Microsoft Shows Strong Growth in Gaming, Cloud -- 3rd Update

April 27 2021 - 6:04PM

Dow Jones News

By Aaron Tilley

Microsoft Corp. extended its pandemic-fueled run of strong

quarterly earnings that have bolstered investor enthusiasm in the

software giant, bringing the company near a $2 trillion

valuation.

Microsoft has seen massive growth across its professional and

consumer businesses with people stuck at home and remote work and

distance education becoming the norm for many. That has driven

rapid uptake of its cloud-computing services and supercharged the

company's videogaming sales. Microsoft's stock is up around 50%

over the past year, driving the company's valuation to about $1.97

trillion, second only to Apple Inc.

"Over a year into the pandemic, digital adoption curves aren't

slowing down. They're accelerating, " Microsoft Chief Executive

Satya Nadella said in a statement.

The Redmond, Wash., company posted a 19% increase in its fiscal

third-quarter sales to about $41.7 billion, generating net income

of $15.5 billion for the January through March period. The results

beat Wall Street expectations, according to FactSet.

Microsoft shares retreated around 3% in after-hours trading

after a strong run-up in the stock ahead of earnings.

"Now there are worries about the sustainability of Microsoft

post-pandemic," said Rishi Jaluria, an analyst for investment

research firm D.A. Davidson & Co.

Microsoft's hardware sales were affected by chip shortages, said

Kyle Vikström, a director of investor relations at the company. The

impact was chiefly on its Xbox gaming consoles and Surface laptops,

she said.

The company's videogaming activity has been particularly hot

during the pandemic. Xbox content and services revenue increased

34% in the latest quarter aided by the recent release of two new

consoles, Xbox Series X and S. Xbox hardware revenue more than

tripled from the previous year.

Revenue from Surface laptops, which have been popular with

people working and learning from home, rose 12% from a year ago.

Surface sales are expected to decline in the current quarter, Chief

Financial Officer Amy Hood said on an analyst call, in part because

of the chip-supply issues.

Strong demand for cloud services late last year helped Microsoft

reverse a trend of a gradually declining pace of growth. The

company said sales linked to Azure cloud services advanced 50% in

the most recent quarter, on par with the December quarter.

Azure, the collection of a global network of data centers and

software tools Microsoft sells as a service, last year became a

larger revenue source for the company than its Windows operating

system, Piper Sandler analyst Brent Bracelin has said. Microsoft is

No. 2 in the cloud behind Amazon.com Inc.

Azure growth had been slowing before the pandemic hit as the

business gained scale. Microsoft sees a return to that pattern as

likely.

"We're getting into the law of large numbers" on Azure's growth,

said Microsoft's Ms. Vikström. "We expect over time that it's going

to decelerate as numbers get bigger."

Microsoft also was able to popularize during the pandemic its

Teams workplace collaboration suite that offers features competing

with companies such as Zoom Video Communications Inc. and Slack

Technologies Inc. Teams usage rose from 20 million active users

before the pandemic in November 2019 to reach more than 145 million

today, Mr. Nadella said.

Microsoft also benefited from the broad strength in the

advertising market. Its search advertising business was up 17%, and

ad-spending also helped lift revenue at LinkedIn, the professional

social-media network, by 25%.

Tech rival Alphabet Inc. on Tuesday reported a 34% jump in

first-quarter sales from the year earlier, driven by a surge in

digital ad spending.

Microsoft's Ms. Hood said she expected "another strong quarter"

for the three months ending in June. The company forecast $43.6

billion to $44.5 billion in sales in the three-month period,

beating Wall Street expectations.

--For more WSJ Technology analysis, reviews, advice and

headlines,

sign up for our weekly newsletter

.

Write to Aaron Tilley at aaron.tilley@wsj.com

(END) Dow Jones Newswires

April 27, 2021 18:49 ET (22:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

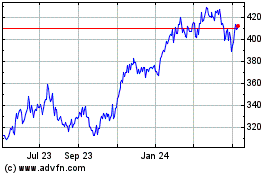

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

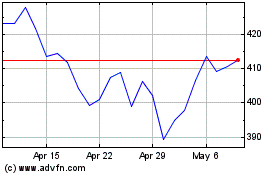

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024