 02:00 ET (06:00 GMT)

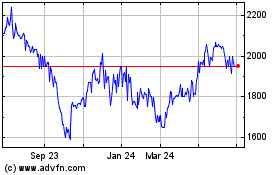

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

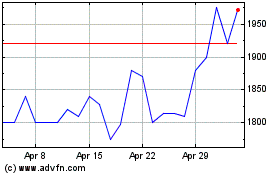

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Apr 2023 to Apr 2024