GM Affirms Profit Outlook Despite Chip-Shortage Woes -- 2nd Update

May 05 2021 - 9:16AM

Dow Jones News

By Mike Colias

General Motors Co. said it expects to hit the high range of its

2021 profit forecast despite the vexing computer-chip shortage, as

strong pricing and brisk new-vehicle demand offset supply woes.

GM reiterated its guidance Wednesday while reporting

first-quarter net profit rose hit $3.02 billion, compared with

about $300 million a year earlier, when the pandemic disrupted

operations. The company said the semiconductor shortage will hurt

second-quarter output, but the company will continue to give

priority to its most profitable vehicles, large pickup trucks and

sport-utility vehicles.

The nation's largest auto maker by sales said pretax profit

adjusted for one-time items hit $4.42 billion, equivalent to $2.25

a share. That beat the $1.05 average estimate of analysts surveyed

by FactSet.

Revenue was $32.5 billion for the first quarter, compared with

$32.7 billion a year earlier.

GM said it is confident that it will hit the high end of its

previously issued guidance of $10 billion to $11 billion for the

year, even as the impact from the semiconductor shortage cuts as

much as $2 billion from the bottom line.

Shares of GM, up 33% this year through Tuesday's close, rose

about 3.1% in early trading Wednesday.

A shortage of semiconductors globally continues to bedevil the

auto industry with car companies expected to lose about 3.4 million

units of vehicle production this year due to factory stoppages

related to the lack of this critical part, according to research

firm AutoForecast Solutions LLC. The industry produced 90.7 million

vehicles during all of 2020, according to Wards Intelligence.

In North America -- by far the biggest profit generator for GM

and rival Ford Motor Co. -- GM was force to cut around 340,000

vehicles from its production plans so far this year, while Ford cut

around 310,000, AutoForecast estimates.

But for Ford, the financial impact has been deeper because it

has had to reduce output for several weeks at two F-150 pickup

truck plants. The F-150 pickup truck is the company's bestseller

and its biggest moneymaker. Meanwhile, GM's key pickup-truck and

big-SUV factories have managed to sustain near-normal schedules.

Ford shares sank last week after it gave profit guidance for the

second half of the year that disappointed investors. Shares of Ford

rose 1.3% in early trading Wednesday, and were up 30% this year

through Tuesday.

The auto industry's snarled output has left car makers with

historically low vehicle stocks. At the end of April in the U.S.,

there were fewer than 2 million vehicles on dealership lots or en

route to stores, 39% lower than a year earlier, according to

research firm Wards Intelligence.

Even so, new-car buyers have been showing up at dealerships in

droves as pandemic restrictions loosen, federal stimulus money

flows and interest rates remain tame. The pace of new-vehicle sales

in April hit its fastest clip in more than 15 years on a

seasonally-adjusted basis, according to JPMorgan Chase.

The ripe car-buying environment has helped shares of auto makers

remain resilient despite the supply-chain disruptions, Morgan

Stanley analyst Adam Jonas said in a research note Monday.

Investors so far have largely been looking past the chip issue, and

are drawn to the industry's strong pricing and future bets on

electric and autonomous cars, he said.

GM credited the strong bottom line in part to brisk sales of its

redesigned large SUVs, including the Chevrolet Suburban and

Cadillac Escalade, which have routinely sold for more than $100,000

since refreshed models arrived last year.

Chief Executive Mary Barra said the semiconductor situation is

"complex and fluid" and will cause more trouble in the second

quarter, but should subside through the second half of the

year.

Ms. Barra also said the disruption won't affect the company's

plan to spend bigger this year on developing electric and

autonomous vehicles, future bets that today are money losers but

have sparked investor enthusiasm. GM has said the majority of its

roughly $10 billion in capital expenditures this year will go

toward those potential growth areas.

"We continue to manage the transformation while managing, I'll

say, the tactical challenges of the semiconductors that we will

move out of," Ms. Barra told reporters during a conference

call.

GM also cited strong results from its lending arm, GM Financial,

which is benefiting from surging resale values for the used cars it

keeps on its books. The lender posted a record first-quarter pretax

profit of about $1.2 billion.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

May 05, 2021 10:01 ET (14:01 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

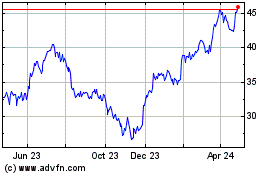

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

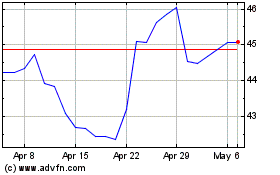

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024