By Mike Colias

Auto makers fresh off heady sales and profits in the first

quarter are preparing for a rough ride ahead, as the global

computer-chip shortage clouds an otherwise ripe environment for car

sales.

General Motors Co. on Wednesday reported a near-record operating

profit for the January-March period while rival Ford Motor Co. a

week earlier posted its best bottom line in years. Jeep-maker

Stellantis NV said sales rose 14% for the quarter and confirmed

earlier full-year guidance of 5.5% to 7.5% adjusted operating

margins. It reports half-year earnings results in August.

But each company said the shortage of semiconductors that has

forced production cuts across car factories world-wide since

January will pinch production and inventories even more heading

into the summer, just as American car buyers are turning out to

dealerships in droves.

That means car shoppers in the coming months are likely to find

slimmer options and fewer deals, from new and used dealerships to

the rental-car lot.

The auto industry's inventory crunch has produced a favorable

knock-on effect: record pricing. Dealers and car companies are

working with such thin inventory that they have been able to

withhold the generous discounts and promotions they normally dangle

to entice shoppers.

In the first quarter, the average financial incentive on new

vehicles fell 20% from a year earlier, while the average price paid

hit a quarterly record of $37,314, according to research firm J.D.

Power.

Meanwhile, the economic conditions for new-vehicle demand are

more favorable than they have been in years, analysts and

executives say, as pandemic restrictions loosen, federal stimulus

money flows and interest rates remain tame. The pace of new-vehicle

sales in April hit its fastest clip in more than 15 years on a

seasonally-adjusted basis, according to JPMorgan Chase.

But with the chip shortage worsening, car makers have been

cutting more factory work shifts. While auto executives see the

situation improving after June, for now, it is crimping inventory

even further and could dampen what was setting up to be a banner

summer at U.S. car dealerships.

Stellantis said the lack of semiconductors resulted in an 11%

reduction in planned first-quarter production, or about 190,000

vehicles, and that the problem will force it to cut second-quarter

production even more.

Ford said last week that it will lose half of its planned

second-quarter production because of strained chip supplies. Its

shares slid 9% the day after it laid out profit guidance for the

rest of 2021 that disappointed investors.

On Wednesday, Ford said it is adding at least two more weeks of

down time or limited output at several factories that had been shut

for weeks, including its Explorer SUV plant in Chicago and a Kansas

City, Mo., factory where it makes F-150s and Transit vans. Ford

also is idling its Ranger pickup plant near Detroit for the second

half of May, a spokeswoman said.

GM wouldn't quantify its production cuts, but confirmed the chip

shortage will hurt more in the second quarter.

Still, it seems clear that it is hurting Ford worse. Ford pegged

the fallout for the year at about $2.5 billion, while GM estimated

its impact at $1.5 billion to $2 billion.

The semiconductor shortage has forced Ford to reduce output for

several weeks at its two plants that assemble the F-150 pickup

truck, the company's bestseller and its biggest moneymaker.

Meanwhile, GM's key pickup-truck and big-SUV factories have

managed to sustain near-normal schedules.

RBC analyst Joseph Spak said investors were spooked by Ford's

dimmer outlook and had been waiting to see if GM would cut its

profit forecast because of the semiconductor situation.

"Bottom line, GM looks to be managing through better," he said

in a note.

Tens of thousands of factory workers have been put on layoff for

weeks or even a month or two as the auto makers have canceled work

shifts. The companies pay them reduced wages under terms of their

contracts with the United Auto Workers.

GM Chief Executive Mary Barra said she is confident that GM can

hit the high range of its original 2021 pretax profit forecast of

$10 billion to $11 billion. Ford's guidance is for $5.5 billion to

$6.5 billion.

Shares of GM rose 3.5% in afternoon trading Wednesday and were

up 33% this year through Tuesday. Ford's stock rose 1.2% Wednesday

and was up 30% this year through Tuesday.

GM credited its $4.4 billion pretax first-quarter profit in part

to brisk sales of its redesigned large SUVs, including the

Chevrolet Suburban and Cadillac Escalade, which have routinely sold

for more than $100,000 since refreshed models arrived last

year.

Ms. Barra said the semiconductor situation is "complex and

fluid" and will cause more trouble in the second quarter, but

should subside through the second half of the year.

Ms. Barra also said the disruption won't affect the company's

plan to spend bigger this year on developing electric and

autonomous vehicles, future bets that today are money losers but

have sparked investor enthusiasm. GM has said the majority of its

roughly $10 billion in capital expenditures this year will go

toward those potential growth areas.

"We continue to manage the transformation while managing, I'll

say, the tactical challenges of the semiconductors that we will

move out of," Ms. Barra told reporters during a conference

call.

GM also cited strong results from its lending arm, GM Financial,

which is benefiting from surging resale values for the used cars it

keeps on its books. The lender posted a record first-quarter pretax

profit of about $1.2 billion.

Nick Kostov and Nora Naughton contributed to this article.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

May 05, 2021 16:08 ET (20:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

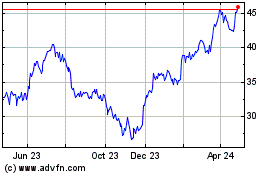

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

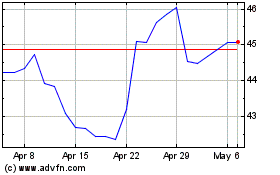

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024