TIDMGBP

RNS Number : 9861W

Global Petroleum Ltd

29 April 2021

29 April 2021

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR'). Upon the

publication of this announcement via a Regulatory Information

Service ('RIS'), this inside information is now considered to be in

the public domain.

Global Petroleum Limited

("Global" or "the Company")

Placing to raise GBP1.0 million

Appointment of Joint Broker

Global Petroleum Limited (AIM: GBP) is pleased to announce that

it has successfully raised GBP1,000,000 million in aggregate before

costs (the "Placing"), through the Placing of 222,222,222 Ordinary

Shares (the "Placing Shares") at a Placing Price of 0.45 pence per

share.

As a further component of the Placing, 111,111,111 Warrants are

also being issued at an exercise price of 0.9 pence per share for a

period of 2 years (one Warrant for every two new Ordinary Shares).

In the event the Warrants are exercised in due course in full,

associated proceeds will be GBP1.0 million, with the result that

the Company will have raised gross proceeds of GBP2.0 million at a

weighted average price of 0.60 pence per share.

Monecor (London) Ltd, trading as ETX Capital ("ETX Capital"),

acted as the Company's sole broker in respect of the Placing, and

will serve as Joint Broker to the Company effective upon Admission

of the Placing Shares.

Rationale for the Placing

In January 2021 the Company announced its updated Prospective

Resources on its Namibian licence PEL0094. The inclusion of seven

new leads, in addition to the Marula and Welwitschia Deep

prospects, resulted in a threefold increase to 2,284 million

barrels of Best Estimate (P50) Prospective Resources of oil net to

Global, confirming the Company's view that the acreage is highly

prospective.

Following this, Global then commenced a farm-out process, which

is currently underway.

The Company has completed its work commitments under the current

licence sub-period, which expires in September 2021. The commitment

for the next sub-period is to shoot a 2,000 square km 3D seismic

survey.

Namibia has seen multiple farm-ins or acquisitions completed

since 2017 by companies such as Qatar Petroleum, Total, ONGC,

Kosmos, and most notably ExxonMobil. Moreover, there are reported

to be several highly prospective exploration wells planned in the

coming months, notably Total's Venus-1 well, and Shell's well in

PEL0039, both in Namibia's Orange Basin.

The Placing will position the Company to enter into the next

sub-phase of PEL0094 in September 2021. Proceeds from the Placing

will be used to part-fund the cost of the future licence work

programme commitment, and for general working capital purposes.

Admission of and Dealings in the Placing and Subscription

Shares

Application has been made to AIM for the Placing Shares, which

will rank pari passu with existing Ordinary Shares, to be admitted

to trading on AIM ("Admission"). Dealings are expected to commence

at 8.00 a.m. on 5 May 2021.

Following Admission, the total issued share capital of the

Company will be 611,541,816 Ordinary Shares. Accordingly, the

figure of 611,541,816 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Peter Hill, Global Petroleum's CEO, commented:

"We are very pleased to have raised additional capital which

enables us to progress our exploration activities on PEL0094, and

to welcome new shareholders to the Company. We look forward to

providing further updates in due course."

For further information please visit: www.globalpetroleum.com.au

or contact:

+44 (0) 20 3 875

Global Petroleum Limited 9255

Peter Hill, Managing Director & CEO

Andrew Draffin, Company Secretary

Panmure Gordon (UK) Limited (Nominated Adviser +44 (0) 20 7886

& Joint Broker) 2500

Hugh Rich / Nick Lovering / Ailsa MacMaster

Nominated Adviser: Nicholas Harland

ETX Capital (Joint Broker designate) +44 (0) 20 7392

Thomas Smith 1568

Tavistock (Financial PR & IR) +44 (0) 20 7920

Simon Hudson / Nick Elwes 3150

The Placing does not constitute a public offer of securities in

accordance with the provisions of Section 85 of the Financial

Services and Markets Act 2000 and accordingly a prospectus will not

be issued in the United Kingdom.

This announcement does not constitute an offer of securities in

the United Kingdom or in any other jurisdiction, including the

United States of America.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEIPMLTMTBTBAB

(END) Dow Jones Newswires

April 29, 2021 02:00 ET (06:00 GMT)

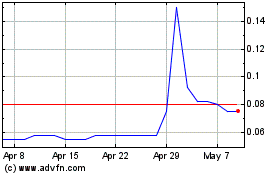

Global Petroleum (LSE:GBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global Petroleum (LSE:GBP)

Historical Stock Chart

From Apr 2023 to Apr 2024